by Calculated Risk on 5/27/2009 07:01:00 PM

Wednesday, May 27, 2009

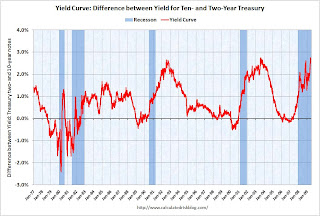

Record High Yield Curve

Earlier we discussed the rising ten year yield (treasury sell-off) and the impact on mortgage rates ... and here is some more interest rate news: the yield curve (ten year yield minus two year yield) is at record levels.

From Bloomberg: Yield Curve Steepens to Record as Debt Sales Surge

The difference in yields between Treasury two- and 10-year notes widened to a record on concern surging sales of U.S. debt will overwhelm the Federal Reserve’s efforts to keep borrowing costs low.

The so-called yield curve steepened to 2.75 percentage points, surpassing the previous record of 2.74 percentage points set on Aug. 13, 2003.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the difference between the ten- and two-year yields.

Usually a steep yield curve precedes a period of decent growth, but several analysts suggest the current ten year sell-off is due to concerns about increased Treasury issuance to finance the deficit. Whatever the reason, this is a challenge for the Fed to keep mortgage rates low.

NOTE: For amusement, check out this New Yorker cartoon by David Sipress: "Wasn't that Paul Krugman?"