by Calculated Risk on 11/15/2009 07:31:00 PM

Sunday, November 15, 2009

Housing Starts and Vacant Units: No "V" Shaped Recovery

On Friday I posted a graph showing the historical relationship between housing starts and the unemployment rate (repeated as the 2nd graph below). The graph shows that housing leads the economy both into and out of recessions, and the unemployment rate lags housing by about 12 to 18 months.

It appears that housing starts bottomed earlier this year, however I don't think we will see a sharp recovery in housing this time - and I also think unemployment will remain high throughout 2010. As I noted in the earlier post, there is still a large overhang of vacant housing in the United States, and a sharp bounce back in housing starts is unlikely.

The following graph shows total housing starts and the percent vacant housing units (owner and rental) in the U.S. Note: this is a combined vacancy rate based on the Census Bureau vacancy rates for owner occupied and rental housing. Click on graph for larger image in new window.

Click on graph for larger image in new window.

It is very unlikely that there will be a strong rebound in housing starts with a record number of vacant housing units.

The vacancy rate has continued to climb even after housing starts fell off a cliff. Initially this was because of a significant number of completions. Also some hidden inventory (like some 2nd homes) have become available for sale or for rent, and lately some households have probably doubled up because of tough economic times.

Note: the increase in the vacancy rate in the '80s was due to several factors including demographics (baby boomers moving from renting to owning), and overbuilding of apartment units (part of S&L crisis).

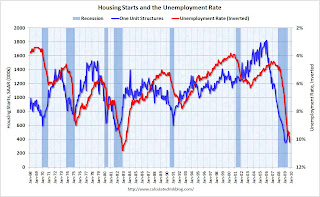

Here is a repeat of the earlier graph: This graph shows single family housing starts and unemployment (inverted). (The first graph shows total housing starts)

This graph shows single family housing starts and unemployment (inverted). (The first graph shows total housing starts)

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

This suggests unemployment might peak in Spring or Summer 2010. However, since I expect the housing recovery to be sluggish, I also expect unemployment to remain high throughout 2010.