by Calculated Risk on 10/31/2009 10:35:00 PM

Saturday, October 31, 2009

October Economic Summary in Graphs

by Calculated Risk on 10/31/2009 06:31:00 PM

Here is a collection of real estate and economic graphs for data released in October ...

Note: Click on graphs for larger image in new window. For more info, click on link below graph to original post.

New Home Sales in September (NSA)

New Home Sales in September (NSA)The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. Sales in September 2009 (31 thousand) were below September 2008 (35 thousand). This is the 3rd lowest sales for September since the Census Bureau started tracking sales in 1963.

In September 2009, 31 thousand new homes were sold (NSA); the record low was 28 thousand in September 1981; the record high for September was 99 thousand in 2005.

From: New Home Sales Decrease in September

New Home Sales in September

New Home Sales in SeptemberThis graph shows shows New Home Sales vs. recessions for the last 45 years.

New Home sales fell off a cliff, but are now 22% above the low in January.

"Sales of new one-family houses in September 2009 were at a seasonally adjusted annual rate of 402,000 ...

This is 3.6 percent (±10.2%)* below the revised August rate of 417,000 and is 7.8 percent (±12.0%)* below the September 2008 estimate of 436,000."

From: New Home Sales Decrease in September

New Home Months of Supply in September

New Home Months of Supply in SeptemberThere were 7.5 months of supply in September - significantly below the all time record of 12.4 months of supply set in January.

"The seasonally adjusted estimate of new houses for sale at the end of September was 251,000. This represents a supply of 7.5 months at the current sales rate."

From: New Home Sales Decrease in September

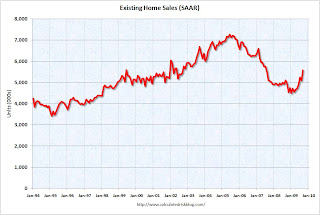

Existing Home Sales in September

Existing Home Sales in September This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in Sept 2009 (5.57 million SAAR) were 9.4% higher than last month, and were 9.2% higher than Sept 2008 (5.1 million SAAR).

From: Existing Home Sales Increase in September

Existing Home Inventory September

Existing Home Inventory SeptemberAccording to the NAR, inventory decreased to 3.63 million in September (August inventory was revised upwards significantly). The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

Typically inventory peaks in July or August, so some of this decline is seasonal.

From: Existing Home Sales Increase in September

Case Shiller House Prices for August

Case Shiller House Prices for AugustThis graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.5% from the peak, and up about 1.0% in August.

The Composite 20 index is off 31.3% from the peak, and up 1.0% in August.

From: Case-Shiller Home Price Index Increases in August

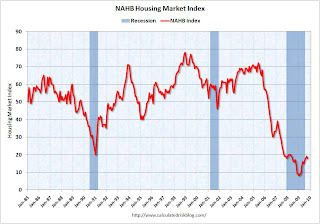

NAHB Builder Confidence Index in October

NAHB Builder Confidence Index in OctoberThis graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) decreased to 18 in October from 19 in September. The record low was 8 set in January. Note that Traffic of Prospective Buyers declined sharply.

This is still very low - and this is what I've expected - a long period of builder depression.

From: NAHB: Builder Confidence Decreases Slightly in October

Architecture Billings Index for September

Architecture Billings Index for September"The Architecture Billings Index was up 1.4 points at 43.1, matching July's level, according to the American Institute of Architects.

The index has remained below 50, indicating contraction in demand for design services, since January 2008."

From: AIA: Architectural Billings Index Shows Contraction

Housing Starts in September

Housing Starts in SeptemberTotal housing starts were at 590 thousand (SAAR) in September, up 0.5% from the revised August rate, and up sharply from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have move sideways for four months.

Single-family starts were at 501 thousand (SAAR) in September, up 3.9% from the revised August rate, and 40 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at this level for four months.

From: Housing Starts in September: Moving Sideways

Construction Spending increases in August

Construction Spending increases in AugustThe first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending increased in August, and nonresidential spending continued to decline.

Private residential construction spending is now 63.1% below the peak of early 2006.

Private non-residential construction spending is still only 12.6% below the peak of last September.

From: Construction Spending increases in August

September Employment Report

September Employment ReportThis graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 263,000 in September. The economy has lost almost 5.8 million jobs over the last year, and 7.2 million jobs during the 21 consecutive months of job losses.

The unemployment rate increased to 9.8 percent. This is the highest unemployment rate in 26 years.

Year over year employment is strongly negative.

From: Employment Report: 263K Jobs Lost, 9.8% Unemployment Rate

September Employment Comparing Recessions

September Employment Comparing RecessionsThis graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

For the current recession, employment peaked in December 2007, and this recession was a slow starter (in terms of job losses and declines in GDP).

However job losses really picked up earlier this year, and the current recession is now the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession was worse).

The economy is still losing jobs at about a 3.2 million annual rate, and the unemployment rate will probably be above 10% soon.

From: Employment Report: 263K Jobs Lost, 9.8% Unemployment Rate

September Retail Sales

September Retail SalesThis graph shows the year-over-year change in nominal and real retail sales since 1993.

On a monthly basis, retail sales decreased 1.5% from August to September (seasonally adjusted), and sales are off 5.7% from September 2008 (retail ex food services decreased 6.4%).

Excluding motor vehicles, retail sales were up 0.5%.

From: Retail Sales Decrease in September

LA Port Traffic in September

LA Port Traffic in SeptemberThis graph shows the loaded inbound and outbound traffic at the port of Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Loaded inbound traffic was 17.4% below September 2008.

Loaded outbound traffic was 8.6% below September 2008.

