by Calculated Risk on 9/17/2009 11:59:00 AM

Thursday, September 17, 2009

Fed: Household Net Worth Off $12.2 Trillion From Peak

The Fed released the Q2 2009 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth is now off $12.2 Trillion from the peak in 2007. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

According to the Fed, household net worth increased in Q2 mostly from increases in stock holdings - although the value of household real estate increased slightly too.

Note that this ratio was relatively stable for almost 50 years, and then ... bubbles! This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (of household real estate) was up to 43% from the all time low last quarter of 41.9%. The increase was due to a slight increase in the value of household real estate and a decline in mortgage debt - and also a decline in overall GDP (so the ratio increases).

When prices were increasing dramatically, the percent homeowner equity was stable or declining because homeowners were extracting equity from their homes. Now, with prices falling, the percent homeowner equity has been cliff diving.

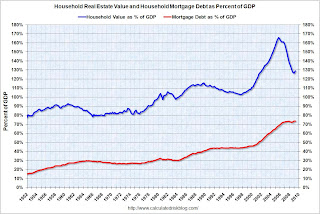

Note: approximately 31% of households do not have a mortgage. So the 50+ million households with mortgages have far less than 43% equity. The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP increased slightly in Q2 - because of a slight increase in real estate values, and a decline in GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP increased slightly in Q2 - because of a slight increase in real estate values, and a decline in GDP.

Mortgage debt declined, but was flat as a percent of GDP in Q2 - since GDP declined too.

After a bubble, the value of assets decline, but most of the debt remains.