by Calculated Risk on 10/31/2007 04:15:00 PM

Wednesday, October 31, 2007

On Estimating PCE Growth for Q3

Each quarter I've been estimating PCE growth based on the Two Month method. Once again, this method has provided a very close estimate for the actual PCE growth.

Some background: The BEA releases Personal Consumption Expenditures monthly (as part of the Personal Income and Outlays report) and quarterly, as part of the GDP report (also released separately quarterly).

You can use the monthly series to exactly calculate the quarterly change in PCE. The quarterly change is not calculated as the change from the last month of one quarter to the last month of the next (several people have asked me about this). Instead, you have to average all three months of a quarter, and then take the change from the average of the three months of the preceding quarter.

So, for Q3, you would average PCE for July, August and September, then divide by the average for April, May and June. Of course you need to take this to the fourth power (for the annual rate) and subtract one.

The September data isn't released until after the advance Q3 GDP report. But I used the change from April to July, and the change from May to August (the Two Month Estimate) to approximate PCE growth for Q3. Click on graph for larger image.

Click on graph for larger image.

This graph shows the two month estimate versus the actual change in real PCE. The correlation is high (0.92).

The two month estimate suggested real PCE growth in Q3 would be about 3.0%. The actual result (in the Advance GDP report) was also 3.0%.

Since the two month estimate was very accurate, this suggests that there was little slowdown in consumer spending in September.

As an aside, the Fed now has the results (not public yet) of the October Senior Loan Officer survey. Based on the Fed statement today, I bet the numbers are ugly.

Fed Cuts Rates, Says Economy to Slow

by Calculated Risk on 10/31/2007 02:13:00 PM

Fed Statement:

The Federal Open Market Committee decided today to lower its target for the federal funds rate 25 basis points to 4-1/2 percent.

Economic growth was solid in the third quarter, and strains in financial markets have eased somewhat on balance. However, the pace of economic expansion will likely slow in the near term, partly reflecting the intensification of the housing correction. Today’s action, combined with the policy action taken in September, should help forestall some of the adverse effects on the broader economy that might otherwise arise from the disruptions in financial markets and promote moderate growth over time.

Readings on core inflation have improved modestly this year, but recent increases in energy and commodity prices, among other factors, may put renewed upward pressure on inflation. In this context, the Committee judges that some inflation risks remain, and it will continue to monitor inflation developments carefully.

The Committee judges that, after this action, the upside risks to inflation roughly balance the downside risks to growth. The Committee will continue to assess the effects of financial and other developments on economic prospects and will act as needed to foster price stability and sustainable economic growth.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Charles L. Evans; Donald L. Kohn; Randall S. Kroszner;

Frederic S. Mishkin; William Poole; Eric S. Rosengren; and Kevin M. Warsh. Voting against was Thomas M. Hoenig, who preferred no change in the federal funds rate at this meeting.

In a related action, the Board of Governors unanimously approved a 25-basis-point decrease in the discount rate to 5 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of New York, Richmond, Atlanta, Chicago, St. Louis, and San Francisco.

Moody's: D.R. Horton, Ryland May be Cut to "Junk"

by Calculated Risk on 10/31/2007 12:59:00 PM

From Reuters: Moody's may cut D.R. Horton, Ryland, into junk

Moody's ... said it may cut its ratings on D.R. Horton Inc and Ryland Group Inc into junk territory ...

The builders have struggled to generate free cash flow, "in part because of their limited success to date in reducing actual inventory, in part because of continuing high cancellation rates, and in part because of the fiercely competitive environment the two companies face in most of their markets," Moody's said in a statement.

"Exacerbating the situation, especially in the case of Horton, is the elevated level of (speculative) inventory," Moody's said.

Q3 Structure Investment

by Calculated Risk on 10/31/2007 11:34:00 AM

According to the BEA, Residential Investment declined at a 20.1% annual rate in Q3 2007.

The first graph shows Residential Investment (RI) as a percent of GDP since 1960. Click on graph for larger image

Click on graph for larger image

Residential investment, as a percent of GDP, has fallen to 4.51% in Q3 2007, and is now below the median for the last 50 years of 4.56%.

Although RI has fallen significantly from the cycle peak in 2005 (6.3% of GDP in Q3 2005), RI as a percent of GDP is still well above all the significant troughs of the last 50 year (all below 4% of GDP). Based on these past declines, RI as a percent of GDP could still decline significantly over the next year or so.

The fundamentals of supply and demand also suggest further significant declines in RI.

Non Residential Structures Investment in non-residential structures continues to be very strong, increasing at a 12.3% annualized rate in Q3 2007.

Investment in non-residential structures continues to be very strong, increasing at a 12.3% annualized rate in Q3 2007.

Investment in non-residential structures is now 3.44% of GDP, above the recent peak in 2001. Whereas RI declines prior to a recession, non-residential investment in structures tends to peak during a recession.

Accounting For Negative Amortization

by Anonymous on 10/31/2007 10:00:00 AM

Accounting for negative amortization is a perennial favorite amongst those who follow banks and thrifts with large Option ARM portfolios. It outrages a lot of folks that the neg am balances, which represent interest that has been earned but not paid, is considered noncash interest income. It also seems to outrage a lot of folks that OA portfolio holders do not simply declare these capitalized balances as "uncollectable." The idea seems to be that 1) the fact of negative amortization itself should mean that the loan is substandard or doubtful, regardless of timely payment of the contractually allowed minimum payment, and therefore 2) the accounting treatment for reserve purposes should be the much more onerous one, "all estimated credit losses over the remaining effective lives of these loans," rather than the standard for non-classified loans, "all estimated credit losses over the upcoming 12 months."

I think this is the argument Jonathan Weil is trying to make in this piece on WaMu:

As for the fourth quarter, Washington Mutual predicted that provisions would be $1.1 billion to $1.3 billion and that charge-offs would increase 20 percent to 40 percent.If you have any sense of how the OA market worked in the last three or four years, you have to find Weil's approach here a bit odd. Back in 2004-2005, when WaMu had more OAs on its books, it had younger OAs on its books. It takes some time for OAs to build up neg am balances, and as origination of this product really didn't take off until 2003-2004, you wouldn't expect any portfolio of OAs to have large capitalized balances for at least a few years.

To see why even $1.3 billion in provisions looks light, consider Washington Mutual's $57.86 billion of so-called option- ARM loans, which make up 24 percent of Washington Mutual's loan portfolio. These adjustable-rate mortgages were popular during the housing bubble, because they give customers the option of postponing interest payments, which the lender then adds to their principal balances.

As of Sept. 30, the unpaid principal balance on Washington Mutual's option ARMs exceeded the loans' original principal amount by $1.5 billion, meaning the customers owed $1.5 billion more in principal than what they originally borrowed. By comparison, that figure was $681 million a year earlier, when Washington Mutual had $67.14 billion, or 16 percent more, option ARMs on its books.

Look to the end of 2005, and the trend becomes even starker. Back then, Washington Mutual had even more option ARMs on its balance sheet, at $71.2 billion. Yet the unpaid principal balance exceeded the original principal amount by only $160 million -- and that was up from a mere $11 million at the end of 2004.

Deferring Pain

The deferred interest from option ARMs also boosts Washington Mutual's earnings, part of a process known as negative amortization, or ``neg-am.'' That's because option-ARM lenders recognize interest income when customers postpone their interest payments, even though the lenders got no cash.

For the nine months ended Sept. 30, Washington Mutual recognized $1.05 billion in earnings as a result of neg-am within its option-ARM portfolio. That represented 7.2 percent of Washington Mutual's $14.61 billion of total interest income year-to-date. By comparison, neg-am contributed 1.8 percent of Washington Mutual's interest income for all of 2005 and just 0.2 percent for 2004.

What's going on here? Either the borrowers postponing their interest payments are doing so as a matter of choice, by and large, or they can't afford to pay them. Common sense suggests it's the latter -- and that there's serious doubt Washington Mutual ever will collect the $1.5 billion of postponed interest that its option-ARM customers have added to their original principal balances.

