by Calculated Risk on 11/30/2006 01:14:00 PM

Thursday, November 30, 2006

Historical: Existing Home Sales and Inventory

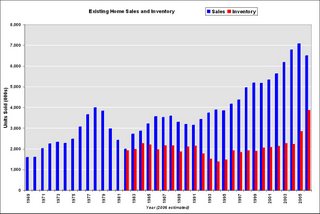

The following graphs show existing home sales and inventory for the last 30+ years. The data is from NAR (via HUD, see table 7) Click on graph for larger image.

Click on graph for larger image.

The first graph shows unit sales and inventory. Inventory is only available since 1982, and 2006 is estimated at 6.5 million sales, and 3.85 million homes for sale (current inventory numbers).

From 1978 to 1982, sales declined by 50%, from almost 4 million units per year to under 2 million units per year. In 1982, inventory almost equaled sales; the months of inventory was 11.5 (compared to 7.4 currently). For the second graph, sales and inventory are normalized by the number of owner occupied units. This shows the extraordinary level of sales for the last few years, reaching 9.5% of owner occupied units in 2005. The median level is 6.0% for the last 35 years.

For the second graph, sales and inventory are normalized by the number of owner occupied units. This shows the extraordinary level of sales for the last few years, reaching 9.5% of owner occupied units in 2005. The median level is 6.0% for the last 35 years.

Some of the sales were for investment and second homes, but normalizing by owner occupied units probably provides a good estimate of normal turnover.

Credit Suisse (Nov 27, 2006) is are projecting existing home sales will fall to 5.9 million units in 2007. If inventories stay at the current level that would be about 8 months of inventory.

If sales fall back to 6% of owner occupied units that would be 4.5 million units per year - a significant decline from current levels.

Weak Chicago PMI, Weak Retail, and Rising Claims

by Calculated Risk on 11/30/2006 11:51:00 AM

I guess we could call today "Roubini Thursday".

From MarketWatch: Chicago economy weakens further in November

Business activity in the key Chicago area decelerated to its slowest pace in more than three years in November, raising fears of a broader slowdown in the U.S. economy, according to the National Association of Purchasing Management Chicago on Thursday.And on retail: Weak November start hurt retailers' sales

The closely-watched Chicago PMI, which measures activity in northern Illinois and parts of Indiana, unexpectedly fell to 49.9% on a seasonally adjusted basis from 53.5% in October.

Readings below 50% in the diffusion index indicate most firms that were surveyed are contracting. The regional economy had expanded for 42 straight months.

The nation's largest retailers turned in mostly disappointing sales results for November as sluggish sales at the beginning of the month outweighed a largely robust post-Thanksgiving start to the holiday shopping season.And on claims: U.S. weekly jobless claims highest in over a year (kudos to charts for predicting the jump in claims in the comment last night!)

Across the board, retailers ranging from Wal-Mart Stores and Costco Wholesale to J.C. Penney and Abercrombie & Fitch turned in weaker-than-expected numbers, according to sales reports issued Thursday.

With 48 of 56 retailers reporting, Thomson Financial said 54% had fallen short of expectations for same-store sales, the industry benchmark of growth measuring receipts rung up at stores open longer than a year.

First time claims for state unemployment benefits rose by 34,000 to 357,000 for the week ending Nov. 25. The rise in claims is up from a revised 323,000 the prior week, the Labor Department said.For claims, the number to follow is the 4-week moving average - currently 325K - and the key level is about 350K, possibly indicating a recession.

OFHEO: House Price Appreciation Slows Further

by Calculated Risk on 11/30/2006 10:13:00 AM

OFHEO released the Q3 House Price Index today: House Price Appreciation Slows Further

U.S. home prices rose in the third quarter of this year, but the rate of increase continued to slow and some areas experienced actual price declines. Nationally, home prices were 7.73 percent higher in the third quarter of 2006 than they were one year earlier. Appreciation for the most recent quarter was 0.86 percent, or an annualized rate of 3.45 percent. This reflects a further slowdown from that reported for the second quarter when the quarterly appreciation rate was 1.3 percent and the annualized rate was 5.1 percent. The quarterly increase is the lowest since the second quarter of 1998.

Click on graph for larger image.

Click on graph for larger image.This graph shows the effect of refinance data on the HPI. The purchase only index has increased 6.0% over the last four quarters, and increased 0.3% in Q3 (compared to 7.73% and 0.86% for the standard HPI).

The HPI is a lagging price indicator, but clearly shows price appreciation has slowed.

Wednesday, November 29, 2006

Dallas Fed: Making Sense of the U.S. Housing Slowdown

by Calculated Risk on 11/29/2006 11:15:00 PM

Dallas Fed Economic Letter: Making Sense of the U.S. Housing Slowdown (hat tip: Mark Thoma at Economist's View)

A nice overview. As Professor Thoma notes:

"The Dallas Fed analyzes the slowdown in the housing market and finds it difficult to make strong predictions about how it will play out."The author touches on several key topics, and uses an approach similar to mine to calculate MEW. Clearly MEW will fall, but Dr. Duca is unsure of the impact on consumption:

"Given these uncertainties, predicting how much a slowing housing market will affect consumption is difficult. This warrants monitoring of home prices, MEW and underlying consumption trends."I guess I'll keep monitoring prices, MEW and consumption trends!

More on October New Home Sales

by Calculated Risk on 11/29/2006 03:08:00 PM

Please see the previous post: October New Home Sales Click on graph for larger image.

Click on graph for larger image.

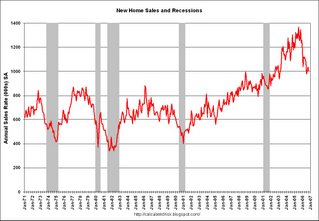

One of the most reliable economic leading indicators is New Home Sales.

New Home sales were falling prior to every recession of the last 35 years, with the exception of the business investment led recession of 2001. This should raise concerns about a possible consumer led recession in the months ahead.

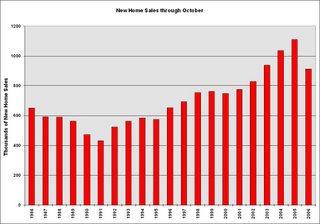

The second graph shows YTD New Home sales through October. It now appears that 2006 will finish as the 4th best year behind 2003. Sales for the most recent months have fallen back to the 2002 level.

