by Calculated Risk on 11/11/2009 01:15:00 PM

As I've noted several times, my general outlook is for GDP growth to be decent in Q4 (similar to Q3) and for sluggish and choppy GDP growth in 2010. I've been asked to list some possible upside surprises, and downside risks, to this forecast.

Possible Upside Surprises:

Consumer spending. One of the key reasons I think growth will be sluggish in 2010 is because I expect the personal saving rate to increase as households rebuild their balance sheets and reduce their debt burden. But you never know. As San Francisco Fed President Dr. Yellen said yesterday: "Consumers have surprised us in the past with their free-spending ways and it’s not out of the question that they will do so again." Still, it is hard to imagine much of a spending boom with high unemployment (putting pressure on wages), and limited credit (so some people can spend beyond their income).

Exports. Perhaps we are seeing a shift from a U.S. consumption driven world economy, to a more balanced global economy. An increase in consumption in other countries, combined with the weaker dollar should lead to more U.S. exports. And if China revalued that might lead to a boom in U.S. exports. Just this morning, Reuters reported: China hints at resumption of yuan appreciation "China sent its clearest signal yet that it was ready to allow yuan appreciation after an 18-month hiatus, saying on Wednesday it would consider major currencies, not just the dollar, in guiding the exchange rate." Please don't hold your breath waiting for China!

Residential Investment. Those expecting a "V-shaped" or immaculate recovery - with unemployment falling sharply in 2010 - are expecting single family housing starts to rebound quickly to a rate significantly above 1 million units per year. That won't happen. But it is possible for single family starts to rebound to 700 thousand SAAR, even with the large overhang of existing housing inventory.

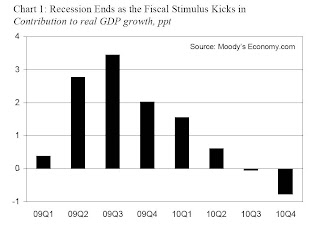

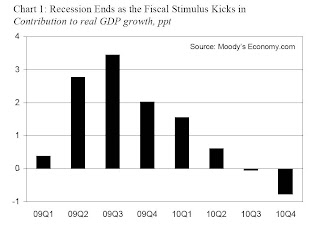

Another large stimulus package. The greatest impact from the stimulus package is behind us as the following graph from economy.com's Mark Zandi shows:

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This suggests that all the growth in Q3 was due to the stimulus package, and the impact will now wane - only 2% in Q4, and 1.5% in Q1 2010 - and then the package will be a drag on the economy (impact on GDP growth will be negative) in the 2nd half of 2010.

With unemployment above 10%, there will be significant political pressure for another stimulus package - especially if the economy starts to slow in the first half of 2010. This next package could be several hundred billion (maybe $500 billion) and could increase GDP growth in 2010 above my forecast.

Possible Downside Risks:

Housing Market. Probably the key downside risk to the economy is further declines in house prices and a large second wave of foreclosures. The government is doing everything possible to support house prices - by reducing supply with the modification programs, foreclosure moratoriums, and servicer backlogs - and boosting demand with the homebuyer tax credit and loose lending standards (especially with FHA insured loans).

I expect another wave of foreclosures in early 2010, and the impact of the housing tax credit to wane, and eventually lower house prices especially in higher priced bubble areas (although I think we've seen the bottom in many other areas). My expectation is prices will fall in real terms for several years. But if prices fall further than I expect that could have a serious impact on banks (more losses) and consumer confidence (less spending).

Consumer Spending and Exports. The flip side to consumer spending is that households might increase their saving rate faster than I expect. And with exports, if the global recovery falters, exports would probably decline.

Unemployment and Wage Deflation If the unemployment rate keeps rising (say to 11% or higher), and CPI goes negative - this could lead to falling wages and even more downward pressure on consumer spending. And deflationary expectations might lead to consumers putting off certain expenditures.

Small businesses. I think there is a strong possibility that small businesses will not be able to obtain financing and increase hiring - partly because many of the banks impacted by the commercial real estate disaster also loan to small businesses. As Atlanta Fed President Dennis Lockhart said yesterday: "[T]here could be an impact resulting from small banks' impaired ability to support the small business sector—a sector I expect will be critically important to job creation. ... small firms' reliance on banks with heavy CRE exposure is substantial. Banks with the highest CRE exposure ... account for almost 40 percent of all small business loans."

These are just some possible upside surprises and downside risks. I'm sure there are plenty more ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.