by Calculated Risk on 11/02/2009 09:40:00 PM

Monday, November 02, 2009

Residential Investment Components in Q3

More from the Q3 GDP underlying detail tables ...

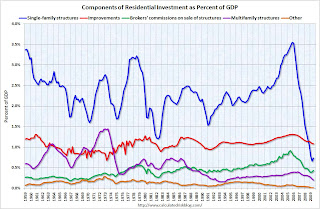

Note: Residential investment (RI), according to the Bureau of Economic Analysis (BEA), includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Back in Q4 2008 - for the first time ever - investment in home improvements exceeded investment in new single family structures. This has continued through Q3 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures followed by home improvement.

Investment in home improvement was at a $154.7 billion Seasonally Adjusted Annual Rate (SAAR) in Q3, significantly above the level of investment in single family structures of $105.2 billion (SAAR).

Home improvement spending, as a percent of GDP, is close to the long term average. And Brokers' commissions are slightly above average (2009 was a solid year for agents).

Of course investment in single family structures is near the record low, and far below the normal level. Also far below normal is investment in multifamily structures. These two categories will not increase significantly until the number of excess housing units is reduced (I'll have more on the number of excess housing in the next few days).