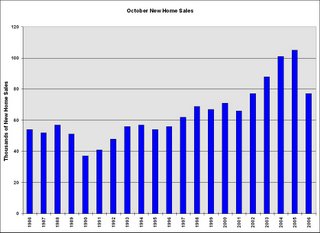

The third graph shows October New Home sales for the last 20 years. The recent sharp drop in sales is even worse than the decrease at the start of the 1990s housing bust.

October sales have fallen back to the 2002 levels.

Update: State Version of Nontraditional Mortgage Guidance

by Calculated Risk on 11/29/2006 11:58:00 AM

This web page, from the Conference of State Bank Supervisors (CSBS) and the American Association of Residential Mortgage Regulators (AARMR), tracks the states that have implemented the new Nontraditional Mortgage Guidance. As of this morning, there are eleven states listed. More are expected to be added this week.

From the CSBS this morning: The CSBS expects that all 50 states will adopt the guidance. Some states will issue regulations:

"So far, the majority of the states that have adopted have issued as regulatory guidelines. A few states (Massachusetts, for example) have or are going to begin their process to make a new regulation. This option takes longer to adopt, but is a much stronger regulatory tool. We have also had states indicate that they are issuing as guidance now, but if their regulated entities do not comply with the guidance, they will propose the guidance as a regulation."Note: This is the state version of the Federal Financial Regulatory Agencies guidance released in September. Here is the state version: GUIDANCE ON NONTRADITIONAL MORTGAGE PRODUCT RISKS

October New Home Sales: 1.004 Million SAAR

by Calculated Risk on 11/29/2006 10:14:00 AM

According to the Census Bureau report, New Home Sales in October were at a seasonally adjusted annual rate of 1.004 million. Sales for September were revised down to 1.037 million, from 1.075 million. Numbers for July and August were also revised down.

Click on Graph for larger image.

Sales of new one-family houses in October 2006 were at a seasonally adjusted annual rate of 1,004,000 ... This is 3.2 percent below the revised September rate of 1,037,000, and is 25.4 percent below the October 2005 estimate of 1,346,000.

The Not Seasonally Adjusted monthly rate was 77,000 New Homes sold. There were 105,000 New Homes sold in October 2005.

On a year over year NSA basis, October 2006 sales were 26.7% lower than October 2005. Also, October '06 sales were below October 2004 (101,000) and October 2003 (88,000) sales. This is the lowest October since 2002 when 77,000 new homes were also sold.

The median and average sales prices were up sharply. Caution should be used when analyzing monthly price changes since prices are heavily revised.

The median sales price of new houses sold in October 2006 was $248,500; the average sales price was $309,700.

The seasonally adjusted estimate of new houses for sale at the end of October was 558,000. This represents a supply of 7.0 months at the current sales rate.

The 558,000 units of inventory is about the same as the last six months. Inventory numbers from the Census Bureau do not include cancellations - and cancellations are at record levels. Actual New Home inventories are much higher - some estimate about 20% higher.

On a months of supply basis, inventory is above the level of recent years.

This another very weak report, especially considering the strong downward revisions for the previous months.

More later today on New Home Sales.

MBA: Mortgage Applications Fall

by Calculated Risk on 11/29/2006 12:21:00 AM

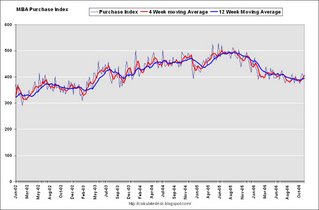

The Mortgage Bankers Association (MBA) reports: Mortgage Applications Fall in Latest Survey  Click on graph for larger image.

Click on graph for larger image.

The week was shortened due to the Thanksgiving holiday.Mortgage rates were stable:

The Market Composite Index, a measure of mortgage loan application volume, was 599, a decrease of 3.9 percent on a seasonally adjusted basis from 623.6 one week earlier. On an unadjusted basis, the Index decreased 34.4 percent compared with the previous week and was down 1.6 percent compared with the same week one year earlier.

The seasonally-adjusted Refinance Index decreased by 9.6 percent to 1749.6 from 1935.3 the previous week and the Purchase Index increased by 1.3 percent to 406.7 from 401.4 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages remained at 6.13 percent ...

The average contract interest rate for one-year ARMs decreased to 5.87 percent from 5.88 ...

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is up 2 percent to 405.8 from 398 for the Purchase Index.

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is up 2 percent to 405.8 from 398 for the Purchase Index.Although overall mortgage applications have declined, seasonally adjusted purchase applications have moved up slightly over the last few weeks.

Tuesday, November 28, 2006

OFHEO: Conforming Loan Limit Remains at $417,000

by Calculated Risk on 11/28/2006 11:30:00 PM

As expected, OFHEO announced today: 2007 Conforming loan limit to remain at $417,000

Office of Federal Housing Enterprise Oversight Director James B. Lockhart today announced the maximum 2007 conforming loan limit for single-family mortgages purchased by Fannie Mae and Freddie Mac (the Enterprises) will remain at the 2006 level of $417,000 for one-unit properties for most of the U.S.If OFHEO sticks to their earlier announcement, the maximum decline in the 2008 limit will be 0.16 percent.

The conforming loan limit determines the maximum size of a mortgage that an Enterprise can buy or guarantee. By law the maximum conforming loan limit is based on the October-to-October change in the average house price in the Monthly Interest Rate Survey (MIRS) of the Federal Housing Finance Board (FHFB). The FHFB reported the decline in the average price was $501, or 0.16 percent, from $306,759 in October 2005 to $306,258 in October 2006. This is the first decline in the MIRS since 1992-93.

OFHEO announced November 15 it would keep the limit at 2007 levels if there was a decrease in October-to-October house prices and would defer that decline for one year.

“This amount is in keeping with OFHEO’s recent announcement of an orderly and transparent process for any downward adjustment,” said Lockhart. “We made this decision so as not to disrupt the end-of-the-year pipeline of mortgages or the market for mortgage-backed securities,” said Lockhart.

OFHEO also stated previously that additional guidance for the 2008 limits would be issued early next year.

Conforming Loan Limit Percentage Increase

2007 $417,000 0%

2006 $417,000 15.9%

2005 $359,650 7.8%

Prior to this year’s decrease, the average increase in the FHFB survey over the previous five years was 8.8 percent.

OFHEO assumed responsibility for establishing the conforming loan limit with a February 2004 guidance.

The conforming loan limit is based on the FHFB monthly survey and not OFHEO’s quarterly House Price Index (HPI), which will be released November 30.

