by Calculated Risk on 10/07/2009 11:52:00 AM

Wednesday, October 07, 2009

Hotel Defaults and Foreclosures Increase Sharply in California

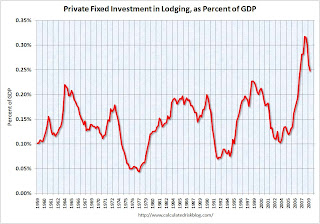

Hotel investment has always been boom and bust, but the most recent boom was off the charts ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows lodging investment as a percent of GDP since 1959 through Q2 2009.

Lodging investment peaked in mid-2008, but because of the length of time for hotel construction, there are many new hotels still coming online - at just the wrong time.

From the LA Times: Hotel defaults, foreclosures rise in California (ht Ann)

... Statewide, more than 300 hotels were in foreclosure or default on their loans as of Sept. 30 -- a nearly fivefold increase since the start of the year, according to an industry report released Tuesday.Not only is the recession impacting business and leisure travel, but there are just too many hotel rooms, and many more on the way.

...

Most struggling hotels remain open, but industry experts believe many properties are likely to be closed down in the months ahead, even if they are not in foreclosure, because they are losing so much money. ...

"I have never seen so many lenders contemplating mothballing properties," said Jim Butler, a hotel lawyer and chairman of the global hospitality group for Jeffer, Mangels, Butler & Marmaro. "It can and it will get worse for the hotel industry."

...

Statewide, 260 hotels were in default on their loans and 47 had been taken over by their lenders in foreclosure, the Atlas report said.

... a leading hotel consulting firm, Smith Travel Research, recently issued a report that predicted no significant improvement for the hotel industry until 2011 at the earliest.

"It's going to be a lot worse than it is now," said Bobby Bowers, senior vice president of Smith Travel Research.

... an increasing number of hotels have so little revenue that they can't even afford to pay their operating bills and payroll, not to mention servicing debt.

Owners of such hotels are increasingly handing the keys back to the lenders, and the problem is likely to get worse: As many as 1 in 5 U.S. hotel loans may default through 2010, UC Berkeley economist Kenneth Rosen said.

In some cases the lenders are simply locking up the properties...

emphasis added