From: LA Area Port Traffic in September

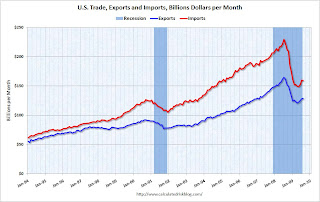

U.S. Imports and Exports Through August

U.S. Imports and Exports Through AugustThis graph shows the monthly U.S. exports and imports in dollars through August 2009.

Imports were down in August, and exports increased slightly. On a year-over-year basis, exports are off 21% and imports are off 29%.

From: Trade Deficit Decreases Slightly in August

Capacity Utilization in September

Capacity Utilization in September This graph shows Capacity Utilization. This series has increased for three straight months, and is up from the record low set in June (the series starts in 1967). Capacity Utilization had decreased in 17 of the previous 18 months.

Note: y-axis doesn't start at zero to better show the change.

An increase in capacity utilization is usually an indicator that the official recession is over.

From: Industrial Production, Capacity Utilization Increase in September

Here is a map of the three month change in the Philly Fed state coincident indicators. Forty one states are showing declining three month activity. The index increased in 7 states, and was unchanged in 2.

A large percentage of states still showed declining activity in September.

From: Philly Fed State Coincident Indicators Show Widespread Weakness in September

Light vehicle sales in September

Light vehicle sales in SeptemberThis graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for September (red, light vehicle sales of 9.22 million SAAR from AutoData Corp).

This is the third lowest monthly vehicle sales this year (SAAR).

From: Light Vehicle Sales 9.2 Million (SAAR) in September

Q3: Rental Vacancy Rate

Q3: Rental Vacancy RateThe rental vacancy rate increased to a record 11.1% in Q3 2009.

The homeowner vacancy rate was 2.6% in Q3 2009.

The homeownership rate increased slightly to 67.6% and is now at the levels of Q2 2000.

These excess units will keep pressure on rents and house prices for some time.

From: Q3: Record Rental Vacancy Rate, Homeownership Rate Increases Slightly

NMHC Quarterly Apartment Survey

NMHC Quarterly Apartment SurveyThis graph shows the quarterly Apartment Tightness Index.

“[T]he economic headwinds remain strong,” [NMHC Chief Economist Mark Obrinsky said], “as the employment market continues to sag, demand for apartment residences continues to slip. Though this quarter’s Market Tightness Index is improved compared to last quarter, it still indicates higher vacancies and lower rents.”

A reading below 50 suggests vacancies are rising. Based on limited historical data, I think this index will lead reported apartment rents by 6 months to 1 year. Or stated another way, rents will probably fall for 6 months to 1 year after this index reaches 50. Right now I expect rents to continue to decline through most of 2010.

From: NMHC Quarterly Apartment Survey: Occupancy Continues to Decline, but Pace Slows

U.S. Consumer Bankruptcy Filings in September

U.S. Consumer Bankruptcy Filings in SeptemberThis graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q3 2009 based on monthly data from the American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

There have been 1.05 million personal bankruptcy filings through Sept 2009, and the American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end

From: ABI: Personal Bankruptcy Filings up 41 Percent Compared to Sept 2008

Truck Tonnage Index in September

Truck Tonnage Index in September"The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.3 percent in September, after increasing 2.1 percent in both July and August. The latest decline lowered the SA index to 103.9 (2000=100). ...

Compared with September 2008, SA tonnage fell 7.3 percent, which was the best year-over-year showing since November 2008."

From ATA Truck Tonnage Index Declines in September

Restaurant Index Shows Contraction

Restaurant Index Shows ContractionThe restaurant business is still contracting ...

Note: Any reading below 100 shows contraction for this index. The index is a year-over-year index, so the headline index might be slow to recognize a pickup in business, but the underlying details suggests ongoing weakness.

From: Restaurant Index Shows Contraction, Less Capital Spending

Fannie Mae Serious Delinquencies

Fannie Mae Serious DelinquenciesFannie Mae reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 4.45% in August, up from 4.17% in July - and up from 1.57% in August 2008.

From Fannie Mae: Delinquencies Increase Sharply in August

Housing: "First-time buyers and investors" are "market’s lifeblood"

by Calculated Risk on 10/31/2009 03:51:00 PM

From three DataQuick reports on Las Vegas, Miami and Phoenix ...

Las Vegas:

In September, a popular form of financing used by first-time home buyers – government-insured FHA loans – accounted for 53.8 percent of all home purchases, up from 52 percent in August. Absentee buyers bought 40.4 percent of all Las Vegas–area homes last month – the highest figure for any month this decade. Absentee buyers are often investors, but could include second-home buyers and others who, for various reasons, indicate at the time of sale that the property tax bill will be sent to a different address.Miami:

emphasis added

A popular form of financing used by first-time home buyers - government-insured FHA loans - accounted for 45.0 percent of all September purchases, while absentee buyers bought 29.7 percent of all homes last month, according to an analysis of public property records.Phoenix:

First-time buyers and investors remained the market’s lifeblood. Last month 46.7 percent of all Phoenix-area buyers used government-insured FHA loans, a popular choice among first-time buyers, according to an analysis of public property records. Absentee buyers made up 38.5 percent of all purchases ...We are far from a healthy market ...

Cartoon: "Trying to Reinflate the Bounce House"

by Calculated Risk on 10/31/2009 11:59:00 AM

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis www.EricGLewis.com (site coming soon) |

FDIC Bank Failure Update

by Calculated Risk on 10/31/2009 08:31:00 AM

| The media, and apparently FDIC employees, gather outside San Diego National Bank just minutes before the bank was seized last night. Photo credit: Lee. The mural is by Wyland. |  |

| This is one of the nine banks seized yesterday by the FDIC; a record for one week during this cycle. The second photo apparently shows the FDIC employees gathering beneath the whales ... Photo credit: Lee. |

The FDIC closed nine more banks on Friday, and that brings the total FDIC bank failures to 115 in 2009. The following graph shows bank failures by week in 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Note: Week 1 on graph ends Jan 9th.

