by Calculated Risk on 4/24/2009 11:07:00 AM

Friday, April 24, 2009

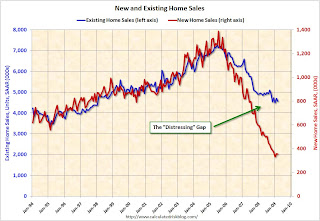

Home Sales: The Distressing Gap

Real Time Economics at the WSJ excerpted some analyst comments about the existing home sales report yesterday: Economists React: ‘Plunge Is Over’ in Existing-Home Sales. A few comments from analysts:

"Home sales have stabilized following the post-Lehmans plunge..."As I've noted before, I believe this "stabilization" discussion in existing home sales analysis is all wrong.

"This is a bit disappointing but the big picture is still clear; the plunge in sales following the Lehman blowup is over."

"The weaker-than-expected result does not change the broad trend in sales, however, which continues to point to a tenuous stabilization..."

"Although home resales were down in March, one can make a reasonable argument that resales are bottoming ..."

Close to half of existing home sales are distressed sales: REO sales (foreclosure resales) or short sales. This has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales (left axis) and new home sales (right axis) through March.

I believe this gap was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

Over time, as we slowly work through the distressed inventory of existing homes, I expect existing home sales to fall further. See Existing Home Sales: Turnover Rate

So I believe those analysts looking at the existing home sales report for stability are looking in the wrong place. The first "signs of stability" in the housing market will be declining inventory (see 3rd graph here), a bottom in new home sales (see previous post), and the gap between new and existing home sales closing.