What Weil is doing is trying to find a negative trend in the performance of these loans: his "common sense" says that the very fact of negative amortization means the borrowers are in trouble, and the very fact that neg am balances are growing in WaMu's portfolio means that a reasonable person would assume that this pattern should be projected into the foreseeable future. What that implies, of course, is that WaMu should "classify" all of these loans, regardless of LTV, timely payment, etc., on the recognized accounting basis of the "negative trend." If they did that, they would have to reserve a lot more against these loans, since allowances for classified loans are required, by the OTS, to be for the life of the loan. Reserves for nonclassified loans are for the next twelve months.

Yet the $1.1 billion to $1.3 billion of fourth-quarter provisions that Washington Mutual predicted -- for the company as a whole -- wouldn't even cover the $1.5 billion of tacked-on principal. The trend among Washington Mutual's option ARMs shows no sign of slowing, either.Surely not even the greatest OA skeptic believes that WaMu could conceivably face default of every last one of its OAs with a neg am balance in the next 12 months. Without saying so explicitly, Weil is suggesting that WaMu pack lifetime estimated losses on this portfolio into current reserves, for no other reason than that the loans are negatively amortizing.

Through a spokeswoman, Libby Hutchinson, Washington Mutual officials declined to comment. She said the company's executives aren't fielding questions until their next meeting with investors on Nov. 7.

Then there's the bigger picture. While Washington Mutual's loan-loss allowance rose 22 percent to $1.89 billion during the 12 months ended Sept. 30, nonperforming assets rose 128 percent to $5.45 billion. So even if Washington Mutual adds $1.3 billion in provisions next quarter, its loan-loss allowance still won't be anywhere close to catching up.

To be sure, Washington Mutual executives have some latitude over the timing of the company's loan-loss provisions. Yet they also may have a monetary incentive to push losses into 2008.

To me, that is the crux of all of this upset over OA accounting. I personally would not make OAs nor would I hold them in any portfolio over which I had control, so don't think I'm defending the product. However, we just went through a major regulatory effort on "nontraditional mortgage products," and the upshot of that was that the regulators did not and would not deem the negative amortization ARM an unacceptable product for depositories, in and of itself. There is plenty in the Nontraditional Mortgage Guidance about what underwriting practices and so on should be followed with these loans, and certainly the guidance isn't a carte blanche for writing any old dumb OA an institution can think of. But they are not, explicitly, "classified" just because they're OAs:

When establishing an appropriate ALLL and considering the adequacy of capital, institutions should segment their nontraditional mortgage loan portfolios into pools with similar credit risk characteristics. The basic segments typically include collateral and loan characteristics, geographic concentrations, and borrower qualifying attributes. Segments could also differentiate loans by payment and portfolio characteristics, such as loans on which borrowers usually make only minimum payments, mortgages with existing balances above original balances, and mortgages subject to sizable payment shock. The objective is to identify credit quality indicators that affect collectibility for ALLL measurement purposes.I do not know how to read this except that there must be specific indicators of credit quality in the analysis besides the fact that the loans are "nontraditional" and that the issue is capital adequacy, not just reserves (capital being expected to cover long-horizon potential losses, and reserves being expected to, well, cover the short term). Weil's "common sense" may tell him that neg am = loan distress by definition, but the regulators' common sense didn't tell them that, and whose common sense do you think matters to WaMu?

What this means is that the federal regulators have said that the fact that a loan accrues neg am balances does not, in and of itself, make the loan unacceptable, substandard, or uncollectable. How, precisely, banks are supposed to get away with reserving for them as if they were beats me: the regulators can get on your case just as much for over-reserving as for under-reserving, as this can smack of "cookie jar" accounting. The only way a bank could defend itself against the charge of over-reserving would be for it to define OAs as unacceptable as a product, without regard to any other facts or characteristics. Why does Weil or anyone else expect an originator of OAs to do this?

Similarly with the issue of treating neg am as income: what else would you treat it as? To argue that deferred interest is never in fact collectable is to argue that OAs always default and the recovery is never enough to cover the balance due. If you believed that to be true, you would never make such loans.

And the issue of a "trend" suffers from the same problems. OAs allow for negative amortization up to some limit. That is established in the legal documents when the loan is closed. When you make those loans, you must assume that any and all borrowers may elect to make the minimum payment. That means that a "trend" over time will occur in a highly predictable way, known as an "amortization schedule." Certainly some industry participants have expressed some pearl-clutching surprise over the fact that making the minimum payment seems to be near-universal among outstanding OA loans, but we can file that under the "stunned but not surprised" heading. You do not make neg am loans unless you're prepared for neg am.

The point: the accounting treatment for these loans--reserves, asset classification, income--isn't going to change as long as they're "legal." And nobody is going to reserve for an OA portfolio today assuming that it will be a total loss in the next twelve months. And nobody is going to stop treating accrued but unpaid interest as income. If you have problems with that--and you surely might--then what you have problems with is allowing banks and thrifts to originate and hold these loans tout court, because you have implicitly defined them as substandard to the extent that they do what they are designed to do.

I realize that it is, in some quarters, more entertaining to speculate about accounting shenannigans than it is to face up to the implications of your rhetoric, but there it is. If you want OAs to be illegal, say so, and let me know what happens when the free-marketers jump all over your case. Otherwise, this business of implying that WaMu is reserving against its performing OA portfolio only for losses expected in the next twelve months because it's playing bonus games, not because that's what the reserve rules are, is really disingenuous.

One can make the case that it is simply impossible to accurately treat a portfolio of OAs: they're either always under-reserved or always over-reserved. Fine. I have some sympathy with that argument. But it's an argument for the abolition of OAs, not a criticism of any one bank's application of accounting rules. In any case, I challenge anyone who has a problem with WaMu's accounting for its OA portfolio, but who does not think the product should be outlawed, to explain to me what it is you do want.

Q3 GDP Growth: 3.9 Percent

by Calculated Risk on 10/31/2007 09:25:00 AM

From the WSJ: GDP Grew 3.9% in Third Quarter On Exports, Consumer Spending

Gross domestic product rose at a seasonally adjusted 3.9% annual rate in the third quarter, the Commerce Department said Wednesday in its first estimate of growth for the July-September period. GDP climbed at a 3.8% pace in the second quarter and 0.6% in the first.Also ADP reports: ADP Numbers Show Job Market Improvement

ADP said nonfarm private employment increased 106,000 in October, following three months in which private-sector jobs grew by an average of 43,000 a month. Assuming public employment rose by 19,000 — the average monthly gain over the last year — the ADP numbers imply that Friday’s payroll report from the Labor Department will show an increase of 125,000 in total nonfarm employment.I'll have more on investment later.

Tuesday, October 30, 2007

Fed Rate Decision

by Calculated Risk on 10/30/2007 09:56:00 PM

Dr. Tim Duy writes at Economist's View: Fed Watch: And So It Begins

"The Fed begins a two-day meeting today, with market participants widely expecting a rate cut. I am mentally prepared to be on the wrong side of this call, joining the lonely few, but I just can’t tease another rate cut out of the incoming data."This is another excellent overview from Tim Duy. Recommended reading!

And Tim makes a point I've been thinking about all day:

"... if they do cut, I wish they would stop telling us that their forecast is for moderate growth near potential. A rate cut would suggest that they clearly do no[t] believe that forecast."Exactly.

In addition to the data that Tim cites, add in this story from the WSJ: P&G, Colgate Plan to Increase Prices

Pressured by high commodity costs, Procter & Gamble Co. and Colgate-Palmolive Co. said they would raise prices on consumer staples .... P&G's price increases will be particularly extensive, between 3% and 12% on goods including diapers, fabric softener and pet food.That suggests P&G and Colgate have significant pricing power. A rate cut with rising prices and a moderate growth forecast? Who's the Fed Chief? Arthur Burns?

Housing Busts and Sticky Prices

by Calculated Risk on 10/30/2007 06:00:00 PM

Even though the current housing bubble is probably the largest ever, both in price terms (relative to fundamentals) and geographically (the bubble was widespread), the bust is still following the normal pattern.

A typical housing bubble does not "pop", rather prices decline slowly, in real terms, over several years. This is because house prices display strong persistence and are sticky downward. Sellers tend to want a price close to recent sales in their neighborhood, and buyers, sensing prices are declining, will wait for even lower prices.

This means real estate markets do not clear immediately, and what we initially observe is a drop in transaction volumes, followed some time later by price declines. We are now observing price declines, with the Case-Shiller index indicating that U.S. home prices have fallen 4.5% over the last 12 months.

For how long will prices decline? Although we can draw some lessons from previous housing busts, we have to remember that different areas will experience different price declines.  Click on graph for larger image.

Click on graph for larger image.

This graph shows the Case-Shiller price indices for several selected cities. This includes some of the more bubbly areas like Miami, San Diego and Las Vegas, and other areas with less of an increase in price (like Cleveland and Denver). In general, those areas with the largest price increases will probably also experience the largest price declines.

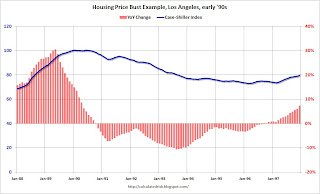

Each housing bust is somewhat unique, however prices declined for 5 to 7 years during most of the previous significant busts. We can use Los Angeles in the early '90s as an example of what happens to prices during a bust.

The second graphs show the Case-Shiller price index for Los Angeles from the late '80s until prices bottomed in 1996. The year-over-year change in prices is also shown.

Prices are sticky but not stuck. As a housing bubble peaks, appreciation slows at first (also transaction volumes decline and inventory rises - not shown), then prices start to decline. Then, about a year or so after the price peaks, prices really start to decline for a couple of years, followed by a couple more years of modest declines.

This graph is for nominal prices, in real terms prices declined almost 39% in LA during the early '90s bust. The third graph lines up the peak for the early '90s LA housing bust with the current nationwide U.S. housing peak. Using the previous bust as a guide - and with prices peaking about 15 months ago - the U.S. has probably just entered the two year period with the most severe price declines.

The third graph lines up the peak for the early '90s LA housing bust with the current nationwide U.S. housing peak. Using the previous bust as a guide - and with prices peaking about 15 months ago - the U.S. has probably just entered the two year period with the most severe price declines.

That is my expectation: we will see the most significant price declines for this cycle over the next two years, followed by more modest declines for a couple more years in the more bubbly areas.

Case-Shiller: Price Declines Accelerate in August

by Calculated Risk on 10/30/2007 11:17:00 AM

The S&P Case-Shiller Home Price index was released this morning for August 2007. The index showed that home price declines accelerated in August, with U.S. prices declining 4.5% over the last 12 months, and at a 8.5% annual rate in August.

Ora Pro Nobis Peccatoribus

by Anonymous on 10/30/2007 11:00:00 AM

Now and in the close of our escrow, amen.

How desperate are home sellers getting?

Item 1: Jewish Buddhist seller buries St. Joseph in the backyard. (Money quote: "I wasn't sure if it would be disrespectful for me, a Jewish Buddhist, to co-opt this saint for my real-estate purposes," says Ms. Luna, a writer. She figured, "Well, could it hurt?")

Item 2: Mortgage broker offers a deal to die for. (Money quote: "'Holy mackerel! This is unbelievable,'" Mr. Cook said.")

Option ARM Performance

by Anonymous on 10/30/2007 10:20:00 AM

Bank of America has kindly given us permission to quote from its Weekly RMBS Trading Desk Strategy Report of October 26 (not online). The subject of this report is Option ARM performance, and the results are rather grim. While OAs are still performing better than Alt-A ARMs of the same vintage, the trends are, well, ugly. Bear in mind that the overwhelming majority of Alt-A ARMs in these two vintages have not yet experienced a rate reset (less than 10% of Alt-A ARMs in 2005-2006 had an initial fixed period of less than 3 years). So while the Alt-A ARM borrowers are making a higher payment than the OA borrowers, they are not yet experiencing payment shock.

While OAs are still performing better than Alt-A ARMs of the same vintage, the trends are, well, ugly. Bear in mind that the overwhelming majority of Alt-A ARMs in these two vintages have not yet experienced a rate reset (less than 10% of Alt-A ARMs in 2005-2006 had an initial fixed period of less than 3 years). So while the Alt-A ARM borrowers are making a higher payment than the OA borrowers, they are not yet experiencing payment shock. But while OAs may be performing better than Alt-A ARMs in recent vintages, their current performance compared to past vintages of OA is gruesome. This chart and the following one break out OAs by loan size and loan purpose, and they suggest that neither factor is driving the current delinquency spike in the 2005-2006 OA vintages. It's important to remember, of course, that the pre-2005 pools of OAs are tiny compared to the later ones. According to UBS, gross issuance of securitized OA pools was $18.5 billion in 2004, $128 billion in 2005, and $175 billion in 2006.

But while OAs may be performing better than Alt-A ARMs in recent vintages, their current performance compared to past vintages of OA is gruesome. This chart and the following one break out OAs by loan size and loan purpose, and they suggest that neither factor is driving the current delinquency spike in the 2005-2006 OA vintages. It's important to remember, of course, that the pre-2005 pools of OAs are tiny compared to the later ones. According to UBS, gross issuance of securitized OA pools was $18.5 billion in 2004, $128 billion in 2005, and $175 billion in 2006. It's hard to escape the conclusion that the "mass marketization" of the negative amortization loan product hasn't done much for its performance. BoA also reports that prepayment speeds have slowed dramatically for outstanding OAs, including those with and without prepayment penalties (or with expired prepayment penalties). That suggests that a fair number of these loans will be around long enough to test "historical" assumptions about what happens when their payments finally recast.

It's hard to escape the conclusion that the "mass marketization" of the negative amortization loan product hasn't done much for its performance. BoA also reports that prepayment speeds have slowed dramatically for outstanding OAs, including those with and without prepayment penalties (or with expired prepayment penalties). That suggests that a fair number of these loans will be around long enough to test "historical" assumptions about what happens when their payments finally recast.

Monday, October 29, 2007

Fitch Places $36.8B CDOs on Negative Rating Watch

by Calculated Risk on 10/29/2007 02:54:00 PM

Fitch Completes Review of All Fitch-Rated SF CDOs; Places $36.8B on Rating Watch Negative

Following a comprehensive global review of the 431 Fitch-rated structured finance collateralized debt obligations (SF CDOs) representing $300.1 billion of outstanding debt, Fitch has placed 150 transactions, representing $36.8 billion, on Rating Watch Negative.

...

Of the $23.9 billion of AAA rated securities on Rating Watch Negative, approximately two-thirds ($16 billion) represent 'AAA' rated tranches of mezzanine subprime deals, and CDO-squareds containing these tranches. The ratings from these deals are expected to suffer the most severe downgrades. While a full analysis remains to be completed, preliminary indications are that a three-to-four rating category average downgrade is to be expected for most of this group, with the revised ratings in the range of 'BBB' to 'BB-'.

The remaining $7.8 billion of 'AAA' rated notes on Rating Watch Negative are from high grade subprime RMBS, prime/Alt-A SF CDOs, and synthetic SF CDOs of all types. The magnitude of downgrade for these deals is expected to be less severe, averaging one-to-two categories with revised ratings ranging from 'AA' to 'A-'.

The ratings subject to Rating Watch Negative from classes currently carrying ratings of other investment-grade categories ('AA', 'A', and 'BBB') are expected to suffer downgrades to below investment grade.