After a busy summer, the FDIC slowed down in late September and early October with only five bank failures in four weeks. Now it appears the pace has picked up again. With 9 weeks to go, it seems 150 or so bank failures is likely this year.

The 2nd graph covers the entire FDIC period (annually since 1934).

The 2nd graph covers the entire FDIC period (annually since 1934).This is the most failures per year since 1992 (181 failures).

As far as failures per week - there were 28 weeks during the S&L crisis when regulators closed 10 or more banks, and the peak was April 20, 1989 with 60 bank closures (there were 7 separate weeks with more than 30 closures in the late '80s and early '90s).

For a graph that includes the 1920s and early '30s (before the FDIC was enacted) see the 3rd graph here.

Of course the number of banks isn't the only measure. Many banks today have more branches, and far more assets and deposits. Also the cumulative estimated losses for the DIF, since early 2007, is now about $47.5 billion.

The FDIC era source data is here - including by assets (in most cases) - under Failures and Assistance Transactions

The pre-FDIC data is here.

Friday, October 30, 2009

Unofficial Problem Bank List Grows to 500

by Calculated Risk on 10/30/2009 11:59:00 PM

Note: This was before the FDIC seized banks related to FBOP today.

This is an unofficial list of Problem Banks.

Changes and comments from surferdude808:

The Unofficial Problem Bank List crossed a major threshold this week as 500 institutions are now listed.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

The list grew by a net 18 institutions this week and nearly $44 billion in assets were added. Most of the increase comes is a result of the FDIC finally releasing its actions for September 2009. It will take another month to get their actions for October 2009.

The FDIC released 25 cease & desist order and 2 Prompt Corrective Actions. The list already included 8 of these 25 as they were identified through 8-K filings, media reports, or the State Banking Department of Illinois’ website.

From last week’s list, we dropped the 6 failures last Friday and another one that had failed back in July. Also, the FDIC issued a Cease & Desist Order on September 28, 2009 against Hillcrest Bank Florida that failed last Friday; hence, it never had time to appear on the list.

Most notable among the new additions are R-G Premier Bank of Puerto Rico ($6.5 billion); Central Pacific Bank, Honolulu, HI ($5.5 billion); and West Coast Bank, Lake Oswego, OR ($2.6 billion). The other 22 institutions added had an average asset size of $262 million.

Looking at the additions from a geographic perspective, there were four institutions headquartered in Washington, and two each in Florida, Georgia, Minnesota, and Wisconsin. There is a new addition from the FDIC issuing a Prompt Corrective Action Order on September 18th against Washita State Bank, Burns Flat, OK. Although not new to the list as they have been operating under a formal action, there were two other Prompt Corrective actions added. First, the OTS issued a PCA order on October 22nd against Century Bank, a Federal Savings Bank, Sarasota, FL; and the Federal Reserve issued a PCA order on October 27th against SolutionsBank, Overland Park, KS.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failures 107 through 115: Nine Failed Banks in Arizona, California, Illinois and Texas

by Calculated Risk on 10/30/2009 10:13:00 PM

Nine set the bar much higher

Ten won't be the peak.

by Soylent Green is People

From the FDIC: U.S. Bank, NA, of Minneapolis, Minnesota, Assumes All of the Deposits of Nine Failed Banks in Arizona, California, Illinois and Texas

The Federal Deposit Insurance Corporation (FDIC) entered into a purchase and assumption agreement with U.S. Bank, NA, of Minneapolis, Minnesota, a wholly-owned subsidiary of U.S. Bancorp, to assume all of the deposits and essentially all of the assets of nine failed banks. ...Nine in one shot ...

The nine banks involved in today's transaction are: Bank USA, National Association, Phoenix, Arizona; California National Bank, Los Angeles, California; San Diego National Bank, San Diego, California; Pacific National Bank, San Francisco, California; Park National Bank, Chicago, Illinois; Community Bank of Lemont, Lemont, Illinois; North Houston Bank, Houston, Texas; Madisonville State Bank, Madisonville, Texas; and Citizens National Bank, Teague, Texas. As of September 30, 2009, the banks had combined assets of $19.4 billion and deposits of $15.4 billion.

The nine banks had 153 offices...

The FDIC estimates that the cost of the nine banks to the DIF will be a combined $2.5 billion. U.S. Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. The failure of the nine banks brings the nation's total number this year to 115.

Reports: U.S. set to seize FBOP, Pacific National Bank

by Calculated Risk on 10/30/2009 07:54:00 PM

While we wait for the FDIC ... it could get real busy ...

From the Chicago Tribune: U.S. set to seize FBOP, congressmen say (ht Josh)

Federal regulators are expected to seize Friday night the banks owned by Oak Park-based FBOP Corp., the troubled owner of Park National Bank of Chicago and eight other U.S. banks, people familiar with the situation say.And another report in California: Pacific National Bank Going to FDIC (ht Vladimir)

A takeover would occur even after several U.S. Congressman from the Illinois area, including Reps. Bobby Rush and Danny Davis and Sen. Roland Burris, called the FDIC asking it to hold off on closing the bank for at least a week, said Marilyn Katz, a spokeswoman for the bank.

San Francisco-based Pacific National Bank is being eyeballed for takeover by federal authorities, according to several sources in the Silicon Valley and San Francisco commercial real estate industry. ... The Federal Deposit Insurance Corp. was expected to take control as early as this afternoon. ... The bank ... reported assets of $2.1 billion

Fannie Mae: Delinquencies Increase Sharply in August

by Calculated Risk on 10/30/2009 05:40:00 PM

Here is the monthly Fannie Mae hockey stick graph ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Fannie Mae reported today that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 4.45% in August, up from 4.17% in July - and up from 1.57% in August 2008.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans. These rates are based on conventional single-family mortgage loans and exclude reverse mortgages and non-Fannie Mae mortgage securities held in our portfolio."

