by Calculated Risk on 8/04/2009 11:59:00 PM

Tuesday, August 04, 2009

Farmland Values Decline

From the WSJ: Farm Real-Estate Values Post Rare Drop

The U.S. Agriculture Department said in its annual report that the value of all land and buildings on U.S. farms averaged $2,100 an acre Jan. 1, down 3.2% from last year. The decline in farm real-estate values was the first since 1987, the agency said.The Chicago Fed had a similar report a couple of months ago: Farmland Values and Credit Conditions

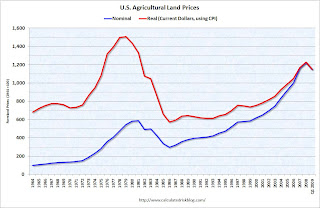

There was a quarterly decrease of 6 percent in the value of “good” agricultural land—the largest quarterly decline since 1985—according to a survey of 227 bankers in the Seventh Federal Reserve District on April 1, 2009. Also, the year-over-year increase in District farmland values eroded to just 2 percent in the first quarter of 2009.And here was a graph I posted in May based on the Chicago Fed report:

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graphs shows nominal and real farm prices based on data from the Chicago Fed.

In real terms, the current increase in farm prices wasn't as severe as the bubble in the late '70s and early '80s that led to numerous farm foreclosures in the U.S.

And as I noted in the earlier post, it was not surprising that John Mellencamp wrote "Rain On The Scarecrow" in 1985 after the farm bubble burst.