Bernanke, Roubini Revise Down Q4 Estimates

by Calculated Risk on 11/28/2006 05:23:00 PM

I watched Bernanke's speech, and my reaction was that he was very worried about future U.S. economic weakness. To my surprise, the always worth reading WSJ's Greg Ip wrote (see Economist's View for excerpts):

Mr. Bernanke's hawkish remarks on inflation and upbeat view of the economy contrast with the emerging view on Wall Street that the economy is weakening and inflation risks have faded.Upbeat view? Sure, Bernanke was fairly positive looking forward, but reading between the lines, I believe Bernanke is very worried. Just last week, CEA Chairman Ed Lazear forecast Q4 GDP at 2.7%:

"We are projecting real GDP to grow at 3.1 percent in 2006, and that's on a Q4, quarter four to quarter four basis."The annualized GDP for Q4 would have to be 2.7% to achieve 3.1% on a "quarter four to quarter four basis".

Today, Fed Chairman Bernanke projected Q4 GDP in the 1.6% to 2.6% range:

"... the indicators in hand suggest that real GDP growth this quarter is likely to be in the same general range that it was in the second and third quarters."Although the Fed and the CEA are separate, Bernanke's forecast is clearly below Lazear's.

In additional to revising down Q4 GDP estimates, Bernanke made several comments that shows he is following housing very closely. Bernanke pointed out that housing prices have fallen more than reported due to incentives, noted that new home inventories are higher than reported - and by extension, new home sales are lower - due to significant cancellations. Contrast these comments with Fed Vice Chairman Kohn's recent comments from October 4th:

"... any overbuilding in 2004 and 2005 was small enough to be worked off over coming quarters at close to the current level of housing starts."At that time housing starts were close to 1.7 million units (SAAR), and I suggested starts might have to fall to a rate of 1.1 million to work off the recent overbuilding. Since then, starts have already fallen to under 1.5 million (SAAR) and Bernanke is now suggesting there is more to come. Bernanke today:

"... we should keep in mind that even if demand stabilizes in its current range, reducing the inventory of unsold homes to more normal levels will likely involve further adjustments in production."But one of the most telling comments from Bernanke was when he tried to offer some possibilities for an upside surprise in 2007:

"... economic growth could rebound more vigorously than now expected. The solid rate of job growth, the decline in the unemployment rate, and the healthy pace of capital investment could be signals that underlying economic fundamentals are stronger than generally recognized. Moreover, to date there is little evidence that the weakness in housing markets is spilling over more broadly to consumer spending or aggregate employment."The rate of job growth and the unemployment rate are lagging indicators, and tell us nothing about future economic growth. Non-residential investment trails residential investment, so that is a weak argument too. Of course Bernanke's argument is that we are missing something and the strength in these areas is a reflection of that underlying strength. On the spillover from the housing bust into the general economy: any impact is ahead of us, not behind us.

Since Dr. Bernanke knows this, and chose to feature these indicators anyway, I'd guess that he thinks there is very little upside potential to his forecast. And plenty of downside risk.

Not to be outdone by Bernanke (just joking), Roubini lowered his Q4 estimate too:

"I have ... been arguing for months now that Q4 growth will be even lower than Q3 at between 0% and 1%. I am now comfortable to forecast that Q4 GDP growth will be closer to 0% than 1%."And Roubini notes Deutsche Bank has also lowered their forecast:

In light of continued weakness in the economic data, we are cutting our fourth quarter real GDP growth forecast to zero from the +1.0% that we were originally predicting.Bernanke looked like a deer in the headlights to me. Except this deer seems to have a good idea of what is coming.

Bernanke: Economic Outlook

by Calculated Risk on 11/28/2006 12:33:00 PM

Chairman Bernanke spoke today in New York: The Economic Outlook . A few excerpts, first on Q4 GDP:

At this juncture, information about economic activity in the fourth quarter is limited, and the range of plausible outcomes remains wide. But the indicators in hand suggest that real GDP growth this quarter is likely to be in the same general range that it was in the second and third quarters.On housing:

... a slowing in the pace of house-price appreciation was inevitable. Moreover, the sustained rise in prices, together with some increase in mortgage interest rates, sowed the seeds of the correction by making housing progressively less affordable. Declining affordability ultimately served to limit the demand for housing, leading to a deceleration in house prices and slowing home purchases.A reasonable description of the current housing situation.

The drop in home sales that began earlier this year has led homebuilders to curtail the rate of new construction. Indeed, single-family housing starts are down about 35 percent since their peak earlier this year. Obtaining a precise read on home prices is difficult: During a period of weak demand, potential sellers often choose to leave their homes on the market longer or even to remove them from the market, rather than accept price offers that are below their expectations. The timeliest data on house prices do not fully account for changes in the composition of home sales by location, size, and other characteristics. Moreover, the data do not capture hidden price cuts, as when builders try to stimulate sales through the use of "sweeteners" such as paying the customer's mortgage points or upgrading features of the house at no additional cost. Nevertheless, there can be little doubt that the rate of home-price appreciation has slowed significantly for the nation as whole. Some areas have continued to experience gains--albeit smaller ones than before--while other markets have seen outright price declines.

Notwithstanding the sharp reduction in starts of new single-family houses, inventories of both new and existing homes for sale have increased markedly this year. For example, according to the most recent data, homebuilders currently have about 550,000 new homes for sale, roughly half again the number that has been typical during the past decade. Moreover, the official statistics likely understate the full extent of the inventory buildup, as many homebuilders have reported a sharp increase this year in the number of buyers canceling signed contracts. A home for which the sales contract is cancelled becomes available for sale once again but is not included in the official data on the inventory of unsold new homes. To reduce this inventory overhang, builders are likely to continue to limit the number of new homes under construction.

Although residential construction continues to sag, some indications suggest that the rate of home purchase may be stabilizing, perhaps in response to modest declines in mortgage interest rates over the past few months and lower prices in some markets. Sales of new homes ticked up in August and increased a bit further in September. The University of Michigan's survey of consumers shows an increase in the share of respondents who believe that now is a good time to buy a home, from 57 percent in September to 67 percent in November. Meanwhile, an index of applications for mortgages for home purchases has been trending up since July. Although these developments are encouraging, we should keep in mind that even if demand stabilizes in its current range, reducing the inventory of unsold homes to more normal levels will likely involve further adjustments in production. The slowing pace of residential construction is likely to be a drag on economic growth into next year. emphasis added

Bernanke also acknowledges the slowdown in manufacturing:

Growth in some manufacturing industries has also slowed of late, and data prepared by the Federal Reserve show that aggregate manufacturing production declined in September and October. The motor vehicle sector in particular has experienced weaker demand and an accompanying buildup in stocks of unsold cars and trucks over the past year.Bernanke also notes the downside risks:

Like all economic forecasts, this one is provisional, and risks exist in both directions. On the downside, the correction in the housing market could turn out to be more severe and widespread than seems most likely at present. A deeper correction would directly affect economic activity through additional cutbacks in housing starts and through its effects on employment in construction and housing-related industries. More indirectly, it might also impose greater restraint on consumer spending by reducing homeowners' equity and thus household wealth, and perhaps by affecting consumer confidence as well. Because consumption makes up more than two-thirds of aggregate expenditure, any significant effect on consumer spending arising from further weakness in housing would have important implications for the economy.The downside is clearly more likely.