Just more evidence of the growing delinquency problem, although these stats do include Home Affordable Modification Program (HAMP) loans in trial modifications.

Martin Wolf Interview, Wilbur Ross on CRE, and Market

by Calculated Risk on 10/30/2009 04:00:00 PM

Remember that rally yesterday? All gone and then some ... Click on graph for larger image in new window.

From Doug Short of dshort.com (financial planner).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The S&P was off 2.8% today ...

A great interview on Tech Ticker: "Still a Very Shaky Sort of World Recovery," FT's Martin Wolf Says

Martin Wolf, chief economics commentator for The Financial Times, talks about the U.S. and world economy.

"It's very difficult to believe in a really strong consumer-led recovery in the U.S.. I think this is still a very shaky sort of world recovery."And on the stock market:

"I think the market actually did a probably not unreasonable job - that is why I think it is not much of a bubble - of anticipating what was going to happen. And you sell on the news, isn't that the story? You buy on the hope and you sell on the news. We now know there is a reasonable recovery. By the way, in the early phases of a recovery, 3.5% annualized growth is not sensational by American standards. And remember if the U.S. is going to reduce its unemployment we will want to see annual growth - not annualized growth - of 4% to 5%."And from Bloomberg: Wilbur Ross Sees ‘Huge’ Commercial Real Estate Crash (ht James, others)

emphasis added

Billionaire investor Wilbur L. Ross Jr., said today the U.S. is in the beginning of a “huge crash in commercial real estate.”I'm not sure this is the beginning of a "huge crash" - prices are already down 41% from the peak according to the Moody’s/REAL Commercial Property Price Indices!

“All of the components of real estate value are going in the wrong direction simultaneously,” said Ross, one of nine money managers participating in a government program to remove toxic assets from bank balance sheets. “Occupancy rates are going down. Rent rates are going down and the capitalization rate -- the return that investors are demanding to buy a property -- are going up.”

Note: on CRE, also see MIT Professor David Geltner discussion on the CPII and the differences between price declines for healthy and distressed properties: Where we are in the aggregate: A two-year anniversary ...

Report: CIT to File Bankruptcy on Sunday

by Calculated Risk on 10/30/2009 02:08:00 PM

From the WSJ: CIT, Icahn Reach Tentative Deal Over Lender's Restructuring

As part of further discussions with CIT, Mr. Icahn has agreed to back down while the company restructures in bankruptcy court. ...This debt-for-equity swap makes the most sense and would allow CIT to continue to operate.

The company plans to file for bankruptcy in New York as soon as Sunday night or early Monday, said people familiar with the matter. CIT is poised to enter bankruptcy with enough creditor support to approve its reorganization plan and shorten its stay in Chapter 11 ...

... CIT asked bondholders to vote on a prepackaged bankruptcy plan, which would give most bondholders new debt it values at 70 cents on the dollar, and all the equity in a restructured company.

Note: CIT provides financing for about one million small businesses, so a prepackaged bankruptcy that allows the company to continue to operate would be helpful. Small businesses are already having trouble obtaining credit, and this might be impacting hiring plans (see from Melinda Pitts at Macroblog: Prospects for a small business-fueled employment recovery )

Restaurant Index Shows Contraction, Less Capital Spending

by Calculated Risk on 10/30/2009 11:21:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Unfortunately the data for this index only goes back to 2002.

The restaurant business is still contracting ...

Note: Any reading below 100 shows contraction for this index. The index is a year-over-year index, so the headline index might be slow to recognize a pickup in business, but the underlying details suggests ongoing weakness.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Remained Uncertain as Restaurant Performance Index Declined in September for Second Consecutive Month

[T]he National Restaurant Association’s ... Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 97.5 in September, down 0.4 percent from August and its 23rd consecutive month below 100.

...

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 96.0 in September – unchanged from August and tied for the second-lowest level on record. In addition, September represented the 25th consecutive month below 100, which signifies contraction in the current situation indicators.

...

The outlook for capital spending fell considerably from recent months. Thirty-seven percent of restaurant operators plan to make a capital expenditure for equipment, expansion or remodeling in the next six months, down sharply from 45 percent who reported similarly last month.

emphasis added

Cartoon: Recession is Over!

by Calculated Risk on 10/30/2009 09:48:00 AM

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis www.EricGLewis.com (site coming soon) |

Actually the recession is not "officially" over until the National Bureau of Economic Research (NBER) determines the end of the recession.

It took the National Bureau of Economic Research (NBER) Business Cycle Dating Committee over a year and half after the 2001 recession ended to call the trough of the cycle. And it took 21 months after the 1990-1991 recession ended for NBER to date the end of the recession.

The previous NBER announcements make it clear that NBER will not date the trough of the recession until certain economic indicators - like real GDP - are above the pre-recession levels. Any downturn before economic activity reaches pre-recession levels will probably be considered a continuation of the recession that started in December 2007.

Here is the NBER dating procedure.

September PCE and Saving Rate

by Calculated Risk on 10/30/2009 08:38:00 AM

From the BEA: Personal Income and Outlays, September 2009

Personal income decreased $0.1 billion, or less than 0.1 percent, and disposable personal income (DPI) decreased $0.2billion, or less than 0.1 percent, in September, according to the Bureau of Economic

Analysis. Personal consumption expenditures (PCE) decreased $47.2 billion, or 0.5 percent.

...

Real DPI -- DPI adjusted to remove price changes -- decreased 0.1 percent in September, compared with a decrease of 0.2 percent in August.

Real PCE -- PCE adjusted to remove price changes -- decreased 0.6 percent in September, in contrast to an increase of 1.0 percent in August.

