by Calculated Risk on 12/23/2009 07:24:00 AM

Wednesday, December 23, 2009

MBA: Mortgage Applications Decrease Sharply

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume decreased 10.7 percent on a seasonally adjusted basis from one week earlier. ...Rates are probably back above 5% now.

The Refinance Index decreased 10.1 percent from the previous week and the seasonally adjusted Purchase Index decreased 11.6 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages remained flat at 4.92 percent, with points increasing to 1.23 from 1.08 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

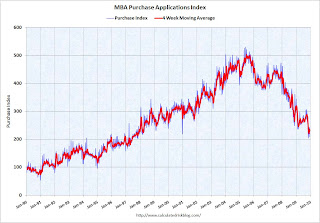

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Note: In the past the MBA index was somewhat predictive of future sales - and was a favorite indicator of Alan Greenspan, but it has been questionable for some time. The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007 even though activity was actually declining. Recently there has been a substantial number of cash buyers, so the MBA index missed the strength of the recent existing home sales increase.

However it is hard to ignore the sharp decline in purchase applications over the last couple of months.