UBS: Further Writedowns Possible

by Calculated Risk on 10/29/2007 10:23:00 AM

From Bloomberg: UBS Says Subprime Contagion May Cause More Writedowns

UBS AG, Europe's largest bank by assets, said the slumping U.S. housing market may lead to further writedowns on debt securities following the company's first quarterly loss in almost five years.I wonder what will happen to the value of these assets next year when there will be record foreclosures and significant declines in U.S. house prices.

UBS is at risk from ``further deterioration in the U.S. housing and mortgage markets as well as rating downgrades'' on mortgage-related securities, the Zurich-based bank said today in a statement.

...

UBS reduced the value of fixed-income securities and leveraged loans by about $4.1 billion in the period, and will release detailed third- quarter results tomorrow.

Meanwhile, on the Option ARM Front

by Anonymous on 10/29/2007 09:56:00 AM

Lenders continue diligently to seek out new customers eager to trade home equity for entrance into the "upscale subprime" class.

From the LA Times:

Sunwest's president and co-owner, Jason Hayes Evans, didn't respond to requests to discuss his company's mailings. But a salesman at Sunwest, describing it as staffed by capable mortgage veterans who survived the industry shakeout, said everyone at the brokerage took pains to carefully explain to borrowers the risks as well as the benefits of option ARMs.This kind of reminds me of my favorite cheesecake recipe, which calls for two and a half pounds of cream cheese, six large eggs, and a half a pint of heavy cream, among other things. It's intended for people in perfect health and at an ideal body weight whose ancestors lived to be 100 and who only eat raw green veggies. Somehow it gets consumed down to the last crumb anyway.

The salesman, who asked not to be identified because he wasn't authorized to speak for Sunwest, said the company provided option-ARM loans from several companies, including Wachovia, that keep the loans as investments rather than sell them.

Sunwest considered disclosing more about pay-option perils in its two-page mailings, the salesman said. "But that would have taken up too much space. You'd need four pages to cover everything." The firm instead relies on explanations by its employees, he said.

The option ARM that allows payments based on a 1% interest rate is intended only for people who have at least 30% home equity, have lived in the home for three years or more and have solidly prime credit scores of 700 and up, the Sunwest salesman said.

Good candidates for such loans, he added, include salespeople living on commissions that vary month to month or people nearing retirement who have more than 50% equity in their homes and know for sure that they will sell their properties when they downsize in a few years.

Of course, the salesman acknowledged, many borrowers at all income levels are attracted to the option ARM because they have let their personal spending get so out of control that the low payment is the only one they can afford.

"Newport Beach, where everyone is driving a Mercedes and the homes start at $1 million, is like an old western movie set," he said, describing the finances of many wealthy homeowners as precarious. "It's all just a front, with stilts holding it up."

MMI: Maternal Merrill Comes to Me

by Anonymous on 10/29/2007 09:24:00 AM

Remember all those witty ursine puns in July when the news was all Bear Stearns all the time? Sure you do.

Since it's likely to be all Merrill all day for the foreseeable future, we're going to have to have a talk with the headline writers at Bloomberg.

"O'Neal Ouster Makes Mess of Maternal Merrill Lynch."

"Maternal Merrill"? Is this the New Formality, or did someone's online translator have a bit of difficulty with "Mother Merrill"?

Let it be . . .

Sunday, October 28, 2007

WSJ: Merrill CEO Exits

by Calculated Risk on 10/28/2007 03:23:00 PM

From the WSJ: Merrill Chief O'Neal Decides To Leave Firm, Source Says

Merrill Lynch & Co. Chief Executive Stan O'Neal has decided to leave the firm, according to a person familiar with the matter.There is an old saying in the corporate world: "New broom sweeps clean". With a new CEO, I'd expect more write-downs and a reduction in headcount.

An announcement on his departure could come today or Monday morning ...

Huge Writedowns: "Leading edge, not the end"

by Calculated Risk on 10/28/2007 11:00:00 AM

From Gretchen Morgenson at the NY Times: Guesstimates Won’t Cut It Anymore

THE props holding up the values of risky mortgage securities finally started to give way last week. And that means the $30 billion in losses and write-downs taken by big brokerage firms in the third quarter are not likely to be the last.No worries. It's all

...

First to face the music was Merrill Lynch, which stunned investors Wednesday with an $8.4 billion write-down, $7.9 billion of which was for mortgage-related assets. The write-down was $3.4 billion more than it had warned investors about just three weeks before.

Until that moment, investors had been willing to trust companies claiming to have limited exposure to the credit mess.

...

The executives on Merrill’s dismal conference call conceded that even after they decided to value their C.D.O. holdings more conservatively — resulting in losses — much of their methodology was based on “quantitative evaluation.” ...

ANALYSTS quickly responded by forecasting an additional $4 billion in write-downs on Merrill’s portfolio. ...

We’ll definitely see a lot more write-downs,” said Josh Rosner, an expert on asset-backed securities at Graham-Fisher, ... “I think that the exposures that we are seeing and the announcement out of Merrill are the leading edge, not the end.”

emphasis added

Saturday, October 27, 2007

Fleck: "Discounted" is the new "Contained"

by Calculated Risk on 10/27/2007 03:44:00 PM

From Fleck at MSN: Tech stocks' pain proves they're vulnerable, too. Here is an excerpt on housing and credit:

... the Lord of the Dark Matter, whose postings on the mortgage-paper unwind will be familiar to my regular readers [says] [t]he problems continue to worsen ... But people keep giving him the same silly line, that it's all been discounted, which is a variation of "it's contained." He says that there are more dark-matter downgrades to come and that some of the insurers of credit may find themselves in serious trouble as credits go bad. He points out that if the insurers get into trouble, then all of the credits they insure obviously will worsen.Discounted, the new Contained.

For those who don't know, there is an absolute mountain of paper that trades where it does only because it has insurance. Sort of like the paper that traded where it did because it was supposedly AAA, and that rating turned out to be worthless. Any AAA, AA, A or whatever rating that's based on insurance may not be worth the paper it's written on.

Barf went the Merrill bull

It's a lesson that hit Merrill Lynch hard. Witness the subprime fallout behind the company's sobering third-quarter earnings report. Merrill wrote down about $5.8 billion of $14.2 billion in what's known as super-senior subprime assets -- the stuff that's supposedly above AAA and bulletproof.

When asked on the conference call if everything was marked where it could be sold, there was no answer, leaving folks with the idea that there was plenty of stuff still marked to model. And you can be sure that if Merrill Lynch has this problem of potentially mismarked paper, so do all of the brokers and probably some of the big banks. This is a huge deal. (Memo to nonbelievers: The problem is spreading, it has not been discounted and it has not been contained.)

Friday, October 26, 2007

JEC On Subprime Crisis

by Anonymous on 10/26/2007 06:00:00 PM

The Joint Economic Committee report discussed in the Times yesterday, "The Subprime Lending Crisis: The Economic Impact on Wealth, Property Values and Tax Revenues," is now available online.

There's lots in here to discuss, but I just noticed one little snippet while I was skimming that answers a question I had a while back. In 2006, 29% of all mortgage loans were originated through mortgage brokers, but 63% of all subprime mortgages were originated through brokers (page 17).

Otherwise, enjoy the graphs, charts, and maps.

Economist Berson Leaves Fannie Mae, Joins PMI

by Calculated Risk on 10/26/2007 05:23:00 PM

From PMI: David W. Berson Joins PMI as Chief Economist and Strategist (hat tip Lurker).

I wish Dr. Berson well at PMI, but I'm going to miss his publicly available economic analysis at Fannie Mae. Here is his final Fannie Mae piece: Twenty years of economic, housing, and mortgage market analysis.