On the other hand, economic growth could rebound more vigorously than now expected. The solid rate of job growth, the decline in the unemployment rate, and the healthy pace of capital investment could be signals that underlying economic fundamentals are stronger than generally recognized. Moreover, to date there is little evidence that the weakness in housing markets is spilling over more broadly to consumer spending or aggregate employment. If these trends continue, growth in real activity might return to a pace that could intensify upward pressures on resource utilization.

NAR: Sales Up, Inventory Up

by Calculated Risk on 11/28/2006 10:26:00 AM

The National Association of Realtors (NAR) reports: Existing Home Sales Rise in October, Market Stabilizing

Click on graph for larger image.

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – rose 0.5 percent to a seasonally adjusted annual rate1 of 6.24 million units in October from an upwardly revised pace of 6.21 million in September, but were 11.5 percent below the 7.05 million-unit level in October 2005.

Total housing inventory levels increased 1.9 percent at the end of October to 3.85 million existing homes available for sale, which represents a 7.4-month supply at the current sales pace.Existing Home Sales are a trailing indicator. The sales are reported at close of escrow, so October sales reflects agreements reached in August and September.

As I've noted before, usually 6 to 8 months of inventory starts causing pricing problem - and over 8 months a significant problem. With current inventory levels at 7.4 months of supply, inventories are now well into the danger zone and prices are falling in most regions.

Monday, November 27, 2006

Ameriquest Mortgage For Sale

by Calculated Risk on 11/27/2006 04:24:00 PM

Dow Jones reports: Ameriquest Mortgage Hires JPMorgan To Advise On Sale

A reminder for CEOs: Never name a stadium, it's bad luck.

Ameriquest Field (named in May 2004), Arlington, Texas. Home of the Texas Rangers.

Fed Expressed Concern About "Housing Bubble" in 2002

by Calculated Risk on 11/27/2006 12:31:00 PM

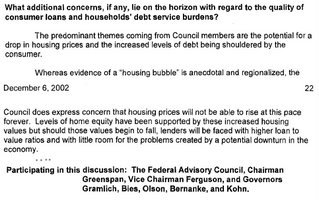

Via the WSJ Markebeat: Distant Early Warning (hat tip: K-Dawg)

The Federal Reserve had some idea of the problems posed by inflated housing values back in 2002, according to summaries of meetings held by the Federal Advisory Council, a group comprised of the Fed governors and a dozen representatives from regional and national banks. The FAC meets quarterly to discuss monetary policy, financial regulation and other matters — summaries are released with a three-year lag — and in December 2002, during Alan Greenspan’s tenure, the council was already warning of problems related to housing. Although the signs were limited, the summary shows that the Fed was already discussing the possibility of a housing bubble as much as four years ago, not long after the technology-stock bubble burst.

“Whereas evidence of a ‘housing bubble’ is anecdotal and regionalized, the Council does express concern that housing prices will not be able to rise at this pace forever,” the summary says. “Levels of home equity have been supported by these increased housing values but should those values begin to fall, lenders will be faced with higher loan to value ratios and with little room for the problems created by a potential downturn in the economy.”

Click on image for larger view.

Click on image for larger view.From Federal Advisory Council (FAC) minutes, December 6, 2002. Note: Paragraph on consumer credit removed.

The FAC included members of the banking industry and Wall Street. See document for members.

WaPo on Non-Residential Construction

by Calculated Risk on 11/27/2006 12:25:00 AM

From the WaPo: Commercial Boom Softens Housing Bust

To understand why the housing slump hasn't dragged the economy into a recession, it helps to visit the Smoketown Plaza in Woodbridge, where the thumping of hammers signals the healthy pulse of a building boom that's still going strong.The main reasons the housing bust hasn't dragged the economy into a recession yet, are: 1) there have been few layoffs in residential construction (they are coming), and 2) mortgage equity withdrawal (MEW) has still been strong (MEW will slow soon). The boom in non-residential construction has helped, but if the bust follows the typical pattern, the non-residential boom will end soon (or is already ending).

...

[These commercial projects have boosted] non-residential construction enough over the past year to more than offset the decline in home construction. That boom is helping to cushion the impact of the housing slump on the economy.

The money spent on private non-residential construction nationally rose a sizzling 19.2 percent over the 12 months that ended in September, according to Census data. In addition, state and local governments are building roads, schools and other public buildings. Public construction rose a robust 11.6 percent in the year ended in September.These YoY numbers are correct, but the picture is different if you look at the last 6 months. Total nominal private construction spending peaked in May, and has declined since then. Total construction spending, including public spending, peaked in June.

Add it all up and the increase in non-residential work more than offset the 6.7 percent decline in home building over the same period, so the value of all construction rose a net 2.9 percent.

Builders of non-residential projects say they are simply playing catch-up. So many new neighborhoods filled up during the housing boom that they're still building the stores, offices, restaurants, bank branches, hotels and hospitals needed to serve the influx of residents.From a previous post, but worth repeating: YoY Residential Investment typically leads YoY Non-residential investment by 3 to 5 quarters.

In Prince William County, for example, the population surged by 23 percent in the past five years, during the peak of the home-building boom, to 374,678 people. Now, many residents complain they have to drive too far, often to Fairfax County, for basic business services.

The companies that provide those services "don't build until they see the rooftops" over new customers, said Bill Fairchild, president of R.W. Murray Co., a construction contractor in Manassas that's overseeing the Arby's on Minnieville Road and a dozen other non-residential projects in Northern Virginia. "People have got to get groceries. They've got to get their hair cut. They need to go to the cleaners."

Click on graph for larger image.

