by Calculated Risk on 12/22/2009 10:54:00 AM

Tuesday, December 22, 2009

More on Existing Home Sales

Earlier the NAR released the existing home sales data for November; here are a couple more graphs ... and a few comments. Click on graph for larger image in new window.

Click on graph for larger image in new window.

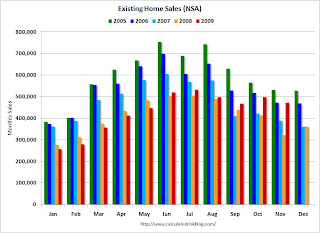

This graph shows NSA monthly existing home sales for 2005 through 2009 (see Red columns for 2009).

Sales (NSA) in November were much higher than in November 2007 and 2008, and were at the same level as November 2006.

Of course - as I noted earlier - many of these transactions in November were due to first-time homebuyers rushing to beat the expiration of the tax credit (that has now been extended).

Note: Existing home sales play an important role in the economy because they allow people to move for new job opportunies, or to move to larger or smaller homes for various reasons. It is the reason that people move that contributes to the economy; churning homes does nothing except generate some fees and commissions. Nothing has been added to the housing stock or the wealth of the nation.

The way to think of existing home sales is as grease for the economy. Once you have enough - probably around 4.5 to 5.0 million units per year - any extra is just a waste.

What matters for the economy are new home sales, housing starts and residential investment. And there has been little improvement in these key indicators - and there will not be any until the huge overhang of excess inventory is reduced.

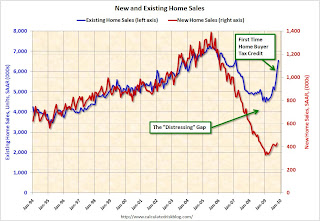

This really shows up on the following graph:  This graph shows existing home sales (left axis) through November, and new home sales (right axis) through October.

This graph shows existing home sales (left axis) through November, and new home sales (right axis) through October.

The initial gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The recent spike in existing home sales was due primarily to the first time homebuyer tax credit.

A few more comments: