by Calculated Risk on 9/30/2009 11:32:00 AM

Wednesday, September 30, 2009

OCC and OTS: Foreclosures, Delinquencies increase in Q2

From the Office of the Comptroller of the Currency and the Office of Thrift Supervision: OCC and OTS Release Mortgage Metrics Report for Second Quarter 2009

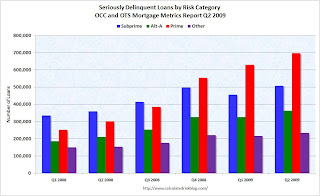

This OCC and OTS Mortgage Metrics Report for the second quarter of 2009 provides performance data on first lien residential mortgages serviced by national banks and federally regulated thrifts. The report covers all types of first lien mortgages serviced by most of the industry’s largest mortgage servicers, whose loans make up approximately 64 percent of all mortgages outstanding in the United States. The report covers nearly 34 million loans totaling almost $6 trillion in principal balances and provides information on their performance through the end of the second quarter of 2009 (June 30, 2009).Much of the report focuses on modifications and recidivism, but this report also shows far more seriously delinquent prime loans than subprime loans (by number, not percentage).

The mortgage data reported for the second quarter of 2009 continued to reflect negative trends influenced by weakness in economic conditions including high unemployment and declining home prices in weak housing markets. As a result, the number of seriously delinquent mortgages and foreclosures in process continued to increase. However, a lull in newly initiated foreclosures occurred as servicers worked to implement the “Making Home Affordable” program during the second quarter.

...

The percentage of current and performing mortgages in the portfolio decreased by 1.4 percent from the previous quarter to 88.6 percent of all mortgages in the portfolio. All categories of delinquencies increased from the previous quarter, with serious delinquencies—loans 60 or more days past due and loans to delinquent bankrupt borrowers—reaching 5.3 percent of all mortgages in the portfolio, an increase of 11.5 percent from the previous quarter. Foreclosures in process reached 2.9 percent of all mortgages, a 16.2 percent increase.

...

In the second quarter, 15.2 percent of Payment Option ARMs were seriously delinquent, compared with 5.3 percent of all mortgages, and 10 percent were in the process of foreclosure, more than triple the 2.9 percent rate for all mortgages.

...

Mortgages guaranteed by the U.S. government, primarily through the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA), also showed higher delinquencies than the overall servicing portfolio. Serious delinquencies increased to 7.5 percent of all government guaranteed mortgages, up from 6.8 percent in the previous quarter.

emphasis added

Click on graph for larger image.

Click on graph for larger image.We're all subprime now!

Note: "Approximately 13 percent of loans in the data were not accompanied by credit scores and are classified as “other.” This group includes a mix of prime, Alt-A, and subprime. In large part, the loans were result of acquisitions of loan portfolios from third parties where borrower credit scores at the origination of the loans were not available."

This report covers about two-thirds of all mortgages. There are far more prime loans than subprime loans - and the percentage of delinquent prime loans is much lower than for subprime loans. However, there are now significantly more prime loans than subprime loans seriously delinquent. And prime loans tend to be larger than subprime loans, so the losses from each prime loan will probably be higher.

The second graph shows foreclosure activity.

Notice that foreclosure in process are increasing sharply, but completed foreclosures were only up slightly.

The only reason initiated foreclosures declined slightly was because Q1 was revised up significantly. Short sales remain mostly irrelevant.

The next wave of completed foreclosures is about to break, but the size of the wave depends on the modification programs.