Click on graph for larger image.This graph shows the YoY change in residential investment vs. nonresidential investment. As I noted in August: In general, residential investment leads nonresidential investment. There are periods when this observation doesn't hold - like '95 when residential investment fell and the growth of nonresidential investment remained strong.

Another interesting period was 2001 when nonresidential investment fell significantly more than residential investment. Obviously the fall in nonresidential investment was related to the bursting of the stock market bubble. But typically changes in residential investment lead changes in nonresidential investment, and GDP, by three to five quarters.

As the article noted, companies don't build non-residential projects "until they see the rooftops" - and that is why there has been a non-residential boom - about 3 to 5 quarters behind the final residential boom. But the analysis in the article didn't take the next step - what happens to non-residential construction 3 to 5 quarters after the residential construction bust? The graph above provides the likely answer.

Saturday, November 25, 2006

Strong Black Friday Sales

by Calculated Risk on 11/25/2006 06:39:00 PM

From AP: Black Friday sales up 6 percent over '05

The nation's retailers had a strong start to the holiday shopping season, according to results announced Saturday by a national research group that tracks sales at mall-based stores. One big exception was Wal-Mart Stores Inc., which said it expects to report same-store sales in November below its already lackluster forecast.This is to balance out the previous post!

According to ShopperTrak RCT Corp., which tracks total sales at more than 45,000 mall-based retail outlets, total sales rose 6 percent to $8.96 billion on Friday, the start of the holiday shopping season, compared to the same day a year ago.

Wal-Mart sees weak sales

by Calculated Risk on 11/25/2006 01:23:00 PM

From Reuters: Wal-Mart sees weak sales as holiday season starts

Wal-Mart Stores Inc. predicted a rare decline in monthly sales on Saturday, even as U.S. bargain-hunters jammed stores in search of gifts at the start of the crucial holiday shopping season.Holiday retail sales are important every year, but as the article noted:

...

Wal-Mart estimated that November sales fell 0.1 percent at its U.S. stores open at least a year -- a closely watched retail measure known as same-store sales.

The retailer will provide a final monthly sales report on Thursday, when most other major chain stores report their November figures. This would mark Wal-Mart's first monthly same-store sales decline since April 1996.

Wal-Mart had expected same-store sales to be flat compared with the same period last year, which many Wall Street analysts had viewed as disappointing. Wal-Mart's four-week November sales period ended on Friday.

Investors are watching holiday sales particularly closely this year to gauge how consumers are coping with a slowdown in the housing market that has already hurt home improvement retailers and furniture stores.

Thursday, November 23, 2006

UBS: 2006 Subprime Loans Doing Badly

by Calculated Risk on 11/23/2006 01:11:00 AM

From AP: UBS: 2006 Subprime Loans Doing Badly

Subprime loans ... in particular those used to back mortgage bonds, could prove to be one of the worst-performing groups yet, according to UBS.

Wednesday, November 22, 2006

MBA: Mortgage Applications Decline

by Calculated Risk on 11/22/2006 10:42:00 AM

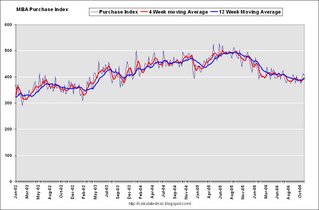

The Mortgage Bankers Association (MBA) reports: Mortgage Applications Fall in Latest Survey  Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 623.6, a decrease of 3.7 percent on a seasonally adjusted basis from 647.5 one week earlier.Mortgage rates were stable:

The seasonally-adjusted Refinance Index decreased by 4.3 percent to 1935.3 from 2022.2 the previous week and the Purchase Index decreased by 2.8 percent to 401.4 from 412.9 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages decreased to 6.13 percent from 6.14 percent ...

The average contract interest rate for one-year ARMs increased to 5.88 percent from 5.87 ...

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002.

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002.

Tuesday, November 21, 2006

Lazear Still Misunderstands Housing

by Calculated Risk on 11/21/2006 06:59:00 PM

"The housing market, as you know, it has been hit, I think, harder than most of us had expected."During the housing boom, there were two distinct views of the causes of the boom. The consensus view was that the boom was mostly driven by fundamentals and perhaps a little "froth" in 2005.

Edward Lazear, Q&A Nov 21, 2006, chairman of the White House's Council of Economic Advisers

The minority opinion was that the housing market had become a bubble. The minority view was based on evidence of speculation: flippers, a high percentage of investment purchases, and homebuyers using excessive leverage, especially with nontraditional mortgage products.

Now that the housing bust is here, there are also two views of the bust. The consensus view is that the "worst is over". The minority view is that the bust has a ways to go.

Not surprisingly, those that felt the boom was based on fundamentals now believe the worst is over. And those that felt the boom was driven by excessive speculation believe the housing market will continue to slowdown. How one viewed the housing boom colors how one looks at the housing bust.

All the evidence so far suggests the minority view was correct. The severity of the bust has caught the majority off guard as evidenced by Lazear's comments above. Here are Lazear's comments today on housing:

Question: I was wondering if you could talk more about your outlook for the housing market. Do you expect there to be -- it to bottom in 2007? And is the worst behind us in your opinion? And what are the risks, in your mind, of a recession?And Lazear's answer:

CHAIRMAN LAZEAR: The housing market, as you know, it has been hit, I think, harder than most of us had expected. Most forecasters were expecting a slower decline. What that probably signals is that the future will not be as negative as it otherwise would have been because we've probably had much of the decline that we're expecting to have.Maybe. The other possibility is that Lazear and most forecasters misunderstood the housing boom, and they remain too optimistic about the housing bust. Lazear:

That said, there are -- you know, there are a number of indications that things are still not as strong as they were last year in the housing market. You know, do I see that as a problem for the economy? Obviously, we don't like to see any one industry get hit and hit hard. That affects people's jobs. The good side of that, of course, has been that non-residential construction has taken up much of the slack in that industry. So we haven't seen construction jobs fall off dramatically as a result of the housing decline.Residential construction is off $55 Billion (SAAR), and non-residential construction is up $38 Billion from December 2005 (Census Bureau, Construction Spending). So Lazear is correct that non-residential spending has "taken up much of the slack".

But Lazear is overlooking a few facts: Even though starts have fallen off a cliff, completions are still near record levels - and when completions fall (they trail starts by about 6 months), construction spending will drop significantly. Also, non-residential investment tends to trail residential investment.

And the reason residential construction jobs haven't fallen "off dramatically as a result of the housing decline" is jobs track housing completions (for obvious reasons). I've presented these graphs before, but they fit here ...

