by Calculated Risk on 10/29/2009 10:55:00 PM

Thursday, October 29, 2009

Mark Zandi on the Great Recession

Testimony from Mark Zandi of Economy.com: The Impact of the Recovery Act on Economic Growth (ht Professor Brad DeLong). A few excerpts:

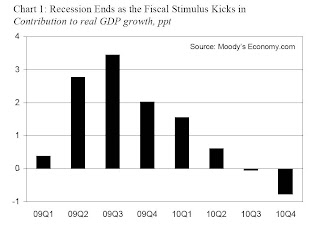

The Great Recession has finally given way to recovery. This downturn will go into the record books as the longest, broadest and most severe since the Great Depression (see Table 1). The recession was twice the length of the average economic contraction, and it dragged down nearly every industry and region in the country. Its final toll in terms of increased unemployment and falling real GDP will be greater than that seen during any other recession on record.The following graph shows Mark Zandi's estimate of the impact of the stimulus package:

...

The housing market crash that was at the recession's center is also moderating. House prices are probably not done falling, but home sales have come off the bottom, and the free fall in housing construction is over. After reducing housing starts to levels last seen during World War II, builders have finally begun to put up a few more homes. There is still a surfeit of vacant existing homes for sale and rent, but inventories of new homes are increasingly lean in a number of markets.

Retailers and manufacturers have also worked hard to reduce bloated inventories. The plunge in inventories in the second quarter was the largest on record and came after a year of steady destocking. Inventories are now so thin that manufacturing production is picking up quickly, as otherwise stores will not have enough on their shelves and in warehouses to meet demand even at currently depressed levels.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This suggests that all the growth in Q3 was due to the stimulus package, and the impact will now wane - only 2% in Q4, and 1.5% in Q1 2010 - and then the package will be a drag on the economy in the 2nd half of 2010.

And on the job loss recovery:

Although the recession is over, the economy is struggling. Job losses have slowed significantly since the beginning of the year, but payrolls are still shrinking, and unemployment is still rising. The nation's jobless rate will top 10% in coming months ...Clearly Zandi is still very worried.

Whether the recovery becomes self-sustaining or recedes back into recession depends first on how businesses respond to recent improvements in sales and profitability. As the benefit of the stimulus fades, businesses must fill the void by hiring and investing more actively. To date, there is not much evidence that they are doing this. At most, firms are curtailing layoffs and no longer cutting back on orders for equipment and software.

... Unless hiring revives, job growth will not resume and unemployment will continue to rise, depressing wages and ultimately short-circuiting consumer spending and the recovery itself.

It is possible that firms will resume hiring soon. There is historically a lag between a pickup in production and increased hiring. In the past, however, during the gap between increased production and increased full-time hiring, businesses boosted working hours and brought on more temporary employees. None of this has happened so far; hours worked remain stuck at a record low, and temporary jobs continue to decline.

A more worrisome possibility is that firms are too shell-shocked to resume hiring. Smaller businesses are struggling to obtain credit; their principal lenders, small banks, face intense pressure, while another key source, credit card lenders, has aggressively tightened its underwriting standards. ...

... Businesses may also wonder if demand for their products will soon fade, given that the recent improvement is supported by the monetary and fiscal stimulus and an inventory swing, all of which are temporary.

Whatever the reason, unless hiring resumes soon, the severe stress in the job market will not abate. With nearly 26 million workers—17% of the workforce—unemployed or underemployed, and those with jobs working a record-low number of hours, workers' nominal compensation threatens to decline. It is not unusual for real compensation—nominal compensation adjusted for inflation—to turn down in a recession, but it would be unprecedented, save during the Great Depression, for nominal compensation to decline.

Falling nominal compensation will further corrode already-fragile consumer spending. Lower- and middle-income households, who are saving little and cannot borrow, will be forced to rein in spending. The transition from recovery to expansion will be anything but graceful and could even be short-circuited.

Note: NBER will not call the end of the recession until some time after real GDP is above the pre-recession levels (and other indicators too). That would take at least four more quarters of growth at 3%, so the end of the official recession will not be announced until late in 2010 at the earliest. If GDP slips next year that will probably be considered part of the "Great Recession" ...

For more on recession dating, see: Is the Recession Over?