Friday, October 26, 2007 marks my retirement from Fannie Mae after almost exactly 20 years (I started on Monday, November 2). Much has changed in the economy, housing, and mortgage finance markets over that time -- but there are many similarities as well. In that 1987 period, the stock market had crashed just two weeks before and analysts weren’t sure if the economy would head into a downturn (or worse) as a result (it didn’t). Today, we have the severe housing downturn and a broadening credit crisis. Will this be the precursor of a downturn? Most economists don’t think so, although we are skirting dangerously close to recession (not that the real GDP numbers show it) and economists are notorious for egregiously missing business cycle turning points (both up and down). The high odds of a downturn (even if not over 50 percent) suggest that households, businesses, and governments should start to make contingency plans for such an event. Another interesting similarity between that late-1980s period and today has been the rise of new, aggressive mortgage products. In the earlier period, we saw a rise of low-documentation lending -- starting out with loan-to-value ratios (LTVs) of less than 70 percent, but over time moving to LTVs of over 90 percent. Additionally, the investor share of purchase originations rose sharply. More recently we have had a plethora of low-doc, no-doc, investor, 2/28 subprime, even more investors, and option ARMs -- arguably more aggressive lending than in the late-1980s. Of course, in late 1987 the housing/mortgage market was still ramping-up with these new mortgage products. Today, we are suffering the downside of overexposure to them (making 2007 perhaps more similar to 1990, in that regard). Ultimately, the lending practices of the late 1980s resulted in an extended period of weakness in home sales, house prices, and mortgage market volumes. We may be in year two of a similar five-year downturn today. (Note that not all of these areas fell for five years in the earlier period, nor are they all likely to decline for five years this time -- but some of them may.)Best wishes to David Berson! Thanks for all the great analysis.

...

And now, in the immortal words of Porky Pig, “that’s all folks!”

emphasis added

Record California Foreclosure Activity

by Calculated Risk on 10/26/2007 02:35:00 PM

From DataQuick: Record California Foreclosure Activity

Lenders started formal foreclosure proceedings on a record number of California homeowners last quarter, the result of declining home prices, sluggish sales and subprime mortgage distress, a real estate information service reported.It's hard to imagine, but next year will probably be worse.

A total of 72,571 Notices of Default (NoDs) were filed during the July-to-September period, up 34.5 percent from 53,943 during the previous quarter, and up 166.6 percent from 27,218 in third-quarter 2006, according to DataQuick Information Systems of La Jolla.

Last quarter's default level passed the previous peak of 61,541 reached in first-quarter 1996. A low of 12,417 was reached in third-quarter 2004. An average of 34,781 NoDs have been filed quarterly since 1992, when DataQuick's NoD statistics begin.

"We know now, in emerging detail, that a lot of these loans shouldn't have been made. The issue is whether the real estate market and the economy will digest these over the next year or two, or if housing market distress will bring the economy to its knees. Right now, most California neighborhoods do not have much of a foreclosure problem. But where there is a problem, it's getting nasty," said Marshall Prentice, DataQuick's president.

Half the state's default activity is concentrated in 293 zip codes, almost all of which are in the Inland Empire and Central Valley. Grouped together, those zip codes saw year-over-year home price increases that reached 34.0 percent in first quarter 2005. Prices peaked in third-quarter 2006 at $399,000. Last quarter's median of $352,250 is 11.7 percent off that peak.

...

Most of the loans that went into default last quarter were originated between July 2005 and September 2006. The median age was 18 months. Loan originations peaked in August 2005. The use of adjustable-rate mortgages for primary purchase home loans peaked at 77.8% in May 2005 and has since fallen.

Because a residence may be financed with multiple loans, last quarter's 72,751 default notices were recorded on 68,746 different residences.

Census Bureau: Vacancy Rates Stable in Q3

by Calculated Risk on 10/26/2007 01:57:00 PM

From the Census Bureau on Residential Vacancies and Homeownership

National vacancy rates in the third quarter 2007 were 9.8 percent for rental housing and 2.7 percent for homeowner housing, the Department of Commerce’s Census Bureau announced today. The Census Bureau said the rental vacancy rate was not statistically different from the third quarter rate last year, or the rate last quarter. For homeowner vacancies, the current rate was higher than a year ago (2.5 percent), but was not statistically different than the rate last quarter (2.6 percent). The homeownership rate at 68.2 percent for the current quarter was lower than the third quarter 2006 rate, but was not statistically different from the rate last quarter.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the homeowner vacancy rate since 1956. A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, but it does appear the vacancy rate has stabilized.

This leaves the homeowner vacancy rate almost 1% above normal, or about 750 thousand excess homes.

The rental vacancy rate has been trending down slightly for almost 3 years (with some noise). This was due to a decline in the total number of rental units in 2004, and more recently due to more households choosing renting over owning.

The rental vacancy rate has been trending down slightly for almost 3 years (with some noise). This was due to a decline in the total number of rental units in 2004, and more recently due to more households choosing renting over owning.It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. This would suggest there are about 600 thousand excess rental units in the U.S. that need to be absorbed.

This suggests there are about 1.35 million excess housing units in the U.S. that need to be worked off over the next few years. These excess units will keep pressure on housing starts for some time.

Snow on MLEC

by Anonymous on 10/26/2007 12:00:00 PM

While we're on the subject of "price discovery," it appears that former Treasury Secretary Snow isn't impressed by Sivvie Mac ("The Knife"):

WASHINGTON, Oct 26 (Reuters) - Former U.S. Treasury Secretary John Snow on Friday said a proposed multibillion-dollar fund assembled by top banks to prevent a fire sale of shaky debts may cause problems by delaying inevitable losses.Is anyone else enjoying the spectacle of Snow sounding smarter than Paulson?

"We've got all this paper out in the system, and my inclination is to say, let's accelerate the price discovery process on this paper," Snow said on CNBC Television.

"We know that when you prop things up artificially -- Japan -- we know when you prop things up artificially -- the (savings and loans) in the United States -- you get bigger adverse consequences," said Snow, the immediate predecessor of current Treasury Secretary Henry Paulson.

Snow, now chairman of private equity firm Cerberus Capital Management, said he has not discussed the fund with Paulson.

Moody's Cuts Ratings on CDOs

by Calculated Risk on 10/26/2007 11:57:00 AM

From Bloomberg: Moody's Cuts Ratings on CDOs Tied to Subprime Bonds (hat tip Robert)

Moody's ... cut the ratings of collateralized debt obligations tied to $33 billion of subprime mortgage securities, a decision that may force owners to mark down the value of their holdings.

Securities from at least 45 CDOs were either cut or put under review, according to news releases sent by the New York- based ratings company.

AHM v. LEH: The Revenge of Mark to Model

by Anonymous on 10/26/2007 11:47:00 AM

This is killing me:

PHILADELPHIA (Dow Jones/AP) - Bankrupt lender American Home Mortgage Investment Corp. has sued Lehman Bros., accusing the investment bank of essentially stealing from the company as it struggled to stay on its feet.That's an interesting theory of levering up your "assets": if the market says "no bid," you apparently get "no mark" and therefore "no call" and hence "no bankruptcy."

The lawsuit, filed Wednesday in the U.S. Bankruptcy Court in Wilmington, Del., accuses Lehman Bros. of hitting American Home with improper margin calls in July and demanding money the company says it did not owe.

When the Melville, N.Y.-based lender couldn't meet Lehman's second margin call, for $7 million, Lehman foreclosed on $84 million worth of subordinated notes issued in American Home's structured-finance operation. . . .

American Home is relying in part on the frozen market for mortgage-industry paper to make its case against Lehman Bros. Without actual trades to show the value of the notes had declined, American Home argues that Lehman Bros. should have obtained an independent valuation before issuing the margin call.

The thing is, in a nutshell, that AHM was using these borrowings to fund new mortgage origination operations. A "frozen market for mortgage-industry paper" means no money to make new loans with (proceeds from sales of commercial paper backed by the warehouse of held-for-sale loans) until you can sell the loans you've already made. But you can't sell the loans you've already made, unless you want to take a nasty hit on them, because nobody's buying decent whole loans in a "frozen market," and there is excellent reason to think AHM's warehouse held a boatload of not exactly decent loans. We know this because AHM was forced to visit the confessional about its massive number of buybacks of loans that didn't make the first three payments sucessfully.