...

Personal saving -- DPI less personal outlays -- was $355.6 billion in September, compared with $307.0 billion in August. Personal saving as a percentage of disposable personal income was 3.3 percent in September, compared with 2.8 percent in August.

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the September Personal Income report. The saving rate was 3.3% in September. (3.1% with three month average)

Although the saving rate declined in Q3, households are still saving more than during the last few years (when the saving rate was around 1.0%). The saving rate will probably continue to rise as households save more to repair their household balance sheets (and because an aging population usually pushes the saving rate higher) This increase in the saving rate - if it happens as expected - will keep pressure on personal consumption expenditures for the next year or two.

Thursday, October 29, 2009

Mark Zandi on the Great Recession

by Calculated Risk on 10/29/2009 10:55:00 PM

Testimony from Mark Zandi of Economy.com: The Impact of the Recovery Act on Economic Growth (ht Professor Brad DeLong). A few excerpts:

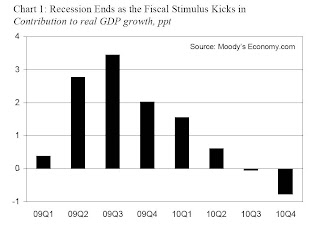

The Great Recession has finally given way to recovery. This downturn will go into the record books as the longest, broadest and most severe since the Great Depression (see Table 1). The recession was twice the length of the average economic contraction, and it dragged down nearly every industry and region in the country. Its final toll in terms of increased unemployment and falling real GDP will be greater than that seen during any other recession on record.The following graph shows Mark Zandi's estimate of the impact of the stimulus package:

...

The housing market crash that was at the recession's center is also moderating. House prices are probably not done falling, but home sales have come off the bottom, and the free fall in housing construction is over. After reducing housing starts to levels last seen during World War II, builders have finally begun to put up a few more homes. There is still a surfeit of vacant existing homes for sale and rent, but inventories of new homes are increasingly lean in a number of markets.

Retailers and manufacturers have also worked hard to reduce bloated inventories. The plunge in inventories in the second quarter was the largest on record and came after a year of steady destocking. Inventories are now so thin that manufacturing production is picking up quickly, as otherwise stores will not have enough on their shelves and in warehouses to meet demand even at currently depressed levels.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This suggests that all the growth in Q3 was due to the stimulus package, and the impact will now wane - only 2% in Q4, and 1.5% in Q1 2010 - and then the package will be a drag on the economy in the 2nd half of 2010.

And on the job loss recovery:

Although the recession is over, the economy is struggling. Job losses have slowed significantly since the beginning of the year, but payrolls are still shrinking, and unemployment is still rising. The nation's jobless rate will top 10% in coming months ...Clearly Zandi is still very worried.

Whether the recovery becomes self-sustaining or recedes back into recession depends first on how businesses respond to recent improvements in sales and profitability. As the benefit of the stimulus fades, businesses must fill the void by hiring and investing more actively. To date, there is not much evidence that they are doing this. At most, firms are curtailing layoffs and no longer cutting back on orders for equipment and software.

... Unless hiring revives, job growth will not resume and unemployment will continue to rise, depressing wages and ultimately short-circuiting consumer spending and the recovery itself.

It is possible that firms will resume hiring soon. There is historically a lag between a pickup in production and increased hiring. In the past, however, during the gap between increased production and increased full-time hiring, businesses boosted working hours and brought on more temporary employees. None of this has happened so far; hours worked remain stuck at a record low, and temporary jobs continue to decline.

A more worrisome possibility is that firms are too shell-shocked to resume hiring. Smaller businesses are struggling to obtain credit; their principal lenders, small banks, face intense pressure, while another key source, credit card lenders, has aggressively tightened its underwriting standards. ...

... Businesses may also wonder if demand for their products will soon fade, given that the recent improvement is supported by the monetary and fiscal stimulus and an inventory swing, all of which are temporary.

Whatever the reason, unless hiring resumes soon, the severe stress in the job market will not abate. With nearly 26 million workers—17% of the workforce—unemployed or underemployed, and those with jobs working a record-low number of hours, workers' nominal compensation threatens to decline. It is not unusual for real compensation—nominal compensation adjusted for inflation—to turn down in a recession, but it would be unprecedented, save during the Great Depression, for nominal compensation to decline.

Falling nominal compensation will further corrode already-fragile consumer spending. Lower- and middle-income households, who are saving little and cannot borrow, will be forced to rein in spending. The transition from recovery to expansion will be anything but graceful and could even be short-circuited.

Note: NBER will not call the end of the recession until some time after real GDP is above the pre-recession levels (and other indicators too). That would take at least four more quarters of growth at 3%, so the end of the official recession will not be announced until late in 2010 at the earliest. If GDP slips next year that will probably be considered part of the "Great Recession" ...

For more on recession dating, see: Is the Recession Over?

Random Thoughts on the Q3 GDP Report

by Calculated Risk on 10/29/2009 07:29:00 PM

After the Q1 GDP report was released, I wrote: GDP Report: The Good News. The headline number in Q1 was ugly, but there was a clear shift in the negative GDP contributions from leading sectors to lagging sectors.

Here is a repeat of the table from that earlier post showing a simplified typical temporal order for emerging from a recession:

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

Now look at the Q3 GDP report from leading to lagging sectors:

This is exactly what I'd expect a recovery to look like.

Unfortunately ... the two leading sectors, residential investment (RI) and personal consumption expenditures (PCE), will both be under pressure for some time. The Census Bureau report this morning showed that there are still far too many excess housing units (homes and rental units) available. There cannot be a sustained recovery in RI without a boom in new home sales and housing starts, and it is difficult to imagine a boom in new home sales with the large overhang of housing units.

