by Calculated Risk on 7/07/2009 02:33:00 PM

Tuesday, July 07, 2009

Office Vacancy Rate and Unemployment

Last night Reis reported that the U.S. office vacancy rate hits 15.9 percent in Q2. (See Reis: U.S. Office Vacancy Rate Hits 15.9% in Q2 for a graph). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the office vacancy rate vs. the quarterly unemployment rate and recessions.

The unemployment rate and the office vacancy rate tend to move in the same direction - and the peaks and troughs mostly line up.

As the unemployment rate continues to rise over the next year or more, the office vacancy rate will probably rise too. Reis' forecast is for the office vacancy rate to peak at 18.2 percent in 2010, and for rents to continue to decline through 2011.

One of the questions is why - given 9.5% unemployment - the office vacancy rate isn't even higher? This is probably a combination of less overbuilding as compared to the S&L related overbuilding in the '80s, and the tech bubble overbuilding a few years ago. And possibly because a higher percentage of construction, manufacturing and retail workers (non-office workers) have lost their jobs in the recession (I'll have to check that).

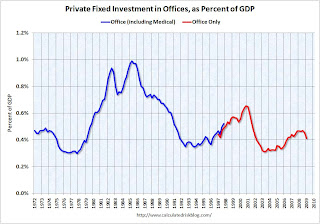

Note: Hotel and retail structure investment were off the charts during the recent boom, but office investment was somewhat muted in comparison ... The second graph shows office investment as a percent of GDP since 1972 through Q1 2009. Office investment peaked in Q3 2008, and with the office vacancy rate rising sharply, office investment will probably decline at least through 2010.

The second graph shows office investment as a percent of GDP since 1972 through Q1 2009. Office investment peaked in Q3 2008, and with the office vacancy rate rising sharply, office investment will probably decline at least through 2010.

Note: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

There is still too much space coming online. From Reuters:

During the second quarter, office space coming on the market topped rented space by about 20 million square feet, slightly less than the 25.2 million square feet in the first quarter.

Year-to-date, 45.2 million more square feet came onto the market than was rented, in line with Reis' projection of about 67.6 million square feet for all of 2009.

If the projection holds true, 2009 will be the worst year for net absorption of office space since Reis began tracking it in 1980.