So Lehman wanted out of its exposure to AHM's held for sale pipeline, as far as I can tell, because unlike your usual "pipeline," this one was a pipe to nowhere (kind of like the bridge to nowhere). It sounds like AHM is now saying that Lehman made up some ugly mark to model valuation instead of getting "independent" verification of the fact that there were no bids--or horrible ones--for the AHM loans. I guess the fact that AHM couldn't get 'em sold in the first place, which is the whole point of having a "held for sale pipeline," is insufficient evidence that the stuff was worthless.

I look forward to hearing about Lehman's response to this.

(Many thanks to the indefatiguable Clyde)

Countrywide reports $1.2 billion loss

by Calculated Risk on 10/26/2007 09:13:00 AM

From MarketWatch: Countrywide reports $1.2 billion loss

... mortgage lender Countrywide Financial Corp. reported Friday its first quarterly loss in 25 years ...

The Company ... said it has also negotiated $18 billion in additional liquidity that it characterized as "highly reliable." Countrywide also said it expects to turn a profit in the fourth quarter and in 2008. ...

Its mortgage-banking business suffered a $1.3 billion loss in the latest quarter.

...

"We view the third quarter of 2007 as an earnings trough, and anticipate that the company will be profitable in the fourth quarter and in 2008," Sambol said.

Countrywide said it took losses and write-downs of about $1 billion on non-agency loans and mortgage-backed securities. Moreover, The company increased its loan-loss provisions on its held-for-investment portfolio to $934 million, up from $293 million in the second quarter.

The lender also raised its estimates of future defaults and charge-offs due to a worsening housing market, higher delinquencies and tighter credit. Countrywide plans to cut between 10,000 and 12,000 workers by the end of the year as a result of plunging origination volume.

...

The company said it expects the housing market to continue to weaken in the near term, and unless interest rates head lower, it sees lower mortgage originations through 2008.

Thursday, October 25, 2007

Analyst: AIG may take $9.8B Hit

by Calculated Risk on 10/25/2007 08:30:00 PM

From MarketWatch: AIG may take $9.8 bln subprime hit, analyst says

American International Group could take a $9.8 billion hit from its exposure to subprime mortgages, Friedman, Billings, Ramsey analyst Bijan Moazami estimated on Thursday.This was the big rumor today.

The write-downs will be big, but manageable...

BoA Exits Wholesale Mortgage Business

by Anonymous on 10/25/2007 06:15:00 PM

Mr. Lewis is not a happy camper:

CHARLOTTE, N.C. - In addition to scaling back its investment banking operations, Bank of America Corp. is exiting the wholesale mortgage business and eliminating about 700 jobs, bank officials said Thursday.Hey, I can relate, Ken. These days nobody likes being a servicer . . .

The nation's second-largest bank will stop offering home mortgages through brokers at the end of the year to focus on direct-to-consumer lending through its banking centers and loan officers. The move also eliminates the jobs in the bank's consumer real estate unit. . . .

The cuts are part of a 3,000-job reduction engineered by Chief Executive Ken Lewis after the nation's second-largest bank reported a huge decline in third-quarter earnings.

"When Ken talks about a top-to-bottom review in five days time, you can't make that happen. These cuts were in the works, and expect more," said Tony Plath, an associate professor of finance at the University of North Carolina at Charlotte. "Don't underestimate the depth of Lewis' disappointment in earnings. This guy is pissed." . . .

"Ken says he likes the retail business, he likes getting to know customers, underwriting, and managing his risk," said Plath, the university professor. "He just doesn't like the securitization and servicing sides of the business."

Up to $4 Trillion Decline in U.S. Household Real Estate Value Predicted

by Calculated Risk on 10/25/2007 01:41:00 PM

Update: Dean Baker says maybe up to$8 Trillion. (hat tip Lindsey)

Last week, in the comments, I noted that some economists were predicting financial losses of $100 Billion from the mortgage crisis. I joked that maybe they dropped a zero - and I also noted that that estimate didn't include the $2 Trillion or more that will be lost in U.S. household net worth.

The NY Times had an article this morning that provided new estimates for these losses: Reports Suggest Broader Losses From Mortgages.

Note: Tanta excerpted part of the same NY Times article this morning on Foreclosure Predictions.

The article includes these projections of financial and household losses:

... economists say the troubles in the mortgage market could, all told, cost financial firms and investors up to $400 billion.These unnamed economists didn't add a zero - yet - to the earlier projections, but they are getting closer!

That is far more than the roughly $240 billion cost, adjusted for inflation, of the savings and loan crisis of the early 1990s, according to estimates of the combined financial toll of that crisis on both the federal government and private sector. The loss in total real estate wealth is expected to range from $2 trillion to $4 trillion, depending on how far home prices fall, according to several economists.

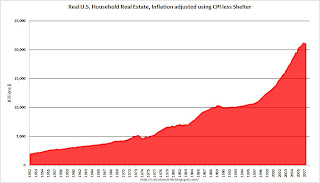

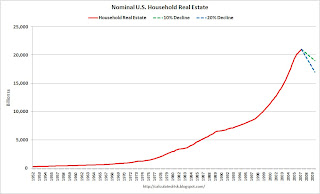

Let's look at these projected U.S. household real estate losses. Currently (end of Q2) U.S. household real estate was valued at $20.997 Trillion (Fed: Flow of Funds report). So a $2 Trillion dollar loss is about a 10% decline in total U.S. household real estate value. A $4 Trillion dollar loss is a 20% decline.

Click on graph for larger image.

Click on graph for larger image.This graph shows the real (inflation adjusted using CPI less Shelter) value of U.S. household real estate since 1952. The real value increases because new homes are built each year, older homes are improved, and, in general, the value of land increases (especially in dense areas) faster than the rate of inflation.

Even adjusted for inflation, the value of U.S. household real estate increased sharply in recent years.

The second graph shows the nominal value (not adjusted for inflation) of U.S. household real estate. This is useful because the $2 Trillion to $4 Trillion in potential losses described in the article are nominal values.

Just to put these numbers into perspective, I've plotted the two declines - $2 Trillion and $4 Trillion - assuming the price declines happen between now and the beginning of 2010. Note that this doesn't add in any new homes or home improvement.

A decline of this magnitude in U.S. household real estate value seems very possible.

More on September New Home Sales

by Calculated Risk on 10/25/2007 10:40:00 AM

For more graphs, please see my earlier post: September New Home Sales

Let's start with revisions. Last month I wrote:

The new homes sales number today [August] will probably be revised down too. Applying the median cumulative revision (4.8%) during this downtrend suggests a final revised Seasonally Adjusted Annual Rate (SAAR) sales number of 757 thousand for August (was reported as 795 thousand SAAR by the Census Bureau). Just something to remember when looking at the data.Sure enough, sales for August were revised down to 735 thousand. I believe the Census Bureau is doing a good job, but the users of the data need to understand what is happening (during down trends, the Census Bureau overestimates sales).

This makes a mockery of headlines like this from the AP: New Home Sales Rebound in September. Sales did not "rebound", in fact the September report was horrible, and the sales number will almost certainly be revised down.

For an analysis on Census Bureau revisions, see the bottom of this post.

Click on graph for larger image.

Click on graph for larger image.This graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001. This should raise concerns about a possible consumer led recession - possibly starting right now!

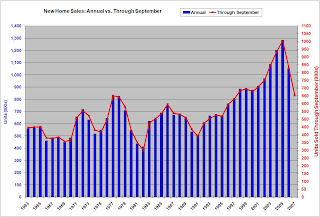

The second graph compares annual New Home Sales vs. Not Seasonally Adjusted (NSA) New Home Sales through August.

Typically, for an average year, about 78% of all new home sales happen before the end of September. Therefore the scale on the right is set to 78% of the left scale.

It now looks like New Home sales will be in the low 800s - the lowest level since 1997 (805K in '97). My forecast was for 830 to 850 thousand units in 2007 and that might be a little too high.