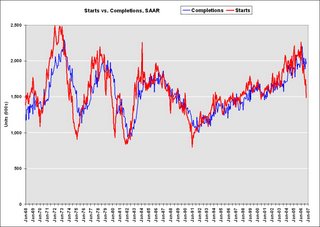

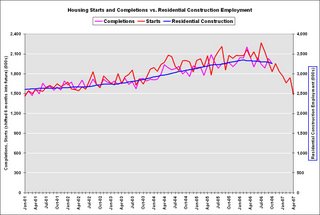

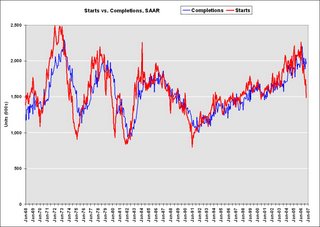

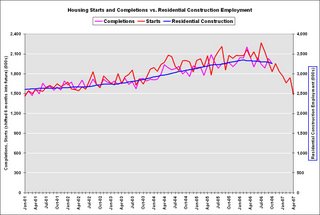

Click on graph for larger image.

Click on graph for larger image.The first graph shows Starts vs. Completions.

Starts have fallen "off a cliff", but completions have just started to fall.

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment are highly correlated, and Completions lag Starts by about 6 months.

Based on historical correlations, it is reasonable to expect Completions and residential construction employment to follow Starts "off the cliff".

More Lazear:

And I would say that as we go forward what we'd be concerned about is employment in that industry and looking to see how it transmits to the rest of the economy. I don't believe that it is going to transmit to the rest of the economy. There's been no indication that it has. Other sectors remain strong. And that would be the primary danger that I would see from the housing market, whether it's bottomed out now or whether it will take another quarter or so to bottom out I think is still up for grabs, and I wouldn't want to speculate on it.Lazear doesn't want "to speculate" on when the housing market will bottom out, but then says "now ... or another quarter or so". Lazear has been consistently surprised by the housing bust, and my guess is he will be surprised some more! But on the last point, job numbers do tell us the economy is decent right now, but they tell us nothing about the future.

But I would be willing to tell you that I don't think that this signifies any kind of weakness throughout the economy, in fact the reverse. The job numbers I think are probably the best indicator that the economy is very strong and in really good shape.

Question: And the risk of recession, do you have a --What can I say? Oh, Lazear also revised down the White House estimates for GDP growth for Q4 and 2007.

CHAIRMAN LAZEAR: Well, again the economy is growing. I don't even think we should be talking about going in the other direction at this point. The economy is growing. The economy is strong. The labor market is strong. You know, you see -- when you see jobs added at this rate, when you see unemployment at 4.4 percent, it's pretty hard to be thinking about things going in the other direction. I mean obviously at some time in the future things can change, but right now, as long as we keep our policies consistent with economic growth, which means keep taxes low, make sure that we don't put impediments, strong impediments to trade and business in there, I think we're on track for a strong economy.

Interest on National Debt

by Calculated Risk on 11/21/2006 12:51:00 PM

Click on graph for larger image.

Click on graph for larger image.

The Treasury Department reports that interest on the National Debt was $405.9 Billion for fiscal 2006. The fiscal 2006 interest payment is an all time nominal record.

However, as a percent of GDP, interest on the National Debt is rising, but still low compared to the previous couple of decades. This is because the effective interest rate is very low compared to previous periods, even though the National Debt is increasing rapidly.

For October 2006 (first month of fiscal 2007), interest payments were $22.3 Billion compared to $18.8 Billion for October 2005.

As a rough estimate, interest payments will probably be in the $440 Billion to $460 Billion range for fiscal 2007. I'll work up a better estimate soon. Last November, I projected interest payments of $411 Billion for fiscal 2006.

Monday, November 20, 2006

Morgan Stanley's Roach: Two-Engine Slowdown

by Calculated Risk on 11/20/2006 11:38:00 AM

Stephen Roach, Chief Economist of Morgan Stanley, writes: Two-Engine Slowdown

"The US and Chinese economies are slowing sharply as 2006 comes to an end. Inasmuch as these two engines have accounted for about two-thirds of the cumulative increase in world GDP over the past five years, this two-engine slowdown can hardly be taken lightly. In my view, it poses major downside risks to the global soft-landing call embedded in liquidity-driven financial markets."Please read his piece for the details. Roach concludes:

"As I put this all together, I continue to believe that global growth will fall well short of consensus expectations in 2007. The IMF’s forecast of another year of 4.9% world GDP growth in 2007 -- identical to the trends of the past four years and the strongest surge in global activity since the early 1970s -- is very much in line with what I hear from the broad consensus of investors I meet with around the world. Implicit in this view is that nothing can stop the American consumer or the Chinese producer -- conclusions that are both being drawn into sharp question in the final months of 2006. With slowdowns in the US and China likely to have a meaningful impact on two-thirds of the global growth dynamic, the burden of proof for the case for global resilience has shifted to the decoupling crowd. The sharp -2.8% annualized decline in Japanese consumption in the third quarter of CY06, together with recent disappointing trade date from Taiwan and Korea, do not exactly bode well for the decoupling case.

There’s one word that permeates virtually every discussion I have with investors around the world -- liquidity. It’s literally the only thing they want to talk about. In the view of most fund managers, liquidity remains more than ample to support ever-frothy markets -- irrespective of the outcome for the global economy. I continue to suspect that this disconnect between the global growth and liquidity cycles will be resolved one way or another in 2007. For my money, the risks of the “global fizzle” are being taken far too lightly."

Saturday, November 18, 2006

Q&A with Professor Thornberg on Housing

by Calculated Risk on 11/18/2006 03:07:00 PM

From the OC Register Insider Q&A: Economist Chris Thornberg. Here are some excerpts: Q. Do you have a firm projection of, say, 2007 price movements?

A. There is no such thing as firm projection. But all in all there are two scenarios. The first is that the rest of the economy keeps chugging ahead and the market is stabilized by job and income growth. Price growth remains at zero. This is the good scenario. The bad is that the rest of the economy also cools, and prices fall. But don't expect that prices will collapse by, say, 30%. Housing markets aren't that liquid. Declines will be moderate.

...

Q. What might change your outlook -- good or bad?

A. The key is consumer spending. If people respond to a cooling in housing prices by cutting back on home spending it could get ugly out there in the rest of the economy very quickly. This would turn a bad housing market into an abysmal one. I don't see much upside for the next few years regardless of what may happen.

