by Calculated Risk on 6/19/2009 02:58:00 PM

Friday, June 19, 2009

California Survey of Loan Servicers Q1

The 2009 First Quarter results from the Department of Corporations Survey of Loan Servicers has been released. Historical data is here.

There is a lot of information in this survey: the unpaid balances by loan type, the number of loans by loan type, and modification data.

From Jim Wasserman at the Sacramento Bee: Growing trouble with prime loans (ht Paul)

I was going through the state Department of Corporation's newest quarterly report (Q1-2009) for lenders' loan modification activities and this jumped out at me: The number of workouts initiated for prime loans is rising fast, mirroring rising unemployment in California.

The data come from lenders that report to the state as part of Gov. Arnold Schwarzenegger's Nov. 2007 Subprime agreement. These lenders service about 3.3 million loans in California, about half the state's total.

Click on graph for larger image in new window.

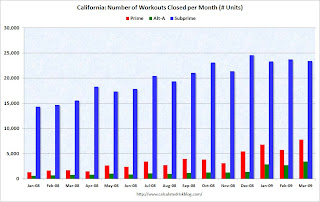

Click on graph for larger image in new window.The first graph shows the number of loan modifications initiated by type (Prime, Alt-A, Subprime). This totals almost 1.5 million loan modifications initiated in California since January 2007 (there are 3.3 million loans including HELOCs) - so there is probably some double counting as modification negotiations are started and stopped.

Modifications for prime loans are surging (and Alt-A is increasing rapidly too). It is possible that subprime peaked during the moratorium period.

The second graph shows loan mods completed by category. The data was only broken out by category starting in Jan 2008.

The second graph shows loan mods completed by category. The data was only broken out by category starting in Jan 2008.I expect a surge in prime loan mods completed based on the mods initiated.

Note that completion can mean: account paid current (about 5%), paid-in-full (6%), modified terms (about 60% of completions), short sale (about 11%), deed-in-lieu of foreclosure (few), reductions in principal (few), and other workouts (about 15%).

As an aside, the California website is titled "Subprime". With the surge in prime modifications, I guess we're all subprime now!