It takes household formation to reduce the excess inventory, and household formation requires job creation so that individuals and families will feel more confident and move out of their parent's basements. Some day there will be a boom in household formation, once job creation returns, but usually the first jobs in a recovery are from RI and PCE - so the economy is in sort of a circular trap.

That is why we need policies aimed at job creation and household formation. As housing economist Tom Lawler wrote today in a note to clients: "policies that move renter households into owned homes but that don't stimulate household formations MAKE MATTERS WORSE!"

And the other leading sector, PCE, is also under pressure. The personal saving rate declined in Q3 to 3.3%, but the decline was probably temporary. I expect the saving rate to increase over the next year or two to around 8% - as households repair their balance sheets - and that will be a constant drag on PCE.

I expect Q4 GDP to be similar to Q3, however I think growth in 2010 will be sluggish - with downside risks. I think RI and PCE will be sluggish in 2010, and the stimulus will fade (and become a drag in the 2nd half of 2010).

Here is a look at investment:

Click on graph for larger image in new window.

Click on graph for larger image in new window.Residential investment (RI) had declined for 14 consecutive quarters, and the increase in Q3 2009 was the first since 2005.

This puts RI as a percent of GDP at 2.5%, just barely above the record low - since WWII - set last quarter.

The second graph shows non-residential investment as a percent of GDP.

The second graph shows non-residential investment as a percent of GDP.Business investment in equipment and software increased 1.1% (annualized), breaking a streak of 6 consecutive quarterly declines.

Investment in non-residential structures was only off 9.0% (annualized) and will probably be revised down (this happened last quarter). I expect non-residential investment in structures to decline sharply over the next several quarters. In previous downturns the economy recovered long before nonresidential investment in structures recovered - and that will probably be true again this time.

When the supplemental data is released, I'll post graphs of investment in retail, offices, and hotels, and a breakdown of residential investment.

Some possibly interesting notes:

Moody's Projects Further House Price Declines, Market and More

by Calculated Risk on 10/29/2009 04:00:00 PM

I'm working on a GDP post for later ... Click on graph for larger image in new window.

From Doug Short of dshort.com (financial planner).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The S&P was up 2.24% today ...

From Bloomberg: Moody’s May Downgrade Mortgage Bonds With New Outlook (ht Brian)

Moody’s Investors Service said it’s planning a review of U.S. home-loan securities that will likely lead to another round of rating changes based on a new view that property prices won’t bottom until next year’s third quarter.And the Fed has finished its $300 billion Treasury purchase program - from Bloomberg: Fed Ends Treasury Buys That Capped Rates

The firm will boost its loss projections by “significant” amounts for prime-jumbo, Alt-A, option adjustable-rate and subprime mortgages backing bonds issued between 2005 and 2008, also after seeing higher losses per foreclosure than expected ... Recent data showing rising home prices doesn’t prove the slump is over, the company said.

“The overhang of impending foreclosures and the continued rise in unemployment rates will impact home prices negatively in the coming months,” New York-based Moody’s said.

emphasis added

NMHC Quarterly Apartment Survey: Occupancy Continues to Decline, but Pace Slows

by Calculated Risk on 10/29/2009 01:48:00 PM

Note from NMHC: "Market Tightness Index reading above 50 indicates that, on balance, apartment markets around the country are getting tighter; a reading below 50 indicates that market conditions are getting looser; and a reading of 50 indicates that market conditions are unchanged."

So the increase in the index to 31 implies lower occupancy rates and lower rents - "looser" apartment conditions - but at a slower pace of contraction than the previous quarter.

From the National Multi Housing Council (NMHC): Apartment Market Conditions Improving, Bid-Ask Spread Narrowing

Only one index—the one measuring market tightness (vacancies and rent levels)—remained below 50 (index numbers below 50 indicate worsening conditions), but it also showed improvement over the prior quarter, rising from 20 to 31.

“The broad improvements in sales volume and debt and equity financing suggest the transactions market may finally be thawing,” noted NMHC Chief Economist Mark Obrinsky. “Nearly half (45 percent) of respondents indicated that the gap between what sellers are asking for and what buyers are offering—the bid-ask spread—has narrowed.”

“But the economic headwinds remain strong,” Obrinsky added, “as the employment market continues to sag, demand for apartment residences continues to slip. Though this quarter’s Market Tightness Index is improved compared to last quarter, it still indicates higher vacancies and lower rents.”

...

The Market Tightness Index rose from 20 to 31. Nearly half (49 percent) said markets were looser (with higher vacancies and lower rents), while 11 percent said markets were tighter. This was the ninth straight quarter in which the index remained below 50, but the fourth consecutive quarter in which the index measure has risen. For the year, the Market Tightness Index averaged 20, the lowest on record (since 1999).

emphasis added

Click on graph for larger image in new window.

This graph shows the quarterly Apartment Tightness Index.

A reading below 50 suggests vacancies are rising. Based on limited historical data, I think this index will lead reported apartment rents by 6 months to 1 year. Or stated another way, rents will probably fall for 6 months to 1 year after this index reaches 50. Right now I expect rents to continue to decline through most of 2010.

This data is for apartment buildings. The data released earlier today from the Census Bureau - showing a record rental vacancy rate - includes all rental units.

Hotel RevPAR Off 14 Percent

by Calculated Risk on 10/29/2009 11:47:00 AM

From HotelNewsNow.com: New Orleans ADR, RevPAR increase in STR weekly numbers

For the industry, in year-over-year measurements, occupancy fell 6.3 percent to end the week at 59.0 percent, ADR dropped 8.3 percent to US$100.04, and RevPAR decreased 14.1 percent to US$59.03.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week for each of the last four years (2006 through 2009 labeled by start of month).