September New Home Sales

by Calculated Risk on 10/25/2007 10:00:00 AM

According to the Census Bureau report, New Home Sales in September were at a seasonally adjusted annual rate of 770 thousand. Sales for August were revised down to 735 thousand, from 795 thousand. Numbers for June and July were also revised down.

Click on Graph for larger image.

Sales of new one-family houses in September 2007 were at a seasonally adjusted annual rate of 770,000 ... This is 4.8 percent above the revised August rate of 735,000, but is 23.3 percent below the September 2006 estimate of 1,004,000.

The Not Seasonally Adjusted monthly rate was 60,000 New Homes sold. There were 80,000 New Homes sold in September 2006.

September '07 sales were the lowest September since 1995 (54,000).

The median and average sales prices are declining. Caution should be used when analyzing monthly price changes since prices are heavily revised and do not include builder incentives.

The median sales price of new houses sold in September 2007 was $238,000; the average sales price was $288,000.

The seasonally adjusted estimate of new houses for sale at the end of September was 523,000.

The 523,000 units of inventory is slightly below the levels of the last year.

Inventory numbers from the Census Bureau do not include cancellations - and cancellations are once again at record levels. Actual New Home inventories are probably much higher than reported - probably about 100K higher.

This represents a supply of 8.3 months at the current sales rate

This is another very weak report for New Home sales. The stunning - but not surprising - downward revision to the August sales numbers was extremely ugly. This is the second report after the start of the credit turmoil, and, as expected, the sales numbers are very poor.

I expect these numbers to be revised down too. More later today on New Home Sales.

Foreclosure Predictions

by Anonymous on 10/25/2007 09:51:00 AM

This is what we refer to in the risk management business as "interesting." From the New York Times:

In a new report to be issued today, the Joint Economic Committee of Congress predicts about two million foreclosures by the end of next year on homes purchased with subprime mortgages. That estimate is far higher than the Bush administration’s prediction in September of 500,000 foreclosures, which in itself would be a tidal wave compared with recent years. Congressional aides provided details of the report yesterday to The New York Times.For those of you keeping score, back in October of 2006 Michael Perry predicted foreclosures "in the coming months" of around 2 million.

The Joint Economic Committee estimates that the lost of real estate wealth just from foreclosures on subprime loans will be about $71 billion. An additional $32 billion would be lost because foreclosed homes tend to drive down the prices of other houses in the neighborhood.

Those figures would cause a decline of $917 million in lost property tax revenue to state and local governments, which will also have to spend more on policing neighborhoods with vacant homes. The states most likely to be hard hit fall into two categories: those where prices had been rising fastest, like California and Florida, and Midwest states with weak economies, like Michigan and Ohio, where people with low or moderate incomes made heavy use of subprime loans to become homeowners and consolidate debts.

In December of 2006, the Center for Responsible Lending predicted 2.2 million foreclosures of subprime loans.

In March of 2007, First American predicted 1.1 million foreclosures in the next 6-7 years.

Anybody want to take 500,000 foreclosures by the end of 2007?

(Thanks, Clyde!)

WSJ: Commercial Construction May Slow

by Calculated Risk on 10/25/2007 02:13:00 AM

From the WSJ: Commercial Construction May Slow (hat tip Jim)

The pace of U.S. commercial-construction activity ... is showing signs of slowing and could drop next year for the first time since the early part of the decade ...

In a closely watched report expected to be released today, McGraw-Hill Construction will forecast that spending on commercial and manufacturing buildings, such as offices, warehouses and hotels, will decline 7% next year, in dollar volume, and 10% in the number of square feet of space built. That would be a sharp turnaround from this year, when commercial and manufacturing construction is expected to end the year up 11% in dollar volume.

Wednesday, October 24, 2007

Subprime: Winners are Losers, Too

by Anonymous on 10/24/2007 06:37:00 PM

We haven't seen that many defenses of subprime lending recently. Long-time readers of the blog will remember a certain vogue earlier this year for the "but subprime helps the poor" schtick, which predictably got less fashionable as the losses racked up.

So it was interesting to see this Barron's column heaving out the old argument in order to scare us all about Barney Frank's proposed subprime mortgage regulation:

Some two million borrowers have taken subprime mortgages in the past few years, of which one-quarter astonishingly may go into foreclosure. That means 1.5 million Americans own homes that they wouldn't likely get to buy under Barney Frank's rules. They are lucky, indeed.What a ringing defense of the subprime industry: we have to make 500,000 disasters in order to get 1,500,000 successes, and apparently which group you're in is a matter of luck, since tighter standards would have eliminated all 2 million, not just the 500,000. I am curious: do other industries get away with results like that?

Then there's the "strivers" canard:

Immigrant and other minority borrowers would be most likely to be shut out. These strivers often have cash businesses and avail themselves of "no-doc" loans, even though they may have good incomes and assets. Frank's measure would end that.If there's an interpretation of that claim that isn't "Look, we know that brown people frequently cheat on their taxes, and tax cheats have great cash flow to make loan payments with!", would someone share it with me in the comments?

But this part is my favorite, and I think the key to Forsyth's real discomfort with Frank's proposed legislation:

Legislation introduced by Barney Frank, the Massachusetts Democrat who heads the House Financial Services Committee, would, among other things, permit subprime borrower to sue Wall Street firms that underwrote securities backed by those loans. No matter that Lehman, Merrill Lynch or any their cohorts weren't in the neighborhood when some slick mortgage broker [was?] selling an unsophisticated borrower on a lousy loan, the big Street firms can be deemed an accessory after the fact.Here's my modest proposal: you should not be allowed to opine on the subject of assignee liability if you do not understand that the definition of a broker (as opposed to a lender) is that a broker has no money to lend. Someone else must supply the money. Assignee liability is a matter of getting clear on who the "lender" really is in the first place. And you should also not use Lehman or Merrill as your example of innocent Wall Street bystanders when two minutes on Google would tell you they both own mortgage originators.

So there's your argument: people with capital to lend cannot be responsible for what kinds of loans get made, because they delegate the process of taking applications to brokers, and nothing that happens after the application is taken matters. This is true because apparently loan success or failure is unpredictable, a sheer matter of luck. That implies that you just have to produce 100 loans, and let God pick out the 75 that are blessed with homeownership. Drag and all about the 25, but as long as you change the disclosures to let everyone know that this is just a casino, the ones who lose can't complain. New motto: Subprime: The odds are better than blackjack!

For what it’s worth, a recent research report from Lehman* just caught my eye. The analysts looked at a pool of subprime ARM loans from older vintages that are current, and have always been current, but have never refinanced out of those old pools. This is a curious phenomenon, since these borrowers are paying very high interest rates (they’re in ARMs that have already adjusted), they didn’t necessarily start with a high CLTV, and in many cases their properties have probably not depreciated that much, or even appreciated at least some, since origination. Why wouldn’t they refi into a cheaper prime loan with a 24-48 month perfect mortgage payment history and a sliver of equity?

The analysis compared the borrowers’ FICO at origination of the loan with the borrower’s current FICO (presumably ordered for account monitoring purposes). Some 40% of subprime loans with a perfect 24-48 month mortgage history have FICOs that are unchanged or have dropped by as much as 75 points since the loan closed. The implication is that a significant number of current borrowers subsidized their mortgage payment shocks with credit cards: the high balance-to-limit or mounting delinquencies on consumer debt is offsetting the positive FICO effect of on-time mortgage payments. This is a recipe for a permanent subprime borrower: someone who “performs” on the mortgage by supplementing income shortfalls with credit card debt, keeping the FICO at a level that precludes ever becoming a prime mortgage borrower.

That should knock the last leg out from under the argument of subprime lenders that they are giving borrowers a chance to “cure” their credit problems. You have to wonder whether these folks would have been given a mortgage in the first place if they had been qualified on the fully-indexed, fully-amortizing payment and documented income; my guess is they probably wouldn’t. In that sense, they'd "lose out" under tighter mortgage regulation.

