by Calculated Risk on 11/19/2009 11:08:00 AM

Thursday, November 19, 2009

MBA Forecasts Foreclosures to Peak in 2011

On the MBA conference call concerning the "Q3 2009 National Delinquency Survey", MBA Chief Economist Jay Brinkmann said this morning:

Note: Many more questions this time!

A few graphs ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the delinquency and in foreclosure rates for all prime loans.

Prime loans account for about 76% of all loans.

"We're all subprime now!" NOTE: Tanta first wrote this saying in 2007 in response to the 'contained to subprime' statements.

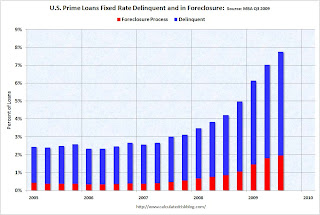

The second graph shows just fixed rate prime loans (about two-thirds of all loans).

The second graph shows just fixed rate prime loans (about two-thirds of all loans).Prime ARMs have a higher delinquency rate than Prime FRMs, but the foreclosure crisis has now spread to Prime fixed rate loans.

Note that even in the best of times (with rapidly rising home prices in 2005), just over 2% of prime FRMs were delinquent or in foreclosure. However the cure rate was much higher back then since a delinquent homeowner could just sell their home.

The third graph shows the delinquency and in foreclosure process rates for subprime loans.

The third graph shows the delinquency and in foreclosure process rates for subprime loans. Although the increases have slowed, about 40% of subprime loans are delinquent or in foreclosure.

And a final comment: historically house prices do not bottom until after foreclosure activity peaks in a certain area. Since the subprime crisis delinquency rates might be peaking, it would not be surprising if prices are near a bottom in the low end areas. But in general I'd expect further declines in house prices - especially in mid-to-high end areas.