Notes: the scale doesn't start at zero to better show the change. Thanksgiving was late in 2008, so the dip doesn't line up with the previous years.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

The above graph shows two key points:

The HotelNewsNow press release has two graphs on room rates (ADR: Average Daily Rate) and RevPAR variance comprared to 2008.

The HotelNewsNow press release has two graphs on room rates (ADR: Average Daily Rate) and RevPAR variance comprared to 2008.This graph shows the RevPAR variance by day, and indicates that business travel (weekdays) is still off more than leisure travel (weekends).

This has been an ongoing story ...

Q3: Record Rental Vacancy Rate, Homeownership Rate Increases Slightly

by Calculated Risk on 10/29/2009 10:00:00 AM

This morning the Census Bureau reported the homeownership and vacancy rates for Q3 2009. Here are a few graphs ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

The homeownership rate increased slightly to 67.6% and is now at the levels of Q2 2000.

Note: graph starts at 60% to better show the change.

The homeownership rate increased in the '90s and early '00s because of changes in demographics and "innovations" in mortgage lending. The increase due to demographics (older population) will probably stick, so I expect the rate to decline to the 66% to 67% range - and not all the way back to 64% to 65%.

The small increase in the homeownership rate in Q3 might by related to the first-time home buyer tax credit, but I expect the rate to decline further.

The homeowner vacancy rate was 2.6% in Q3 2009. A normal rate for recent years appears to be about 1.7%.

A normal rate for recent years appears to be about 1.7%.

This leaves the homeowner vacancy rate about 0.9% above normal, and with approximately 75.3 million homeowner occupied homes; this suggests there are close to 675 thousand excess vacant homes.

And as expected, as a result of the first-time homebuyer tax credit ...

The rental vacancy rate increased to a record 11.1% in Q3 2009.  It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 11.1% to 8%, there would be 3.1% X 40 million units or about 1.25 million units absorbed.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 11.1% to 8%, there would be 3.1% X 40 million units or about 1.25 million units absorbed.

These excess units will keep pressure on rents and house prices for some time.

Weekly Initial Unemployment Claims: 530 Thousand

by Calculated Risk on 10/29/2009 08:48:00 AM

The DOL reports weekly unemployment insurance claims decreased slightly to 530,000:

In the week ending Oct. 24, the advance figure for seasonally adjusted initial claims was 530,000, a decrease of 1,000 from the previous week's unrevised figure of 531,000. The 4-week moving average was 526,250, a decrease of 6,000 from the previous week's unrevised average of 532,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Oct. 17 was 5,797,000, a decrease of 148,000 from the preceding week's revised level of 5,945,000.

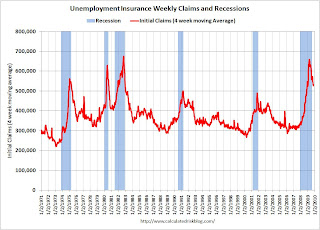

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 6,000 to 526,250, and is now 132,500 below the peak in April. The significant decline from the peak strongly suggests that initial weekly claims have peaked for this cycle.

However, the key question is: Will claims continue to decline sharply, like following the recessions in the '70s and '80s, or will claims plateau for some time at an elevated level, as happened during the jobless recoveries in the early '90s and '00s?

The level is still very high suggesting continuing job losses ...

BEA: GDP Increases at 3.5% Annual Rate in Q3

by Calculated Risk on 10/29/2009 08:30:00 AM

From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 3.5 percent in the third quarter of 2009, (that is, from the second quarter to the third quarter), according to the "advance" estimate released by the Bureau of Economic Analysis.This is close to expectations, and GDP in Q4 will probably be in the same range with more inventory restocking and stimulus spending. But the question is: what happens in 2010?

...

The upturn in real GDP in the third quarter primarily reflected upturns in PCE, in private inventory investment, in exports, and in residential fixed investment and a smaller decrease in nonresidential fixed investment that were partly offset by an upturn in imports, a downturn in state and local government spending, and a deceleration in federal government spending.

...

Real personal consumption expenditures increased 3.4 percent in the third quarter, in contrast to a decrease of 0.9 percent in the second.

...

Real nonresidential fixed investment decreased 2.5 percent in the third quarter, compared with a decrease of 9.6 percent in the second. Nonresidential structures decreased 9.0 percent, compared with a decrease of 17.3 percent. Equipment and software increased 1.1 percent, in contrast to a decrease of 4.9 percent. Real residential fixed investment increased 23.4 percent, in contrast to a decrease of 23.3 percent.

I'll have some more on investment later ...

Wednesday, October 28, 2009

In re Olga: of Bankruptcy and Foreclosure

by Calculated Risk on 10/28/2009 09:23:00 PM

CR Note: This is a guest post from albrt.

In re Olga: of Bankruptcy and Foreclosure.

An article by a person named Morgenson appeared in the New York Times last weekend, calling to our collective attention a New York bankruptcy case that adds to our collective knowledge of our collective foreclosure problem. Driven by a suspicion that the article would have helped us understand more if it had been written by someone other than the aforesaid Morgenson, your intrepid foreclosure correspondent dug into the record and filed the following report.

Picking on Poor Gretchen

First, for recent arrivals, there is a long and honored history at this site of Picking on Poor Gretchen. In this case I want to congratulate Morgenson, as it appears she did break this story herself rather than picking it up, unattributed, from bloggers. Let me also say I am not necessarily the best person to carry on the tradition of Picking on Poor Gretchen. I experimented with journalism in my youth, and I know how difficult it can be to get enough actual facts in a short time to fill up the number of column inches your editor is expecting from you.

But the more I thought about the Times article, the harder it was to escape the conclusion that Brad Delong is right – the print dinosaurs are doomed, and they have done it to themselves. The first few paragraphs of Morgenson’s purported article are appallingly fact-free and hyperbolic, or as Tanta put it, “Morgenson’s valid points are drowning in a sea of sensational swill.”