But they’re trapped: they’ve got some equity they don’t want to walk away from, yet they can maintain the mortgage payment only by racking up unsustainable consumer debt. Eventually they’ll have to sell the property: there’s only so long you can keep making your mortgage payment with a credit card. But in what sense will they then have been "successful" homeowners? They may never have had a mortgage delinquency, and they may have avoided foreclosure, but they still spent years paying too much for too little purpose.

Until we get straight on the idea that there's something wrong with holding a high-risk lottery to see who among first-time homebuyers gets to become middle-class, and that there's something wrong with a situation in which "success" is defined as quitting before you get fired, we're never going to get straight on what has to be done to reform the mortgage industry.

*Akhil Mago, Lehman, "Overview of the Subprime Sector," October 2007 (not available online)

Homebuilder Reports: Pulte and MDC

by Calculated Risk on 10/24/2007 06:21:00 PM

M.D.C. Holdings Announces Third Quarter 2007 Results

MDC received orders, net of cancellations, for 1,228 homes with an estimated sales value of $365.0 million during the 2007 third quarter, compared with net orders for 2,120 homes with an estimated sales value of $678.0 million during the same period in 2006. For the nine months ended September 30, 2007, the Company received net orders for 5,756 homes with a sales value of $1.92 billion, compared with orders for 8,658 homes with a sales value of $2.95 billion for the nine months ended September 30, 2006.Pulte Homes Reports Third Quarter 2007 Financial Results

During the third quarter and first nine months of 2007, the Company's approximate order cancellation rates were 57% and 44%, respectively, compared with rates of 49% and 40% experienced during the same periods in 2006.

Net new home orders for the third quarter were 4,582 homes, valued at $1.3 billion, which represent declines of 37% and 47%, respectively, from prior year third quarter results.Just plain ugly.

Added: Ryland Reports Results for the Third Quarter of 2007

New orders of 1,876 units for the quarter ended September 30, 2007, represented a decrease of 20.9 percent, compared to new orders of 2,372 units for the same period in 2006. For the third quarter of 2007, new order dollars declined 27.0 percent to $491.4 million from $673.2 million for the third quarter of 2006. Backlog at the end of the third quarter of 2007 decreased 36.6 percent to 4,334 units from 6,835 units at the end of the third quarter of 2006. At September 30, 2007, the dollar value of the Company’s backlog was $1.2 billion, reflecting a decline of 41.6 percent from September 30, 2006.

Tim Duy's Fed Watch

by Calculated Risk on 10/24/2007 01:11:00 PM

Mark Thoma says Tim Duy is losing sleep.

Fed Watch: Runaway Rate Cut Train?. Excerpts

... housing is bad. This morning we get existing home sales, which, considering the local reports I have seen, are almost certain to be simply dismal. I did a road trip to Bend last week, and can confidently report that close to half of central Oregon is for sale. Housing of course was the big topic; when will the downturn end, will prices fall, etc. My story of how bubble markets generally end badly, and don’t bounce back for years (look at the NASDAQ, I say), does not make me many friends.Although Dr. Duy sees spillover from housing into the general economy, it is not enough to concern him. He is more worried about the Fed cutting too much:

But when I pressed the business community (not realtors – they only tell you to wait two months, prices will be on the rise again) on the environment outside of sectors directly tied to housing, I continuously received the same story – no problem.

My expectation remains that the US economy will weather the housing rout better than expected, especially given the global pull, particularly from emerging markets. That leads me to believe that we are not on a runaway rate cut train in the US. Indeed, from an inflation standpoint, the last thing the global economy needs is a runaway rate cut train placing further downward pressure on the dollar.I'm not as sanguine as Tim, but his piece is an excellent overview.

More on September Existing Home Sales

by Calculated Risk on 10/24/2007 12:37:00 PM

For more existing home sales graphs, please see the previous post: September Existing Home Sales Plummet

To put the NAR numbers into perspective, here are the year-end sales, inventory and months of supply numbers, since 1969. This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the September inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the September inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

The current inventory of 4.399 million is just below the all time record set in July and well above the record year end inventory for any other year. The "months of supply" metric is 10.5 months. The "months of supply" is now above the level of the previous housing slump in the early '90s, but still below the worst levels of the housing bust in the early '80s.

Both the numerator and the denominator are moving in the wrong direction. Not only is inventory at record levels, but sales - though falling - are still somewhat above the normal range as a percent of owner occupied units.

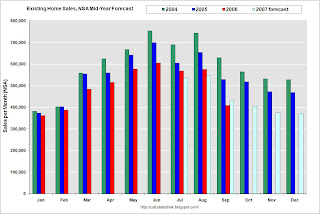

The second graph is an update to my mid-year forecast adding the actual results for July, August and September in 2007. My forecast was for sales to be between 5.6 and 5.8 million units.

My forecast was for sales to be between 5.6 and 5.8 million units.

At mid-year I updated my forecast to the lower end of the previous range (5.6 million units). Through September there have been 4.5 million units sold, and it looks like the total will be right around 5.6 million.

September Existing Home Sales Plummet

by Calculated Risk on 10/24/2007 10:00:00 AM

The NAR reports that Existing Home sales plummeted to 5.04 million in September, the lowest level since September 2001.

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – fell 8.0 percent to a seasonally adjusted annual rate1 of 5.04 million units in September from a downwardly revised pace of 5.48 million in August, and are 19.1 percent below the 6.23 million-unit level in September 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the NSA sales per month for the last 3 years.

The impact of the credit crunch is obvious as sales in September declined sharply.

For existing homes, sales are reported at the close of escrow. So September sales were for contracts signed in July and August.

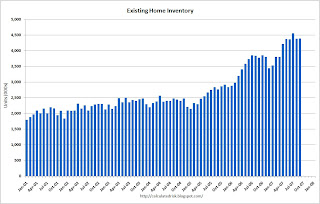

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was flat at 4.4 million homes for sale in September.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was flat at 4.4 million homes for sale in September. Total housing inventory inched up 0.4 percent at the end of September to 4.40 million existing homes available for sale, which represents a 10.5-month supply at the current sales pace, up from a downwardly revised 9.6-month supply in August.This is basically the same inventory level as August, although the months of supply increased to 10.5 months because of the sharp drop in sales.

This is the normal historical pattern for inventory - inventory peaks at the end of summer and then stay fairly flat until the holidays (it then usually declines somewhat). This says nothing about the increasing anxiety of sellers and the rising foreclosure sales.

This wasn't true in 2005 - as inventory continued to increase throughout the year - and that was one of the indicators that the housing boom had ended.

For 2007, I expect that inventory levels are close to the peak level.

The third graph shows the monthly 'months of supply' metric for the last six years.

The third graph shows the monthly 'months of supply' metric for the last six years.Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales continue to decline.

The fourth graph shows monthly sales (SAAR) since 1993.

This shows sales have now fallen to the level of September 2001 (when sales were impacted by 9/11).

This shows sales have now fallen to the level of September 2001 (when sales were impacted by 9/11). I wouldn't be surprised to see a small rebound in SAAR sales next month, but the trend is clearly down.

More later today on existing home sales.

Merrill Reports $8 Billion Write Down

by Calculated Risk on 10/24/2007 08:47:00 AM

From the WSJ: Merrill Lynch Posts Wide Loss, Discloses Bigger Write-Downs

Merrill Lynch & Co. swung to a wider-than-projected third-quarter net loss because of $7.9 billion in write-downs on collateralized debt obligations and subprime mortgages.Talk about a shocking visit to the confessional!

Merrill had warned earlier this month that it would post a net loss of up to 50 cents a share because of writing down $4.5 billion in collateralized debt obligations and subprime mortgages and recording a net $463 million on leveraged finance commitments.

But the CDO and subprime write-downs were much higher than that and even above that of some analysts who were projecting Merrill to record write-downs at or above $7 billion.