Friday, November 17, 2006

RealtyTrac: Foreclosures Pass 1 Million for 2006

by Calculated Risk on 11/17/2006 06:19:00 PM

RealtyTrac reports: Foreclosures Surpass 1 Million Mark in October

“So far this year more than 1 million properties have entered some stage of foreclosure nationwide, up 27 percent from the same time last year. ... Our data from the last three months shows that foreclosures are definitely trending upward...”Check the report for your state.

James J. Saccacio, chief executive officer of RealtyTrac.

Here is a table from an earlier post on default notices in California (source: DataQuick):

| California Default Notices, Source: DataQuick | |

| Year | Default Notices |

| 1992 | 100,573 |

| 1993 | 121,416 |

| 1994 | 122,530 |

| 1995 | 135,713 |

| 1996 | 162,597 |

| 1997 | 141,180 |

| 1998 | 122,775 |

| 1999 | 101,053 |

| 2000 | 88,666 |

| 2001 | 81,003 |

| 2002 | 78,784 |

| 2003 | 66,127 |

| 2004 | 52,674 |

| 2005 | 54,476 |

| 2006 (through Q3) | 66,185 |

There were 26,705 default notices sent to California homeowners in Q3. At that pace, the number of default notices sent in 2006 would be the highest since 1999 (66,185 through Q3 + 26,705 = 92,890).

That projection now seems optimistic. RealtyTrac shows 13,601 default notices sent to California homeowners in October alone (half of my Q4 estimate in one month).

The rapid increase in foreclosure activity, combined with falling home prices and a weakening California economy, lead me to believe there will be a record number of default notices sent to California homeowners in 2007, surpassing the previous record of 162,597 in 1996.

Note that 1996 was the last year of the previous housing bust in California. The bust lasted over 6 years. Next year will only be the second year of the current bust.

Housing: Starts and Completions

by Calculated Risk on 11/17/2006 10:05:00 AM

The Census Bureau reports on housing Permits, Starts and Completions. Permits are falling:

Privately-owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,535,000. This is 6.3 percent below the revised September rate of 1,638,000 and is 28.0 percent below the October 2005 estimate of 2,131,000.Starts are falling:

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 1,486,000. This is 14.6 percent below the revised September estimate of 1,740,000 and is 27.4 percent below the October 2005 rate of 2,046,000.And Completions are still just below record levels:

Privately-owned housing completions in October were at a seasonally adjusted annual rate of 1,953,000. This is 3.8 percent below the revised September estimate of 2,031,000 and is 0.7 percent below the October 2005 rate of 1,967,000.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Starts vs. Completions.

Starts have fallen "off a cliff", but completions have just started to fall.

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment are highly correlated, and Completions lag Starts by about 6 months.

Based on historical correlations, it is reasonable to expect Completions and residential construction employment to follow Starts "off the cliff". This would indicate the loss of 400K to 600K residential construction employment jobs over the next 6 months.

Thursday, November 16, 2006

Seven States Adopt CSBS Nontraditional Mortgage Guidance

by Calculated Risk on 11/16/2006 08:21:00 PM

The Conference of State Bank Supervisors (CSBS) and the American Association of Residential Mortgage Regulators (AARMR) have announced that seven states have agreed to adopt the new Nontraditional Mortgage Guidance.

The CSBS has created a web page to track the states that have adopted the Guidance. The seven states so far are: Georgia, Idaho, Iowa, Massachusetts, Montana, New Hampshire, and Wyoming.

Here is a typical announcement:

Industry Letter Regarding Guidance on Nontraditional Mortgage Product Risks

--------------------------------------------------------------------------------

By the Division of Banks

November 14, 2006

SUBJECT: REGULATORY BULLETIN 5.1-103

GUIDANCE ON NONTRADITIONAL MORTGAGE PRODUCT RISKS

To the Chief Executive of the Licensee Addressed:

The purpose of this letter is to inform you of the Division of Banks’ (the "Division") intention to issue Regulatory Bulletin 5.1-103 (the "Bulletin"), applicable to licensed mortgage lenders and mortgage brokers, and to provide licensed entities with a copy of the proposed Bulletin in advance of its issuance by the Division. The proposed Bulletin sets forth the Division’s policy relative to Guidance on Nontraditional Mortgage Product Risks.

On October 4, 2006, the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, the Office of Thrift Supervision, and the National Credit Union Administration (the "Agencies") issued an interagency guidance relative to nontraditional mortgage product risks. This interagency guidance applies to all banks and their subsidiaries, bank holding companies and their nonbank subsidiaries, savings associations and their subsidiaries, savings and loan holding companies and their subsidiaries, and credit unions.

Recognizing that the federal interagency guidance does not cover a majority of loan originations in the Commonwealth, the Division, in cooperation with the Conference of State Bank Supervisors ("CSBS"), has developed parallel guidance for licensed mortgage brokers and mortgage lenders in this state. The Division strongly supports the purpose of the guidance adopted by the Agencies and is committed to promote the uniform application of consumer protections for all borrowers.

This Bulletin is intended to promote consistent regulation in the mortgage market and clarify how licensed mortgage brokers and mortgage lenders (referred to as "providers") can offer nontraditional mortgage products in a way that clearly discloses the risks that borrowers may assume.

In order to maintain regulatory consistency, this guidance substantially mirrors the interagency guidance, except for the deletion of sections not applicable to non-depository institutions.

The Division is pleased to accept comments on the Bulletin from interested parties which should be submitted by December 4, 2006 via email to dob.comments@state.ma.us or by mail addressed to Steven L. Antonakes, Commissioner of Banks, One South Station, Boston, MA 02110.

Very truly yours,

Steven L. Antonakes

Commissioner of Banks

DataQuick: California Sales Lowest Since 1997

by Calculated Risk on 11/16/2006 02:58:00 PM

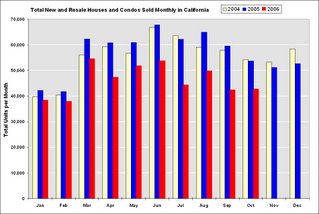

DataQuick reports: California October Home Sales Click on graph for larger image.

Click on graph for larger image.

A total of 42,750 new and resale houses and condos were sold statewide last month. That's up 0.7 percent from 42,450 for September and down 21.7 percent from a 54,600 for October 2005.Although some areas are already seeing YoY nominal price declines (San Diego, Ventura, Contra Costa), the median YoY price in California increased slightly.

Last month's sales made for the slowest October since 1997 when 41,850 homes were sold.