The article begins:

FOR decades, when troubled homeowners and banks battled over delinquent mortgages, it wasn’t a contest. Homes went into foreclosure, and lenders took control of the property.Morgenson deserves credit for finding this story, but it is hardly the first foreclosure-gone-wrong story of the decade, or even of the “recent foreclosure wave.” Morgenson has apparently forgotten the redoubtable Judge Boyko, who dismissed some Ohio foreclosure complaints in 2007 based on somewhat similar facts. We know Morgenson covered that story, so it is not clear to me whether the “decades” of judicial neglect and rubber stamping occurred before 2007 or after. But, well, whatever.

On top of that, courts rubber-stamped the array of foreclosure charges that lenders heaped onto borrowers and took banks at their word when the lenders said they owned the mortgage notes underlying troubled properties.

* * *

But some judges are starting to scrutinize the rules-don’t-matter methods used by lenders and their lawyers in the recent foreclosure wave.

So What Happened In This Case?

Most of the sensational swill is in the first few paragraphs of this Times story. Once you get past the first third, Morgenson’s facts are basically correct. Unfortunately, much of the context is missing. For example, one of the things you would never guess from reading the Times article is that it matters whether you’re talking about a bankruptcy case or a foreclosure case. That is Takeaway Lesson Number One from this case: Bankruptcy is different from foreclosure.

The purpose of a foreclosure case is usually to allow a lender to take back collateral after the borrower stops paying on a loan. It should not be a surprise that lenders often win such cases, frequently by default. By contrast, the purpose of a bankruptcy case is to allow the debtor to restructure debt, distribute the available assets fairly among creditors, and extinguish debt that can’t realistically be paid. It should not be surprising that debtors “win” bankruptcy cases more often than foreclosure cases, especially if the debtor can show the lender has not followed the rules.

I will call the debtor in this case “Olga.” Her last name is redacted because she doesn’t seem to be seeking publicity. Olga filed bankruptcy under Chapter 13, which is a section of the bankruptcy code allowing individuals with regular income to develop a three or five year plan to pay their debts under supervision of a trustee. The debtor is protected from bill collectors, and most debts that can’t reasonably be paid are discharged. Chapter 13 theoretically allows the debtor to keep a mortgaged home if the debtor can catch up on payments within the plan period. The bankruptcy judge does not have the power to change the loan contract much, though, so many people can’t keep their homes using Chapter 13 unless the lender can somehow be “persuaded” to modify the loan.

But Olga was willing to try. She gave notice to creditors and filed a plan, among other things, and her mortgage servicer (PHH Mortgage Corp.) filed a proof of claim with a schedule stating how much was allegedly owed on Olga’s house. Olga’s lawyer noticed that PHH’s paperwork was not very complete, so he sent some information requests. He was not satisfied with the response, so he filed a motion to have PHH’s proof of claim expunged.

Olga’s Motion to Expunge

Mortgage servicers have important rights under the various contracts associated with the loan, but the servicer frequently is not, and PHH in this case was not, the actual owner of the note or the mortgage. In addition, the paperwork provided by PHH was woefully incomplete. Woefully incomplete paperwork can mean something different in bankruptcy than it does in foreclosure.

When your paperwork is woefully incomplete in a foreclosure case, you can ask for a delay or you can drop the case or have it dismissed, and you usually get another chance. Bankruptcy, by contrast, is kind of a one-shot deal by nature. The judge will add up all the debts, add up all the money available, approve a plan, and that’s it. Very limited do-overs.

Olga’s motion listed a number of problems:

These items are explained a little bit more in Olga’s Response to the lender’s objection to her motion to expunge the proof of claim, which is a pretty good summary of things borrowers might want to think about when they are considering whether to contest foreclosures. MERS was a nominee at some point, but was not directly involved in the case.

My impression is that Olga’s lawyer did not expect the proof of claim to be expunged, and was primarily interested in getting more information and forcing the lender to negotiate. Bankruptcy Judge Robert Drain had other ideas – he expunged the claim.

The Aftermath

This is probably not the end of the story because, as Olga’s lawyer explained, a title company probably will not insure the title if Olga tries to sell the house without taking any further action. Judge Drain did not explain much in his order, but what seems to have gotten his attention is the likelihood that the note and mortgage really never were properly assigned to the securitization trust.

Takeaway Lesson Number Two from this case is that, if Judge Drain is right, this is not a nothingburger. This could apply to a large number of securitized mortgages based on the language of the securitization documents themselves, not on the quirks of local law. The decision has been appealed to the district court, so we will likely find out more unless the case settles.

Morgenson also noted that this decision was by a “federal judge.” It is probably worth noting that bankruptcy judges are not quite the same as U.S. District Court judges. Bankruptcy judges are not appointed for life, they only have jurisdiction over matters that are related to bankruptcy, and their decisions are appealable to a District Court judge, as happened in this case. But bankruptcy judges have a lot of power over core bankruptcy matters. This particular judge was the one who slashed executive compensation in the Delphi case.

In my opinion, Takeaway Lesson Number Three is this: lenders would probably have been better off with a reasonable cramdown provision in the bankruptcy laws. As Tanta explained in her cramdown post, home mortgages were often modified in bankruptcy proceedings before 1993. Morgenson’s claim that all types of court proceedings have uniformly favored lenders “for decades” is wrong, but the bankruptcy laws got a lot worse for consumers in 1993 and again in 2005. In the absence of reasonable solutions imposed by a bankruptcy judge, lawyers for debtors and home mortgage lenders sometimes act like Reagan and Brezhnev, threatening each other with nuclear options and hoping none of the tactical warheads go off prematurely. Which is what seems to have happened in this case.

CR Note: This is a guest post from albrt.