by Calculated Risk on 3/10/2009 08:09:00 PM

Tuesday, March 10, 2009

What is a depression?

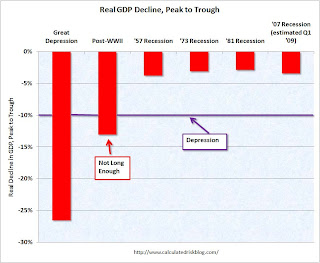

It seems like the "D" word is everywhere. And that raises a question: what is a depression? Although there is no formal definition, most economists agree it is a prolonged slump with a 10% or more decline in real GDP.

Yesterday I heard an analyst say that a 10% unemployment rate is a depression. But the unemployment rate peaked at 10.8% in 1982, and that period is usually not considered a depression.

Some people argue the duration of the economic slump defines a depression - and the current recession is already 15 months old. That is longer than the recessions of '90/'91 and '01. The '73-'75 recession lasted 16 months peak to trough, and the early '80s recession (a double dip) was classified as a 6 month recession followed by a 16 month recession (22 months total). Those earlier periods weren't "depressions", so if duration is the key measure, the current recession still has a ways to go.

Here is a graph comparing the decline in real GDP for the current recession with other recessions since 1947. Depression is marked on the graph as -10%. Click on table for larger image in new window.

Click on table for larger image in new window.

Q1 2009 is estimated at a -7.0% decline in real GDP (Seasonally adjusted annual rate). This will push the cumulative decline (peak to trough) to about 3.4%.

Even though the current recession is already one of the worst since 1947, it is only about 1/3 of the way to a depression (assuming a terrible Q1).

To reach a depression, the economy would have to decline at about a 6.6% annual rate each quarter for the next year. The second graph compares the current recession (estimated through Q1 2009) with the more severe recessions of the last century.

The second graph compares the current recession (estimated through Q1 2009) with the more severe recessions of the last century.

Note that the data is annual for the pre-1947 economic slumps.

The Great Depression saw real GDP decline 26.5%.

The post-WWII recession lasted 8 months and saw real GDP decline 13%. This decline in GDP was due to winding down the war effort - something that was celebrated - and is excluded when analysts call the current slump the "worst since the Great Depression".

I still think a depression is very unlikely. More likely the economy will bottom later this year or at least the rate of economic decline will slow sharply. I also still believe that the eventual recovery will be very sluggish, and it will take some time to return to normal growth.

As I noted last weekend, business cycles have a typical pattern (see Business Cycle: Temporal Order). Housing and personal consumption usually lead the economy out of recession - and both of these areas will probably be slow to recover this time.

The following table and text are an excerpt from the previous post. The table shows a simplified typical temporal order for emerging from a recession.

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

This business cycle there are reasons that housing will not be a significant engine of recovery. It is possible - see Looking for the Sun - that new home sales and housing starts will bottom in 2009, but any recovery in housing will probably be sluggish.

That leaves Personal Consumption Expenditures (PCE) - and as households increase their savings rate to repair their balance sheets, it seems unlikely that PCE will increase significantly any time soon. So even if the economy bottoms in the 2nd half of 2009, any recovery will probably be very sluggish.

At least we know what to watch: Residential Investment (RI) and PCE. The increasingly severe slump in CRE / non-residential investment in structures will be interesting, but that is a lagging indicator for the economy.

(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.