The median price paid for a home last month was $467,000. That was up 0.2 percent from September's $466,000, and up 2.9 percent from $454,000 for October a year ago.

NAHB: Builder Confidence Improves in November

by Calculated Risk on 11/16/2006 02:26:00 PM

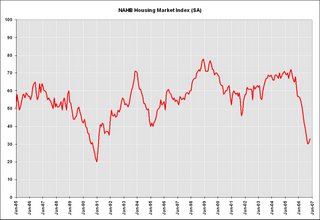

From NAHB: Builder Confidence Improves in November Click on graph for larger image.

Click on graph for larger image.

... home builder confidence in November edged up for the second consecutive month, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI gained two points from the previous month to stand at 33.

...

Derived from a monthly survey that NAHB has been conducting for almost 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as either “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

All three component indexes moved higher in November, including a one-point gain in the current sales index, to 33. The component gauging sales expectations for the next six months rose four points to 46 and the component gauging traffic of prospective buyers moved up three points from last month, to 26.

...

On a regional basis, the HMI for builders in the Northeast rose two points to 37 and posted a two-point gain in the South, to 40. The HMI for builders in the Midwest and West declined by two points to 16, and by one point to 34, respectively.

Inflation

by Calculated Risk on 11/16/2006 12:28:00 PM

The following graph shows monthly CPI, Core CPI (CPI less food and energy) and median CPI from the Cleveland Fed. Click on graph for larger image.

Click on graph for larger image.

Monthly CPI is a very noisy series and that is why many people use Core CPI. Personally I prefer the Cleveland Fed's median CPI. For October, the median CPI increased 0.3% or at an annualized rate of 3.65%.

Over the last 12 months, the median CPI has increased 3.6%, and over the last 6 months, median CPI has increased at a 4.0% annualized rate. Although the inflation news is welcome, I don't think the CPI or PPI numbers will change the Fed's view.

For more, see Kash's Inflation Update, October 2006

UK: Banks told to predict effects of a 40% crash in house prices

by Calculated Risk on 11/16/2006 01:14:00 AM

From The Times: Banks told to predict effects of a 40% crash in house prices (hat tip: Kevin)

BANKS in the UK have been ordered by financial regulators to assess how they would cope in the event of house prices crashing by 40 per cent.And from the Business Online: House prices most overvalued since 1948

...

The FSA said yesterday that an “appropriate” benchmark was to assume property prices fell by 40 per cent and that 35 per cent of mortgages in default ended with homes being re-possessed. It stressed that this was not a forecast but a “severe but plausible scenario” and one that banks should examine when deciding how robust their balance sheets were.

...

[Clive Briault, the FSA’s managing director for retail markets] warned bankers to ensure that they have properly stress-tested their mortgage portfolios in the wake of decisions by some to lend people greater multiples of their incomes.

...

House prices fell about 15 per cent nationwide in 1989-1992, and in parts of East Anglia by 40 per cent, leading to repossessions, write-downs and bank losses.

...

The FSA move came as UK house prices grew at their fastest for four years, according to new figures from RICS.

BRITAIN’S housing market is more overvalued than at any time since 1948 as buyers compete to snap up scarce properties, according to Dresdner Kleinwort.

The research will fuel fears that easy credit is inducing buyers to pay too much when buying their homes and over-stretch themselves financially.

The ratio of house prices to disposable incomes typically peaks at more than six times, the analysis reveals. On this measure, peaks in the housing market were seen in 1948, 1973, 1988 and 2006.

The current ratio is higher than in all previous episodes apart from 1948, when private homes were very scarce after the second world war.

David Owen, an economist at Dresdner Kleinwort, said: “There was an earlier period when inflation and interest rates were both low and the UK housing market was as expensive as it is today: the late 1940s. As in other housing corrections house prices then fell in real terms by over 30%. They also fell in nominal terms.”

After each previous peak, house prices went on to fall sharply in real terms, usually by more than 30%.

Wednesday, November 15, 2006

DataQuick: Bay Area home sales slow, prices flat

by Calculated Risk on 11/15/2006 05:10:00 PM

DataQuick reports: Bay Area home sales slow, prices flat

Bay Area home sales held steady at a five-year low in October ... Prices remained flat.

The median price paid for a Bay Area home was $614,000 last month, up 0.5 percent from September's $611,000, and unchanged from October last year. The median hovered around $630,000 last spring and early summer, and spiked to $644,000 in June before coming down.

| Bay Area California Median Home Prices | ||||

| Area | Oct '04 | Oct '05 | Oct '06 | Pct Change |

| Alameda | $497K | $571K | $578K | 1.2% |

| Contra Costa | $468K | $575K | $544K | -5.4% |

| Marin | $688K | $817K | $844K | 3.3% |

| Napa | $527K | $608K | $555K | -8.7% |

| San Francisco | $666K | $778K | $771K | -0.9% |

| San Mateo | $656K | $759K | $745K | -1.8% |

| Santa Clara | $552K | $639K | $658K | 3.0% |

| Solano | $413K | $476K | $462K | -2.9% |

| Sonoma | $477K | $564K | $531K | -5.9% |

| Bay Area | $524K | $614K | $614K | 0.0% |

I added the October 2004 median prices to give a two year perspective on prices.

A total of 7,979 new and resale houses and condos were sold in the nine-county region in October. That was up 0.9 percent from 7,907 for the month before, and down 24.1 percent from 10,508 for October last year, according to DataQuick Information Systems.

Last month's sales count was the lowest for any October since 2001 when 7,867 homes were sold. An average October has 8,445 sales in DataQuick's statistics, which go back to 1988. The range is from 5,767 in 1994 to 11,728 in 2003.

| Bay Area California Homes Sold | ||||

| Area | Oct '04 | Oct '05 | Oct '06 | Pct Change |

| Alameda | 2,458 | 2,187 | 1,586 | -27.5% |

| Contra Costa | 2,252 | 2,104 | 1,658 | -21.2% |

| Marin | 404 | 395 | 286 | -27.6% |

| Napa | 206 | 187 | 140 | -25.1% |

| San Francisco | 650 | 605 | 523 | -13.6% |

| San Mateo | 840 | 754 | 653 | -13.4% |

| Santa Clara | 2,595 | 2,557 | 1,971 | -22.9% |

| Solano | 978 | 936 | 605 | -35.4% |

| Sonoma | 797 | 783 | 557 | -28.9% |

| Bay Area | 11,180 | 10,508 | 7,979 | -24.1% |

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |