by Calculated Risk on 11/30/2009 08:58:00 PM

Monday, November 30, 2009

More Dubai

From The Times: Fear of creditor wipe-out as Dubai jettisons conglomerate

Dubai World, the state-owned conglomerate, was effectively abandoned to its fate by the Emirate's Government yesterday despite previous assumptions that Dubai would stand behind the company. That has raised the likelihood that lenders to Dubai World, which has liabilities of $60 billion, could lose billions of dollars.This reminds me of a post by Rachel Ziemba in early 2008: Petrodollars: How to Spend It

Dubai World will be restructured and some of its assets ... are likely to be sold to pay down debt.

However, there is uncertainty over the robustness of creditor protection under Dubai law and lenders are understood to be concerned that they will get little or none of their money back.

Analysts at RBC Capital Markets said: “The bottom line is that creditors have almost no legal legs to stand on to maximise recovery values.”

Click on graph for larger image.

Click on graph for larger image.Rachel Ziemba writes:

2007 was the first year that spending growth outstripped revenues [growth] in the GCC and many other oil exporters. 2008 budget plans imply even higher current (especially wages and subsidies) and capital expenditures. Even countries that have traditionally saved more (Kuwait) are ramping up spending especially on capital projects and in some cases transfers to the population or pension funds. ... With megaprojects in the works in a variety of sectors including energy and other infrastructure, capital spending will likely continue to rise.Further Ziemba argued - based on spending growth - that "many GCC countries might have very small current account surpluses" within 5 year, if oil prices hold steady.

And guess what? Oil prices fell - and spending continued to increase. And JA reminded me of this story earlier this month from Bloomberg: Qatar Bonds Gain After $28 Billion of Orders for Sale (ht JA)

Qatar’s bonds rose after the largest-ever sale of debt by an emerging-market government received $28 billion of orders, four times the amount issued.Interesting. From lenders to borrowers ...

...

“This is the largest debt deal from an emerging-market sovereign to date,” said Fabianna Del Canto, syndicate manager at Barclays Capital, a lead arranger for the sale, in London. “Qatar has firmly established itself as the premier borrower in the region.”

...

Qatar, the world’s biggest exporter of liquefied natural gas, will use the bond proceeds to provide “contingency funding” for state-owned companies, pay for infrastructure projects, and invest in the international oil and gas industry, according to the bond sale prospectus obtained by Bloomberg News.

Tanta: A Sad Anniversary

by Calculated Risk on 11/30/2009 06:01:00 PM

One year ago today, my friend and co-blogger Doris “Tanta” Dungey passed away.

This has been a very difficult couple of weeks for her family - Tanta's birthday was Nov 15th and she would have been 48. Cathy, Tanta's sister, asked me to pass along the gratitude of her family for all of your touching comments.

I first "met" Tanta in the comments to my posts in early 2005. She was clearly very knowledgeable about the mortgage industry - and extremely funny - and we shared concerns about the housing bubble and the eventual credit collapse. Tanta was a frequent participant in the comments all through 2005 and into 2006 - and then she disappeared for several months.

When Tanta eventually resurfaced, she revealed she had been seriously ill, and was no longer able to work (she was a mortgage banker). I approached her about writing for this blog, and at first she was hesitant - her health was her primary concern - but in December 2006 she finally agreed.

Tanta became well known for her brilliant posts (see the obituaries below), and she was also very witty and full of life. To understand the impact she had on readers, check out the comments to my post last year: Sad News: Tanta Passes Away

Sadly Tanta’s health declined in the summer of 2008, and she passed away last November. She left us many great posts and wonderful memories. Tanta was about getting the story right – and also having fun. I know this is a sad anniversary, but I think it is also a moment to once again celebrate her life.

Tanta Vive!

| Click on photo for larger image in a new window. Here is more: In Memoriam: Doris "Tanta" Dungey Tanta playing guitar in 2002 (photo credit: family) From David Streitfeld in the NY Times: Doris Dungey, Prescient Finance Blogger, Dies at 47 |

| For some reader remembrances, emails from Tanta and more, see Remembering Tanta Dance, Tanta, dance! (Photo credit: family) From Patricia Sullivan in the WaPo: Doris J. Dungey; Blogger Chronicled Mortgage Crisis |  |

CNBC on Dubai World Debt Restructuring

by Calculated Risk on 11/30/2009 03:55:00 PM

From CNBC: Dubai World to Restructure About $26 Billion of Debt

Dubai World said it would try to restructure about $26 billion of debt, far less than the nearly $60 billion in total liabilities that the Dubai government's investment arm had as of August.Hmmm ... that statement could apply to mortgage lenders in the U.S. too.

...

"Creditors need to take part of the responsibility for their decision to lend to the companies," said Abdulrahman al-Saleh, director general of Dubai's Department of Finance.

Restaurant Index Shows Contraction in October

by Calculated Risk on 11/30/2009 01:20:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Unfortunately the data for this index only goes back to 2002.

Note: Any reading below 100 shows contraction for this index. The index is a year-over-year index, so the headline index might be slow to recognize a pickup in business, but the underlying details suggests ongoing weakness.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Improved Somewhat In October as Restaurant Performance Index Posted First Gain in Three Months

[T]he National Restaurant Association’s ... Restaurant Performance Index (RPI) ... stood at 98.0 in October, up 0.5 percent from its September level. However, the RPI still remained below 100 for the 24th consecutive month, which signifies contraction in the index of key industry indicators.

“Although restaurant operators continue to report soft same-store sales and customer traffic levels, they are somewhat more optimistic about improving conditions in the months ahead,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Restaurant operators reported a positive six-month economic outlook for the fourth consecutive month, and the proportion planning for capital expenditures rose five percentage points.”

...

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 96.5 in October – up 0.4 percent from September and its first improvement in three months. However, October still represented the 26th consecutive month below 100, which signifies contraction in the current situation indicators.

Restaurant operators reported negative same-store sales for the 17th consecutive month in October, with the overall results similar to the September performance. ...

Customer traffic also remained soft in October, with operators reporting net negative traffic for the 26th consecutive month. ...

Although sales and traffic levels remained soft, operators reported a modest uptick in capital spending activity.

emphasis added

US Treasury Announces "Mortgage Modification Conversion Drive"

by Calculated Risk on 11/30/2009 11:20:00 AM

From the U.S. Treasury: Obama Administration Kicks Off Mortgage Modification Conversion Drive

The U.S. Department of the Treasury and Department of Housing and Urban Development (HUD) today kick off a nationwide campaign to help borrowers who are currently in the trial phase of their modified mortgages under the Obama Administration's Home Affordable Modification Program (HAMP) convert to permanent modifications. ... Roughly 375,000 of the borrowers who have begun trial modifications since the start of the program are scheduled to convert to permanent modifications by the end of the year. Through the efforts being announced today, Treasury and HUD will implement new outreach tools and borrower resources to help convert as many trial modifications as possible to permanent ones.The new push includes "operational metrics to hold servicers accountable for their performance, which will soon be reported publicly" and "Servicers failing to meet performance obligations ... will be subject to consequences which could include monetary penalties and sanctions".

"We are encouraged by the pace at which trial modifications are now being made to provide immediate savings to struggling homeowners," said the new Chief of Treasury's Homeownership Preservation Office (HPO), Phyllis Caldwell. "We now must refocus our efforts on the conversion phase to ensure that borrowers and servicers know what their responsibilities are in converting trial modifications to permanent ones." In her new role, Caldwell will lead HPO's conversion drive efforts.

With 375,000 borrowers eligible for permanent modifications by the end of the year, we would expect a minimum of 190,000 permanent modifictions through December - and a 50% conversion rate would be considered very poor. Many of these permanent modifications will probably fail over time too.

Chicago Purchasing Managers Index Increases in November

by Calculated Risk on 11/30/2009 09:46:00 AM

From MarketWatch: CNov. Chicago PMI rises to 56.1%, a 15-month high

The business activity index rose to 56.1% in November from 54.2% in October. ... The employment index rose to 41.9% from 38.3% ...Readings above 50% indicate expansion, and below 50% indicate contraction, so this suggests business activity is increasing, but employment is still declining.

This index is for both manufacturing and service activity in the Chicago region. In general the Chicago area is considered representative of the mix of manufacturing and non-manufacturing business activity in the nation.

The national ISM manufacturing index will be released tomorrow, and the ISM non-manufacturing index on Thursday.

Dubai: Government Will Not Stand Behind Dubai World Debt

by Calculated Risk on 11/30/2009 08:39:00 AM

From The Times: Investors face huge losses as Dubai abandons debt company

The Government of Dubai said today that it will not stand behind its wholly-owned subsidiary Dubai World, prompting fears that the company’s creditors could lose billions of dollars.From the Financial Times: Dubai official confirms no guarantee

Today's comment, from Abdulrahman al-Saleh, the director general of Dubai’s Department of Finance, effectively confirms that country does not have enough money to repay Dubai World’s $60 billion of liabilities. ...

From MarketWatch: Dubai World debt not backed by government:official

Sunday, November 29, 2009

More Dubai and Futures

by Calculated Risk on 11/29/2009 10:55:00 PM

From the WSJ: Worries Grow Over Gulf Rift

The central bank said it "stands behind" U.A.E. banks and would make available funds to local institutions, including local subsidiaries of foreign banks.And from the NY Times: Crisis Puts Focus on Dubai’s Complex Relationship With Abu Dhabi

But the statement pointedly didn't mention Dubai, disappointing many market observers.

Despite the announcement by the emirates’ central bank on Sunday that it would make more money available to local and foreign banks in Dubai, analysts say such imprecise promises — the bank did not say how much, or that it would back all the debt of Dubai or Dubai World — may not be enough to placate investors.But looking at the stock markets, investors don't seem to be worried ...

Many have been left wondering, again, if the Emirate’s debts are worse than most of the world suspects. Analysts estimate Dubai’s total debt at around $80 billion, but some here say it could well be closer to $120 billion, or more.

In Asia, the Hang Seng is up over 3%, and Nikkei is up over 2%.

In the U.S, the S&P futures are up about 6 points (Dow futures up 50). Some sources:

Bloomberg Futures.

CNBC Futures

Best to all.

The Times: United Arab Emirates takes hard line on Dubai

by Calculated Risk on 11/29/2009 07:13:00 PM

For some reason The Times has been removed from news stands in Dubai ...

From The Times: Central Bank of the United Arab Emirates takes hard line as Dubai counts soaring cost

... The rulers of Abu Dhabi are expected to make a statement before the markets open on whether they will bail out Dubai and which businesses and projects will be rescued.I think many people consider most of Dubai "folly".

...

Senior analysts in the region expect that projects regarded as folly will not be backed but operations and investments with a strong business model will be.

...

Today will mark the first key test of whether Dubai will default on its estimated $88 billion debt pile, when interest payments of about $138 million on a $2 billion bond issue by Jebel Ali Free Zone Authority, a unit of Dubai World, become due.

Summary and a Look Ahead

by Calculated Risk on 11/29/2009 03:30:00 PM

The week will start with questions about Dubai, and a Treasury announcement on Monday about a plan to put pressure on lenders to complete modifications.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph is from the most recent Making Home Affordable Program Report for October.

To put the numbers in perspective: as of the end of June (five months is up for those borrowers) there were 143,276 trial modifications, and a 50% conversion rate would be about 70,000 permanent modifications. Of course a 50% conversion rate would be considered dismal. So I'd expect the number of permanent modifications to be well in excess of 100,000 for those early trials, and if some later trial modifications were converted, perhaps many more. The data will probably be released the week of December 7th.

The big news later in the week will be the November employment report. In between will be the ISM reports (manufacturing and service), auto sales (on Tuesday), construction spending, other employment reports and more. An interesting week!

And a summary ...

From the Chicago Fed: Index shows economic activity leveled off in October

The index’s three-month moving average, CFNAI-MA3, decreased to –0.91 in October from –0.67 in September, declining for the first time in 2009. October’s CFNAI-MA3 suggests that growth in national economic activity remained below its historical trend.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed the index should move "significantly into positive territory a few months after the official NBER date of the trough" - and that hasn't happened yet.

Here is the NAR report: Existing-Home Sales Record Another Big Gain, Inventories Continue to Shrink

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in Oct 2009 (6.10 million SAAR) were 10.1% higher than last month, and were 23% higher than Oct 2008 (4.94 million SAAR).

For graph on Not Seasonally Adjust (NSA) sales, inventory and months of supply, see: Existing Home Sales Graphs

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 430 thousand. This is an increase from the revised rate of 405 thousand in September (revised from 402 thousand).

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 430 thousand. This is an increase from the revised rate of 405 thousand in September (revised from 402 thousand).This graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but are now 31% above the low in January. For inventory, NSA sales, and months of supply, see: New Home Sales in October

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).The Composite 10 index is off 29.9% from the peak, and up about 0.4% in September.

The Composite 20 index is off 29.1% from the peak, and up 0.3% in September.

More on house prices: Case Shiller Home Price Graphs

Best wishes to all.FDIC Q3 Banking Profile: 552 Problem Banks First American CoreLogic Negative Equity Report for Q3 "Nearly 10.7 million, or 23 percent, of all residential properties with mortgages were in negative equity as of September, 2009. An additional 2.3 million mortgages were approaching negative equity, meaning they had less than five percent equity. Together negative equity and near negative equity mortgages account for nearly 28 percent of all residential properties with a mortgage nationwide."From the American Trucking Association: ATA Truck Tonnage Index Dipped 0.2 Percent in October From the U.S. Courts: Bankruptcy Filings Up 34 Percent over Last Fiscal Year $430 Billion in CRE Losses? Scott Reckard at the LA Times has an overview: Few mortgages have been permanently modified Unofficial Problem Bank List Increases Significantly

NRF: Number of Shoppers Up, Average Spending Down

by Calculated Risk on 11/29/2009 01:33:00 PM

From the NRF: Black Friday Verdict: As Expected, Number of Shoppers Up, Average Spending Down

... a National Retail Federation survey conducted over the weekend confirms the expected: more people spent less. According to NRF’s Black Friday shopping survey, conducted by BIGresearch, 195 million shoppers visited stores and websites over Black Friday weekend, up from 172 million last year. However, the average spending over the weekend dropped to $343.31 per person from $372.57 a year ago. ...This is for "stores and websites" - not just brick and mortar.

“Shoppers proved this weekend that they were willing to open their wallets for a bargain, heading out to take advantage of great deals on less expensive items like toys, small appliances and winter clothes,” said Tracy Mullin, NRF President and CEO.

...

“During a more robust economy, people may be inclined to hit the “snooze” button on Black Friday, but high unemployment and a focus on price caused shoppers to visit stores early in anticipation of the best deals,” said Phil Rist, Executive Vice President, Strategic Initiatives, BIGresearch.

* NRF’s definition of “Black Friday weekend” includes Thursday, Friday, Saturday and projected spending for Sunday.

Dubai Update

by Calculated Risk on 11/29/2009 11:26:00 AM

Note: I'll have a Black Friday retail post in a few hours ...

From Bloomberg: U.A.E. Central Bank Stands Behind Lenders, Adds Funds

The United Arab Emirates’ central bank said it “stands behind” the country’s local and foreign banks, which face losses from Dubai World’s possible default, and offered them access to more money under a new facility.And from the Financial Times: UAE central bank offers credit facility

“It’s a bit disappointing .... It’s obviously a welcome measure in itself but we want to see more from the central bank. We want to see that they will guarantee the capital position of any banks that have exposure and that they will ultimately be willing to buy out the debt,” one UAE analyst said on Sunday.Apparently the hope is that a majority of the debt due on Dec 14th is held by banks in the UAE, and that by adding liquidity, the UAE Central Bank will make it easier for the bondholders to accept the deferral of payment. However this isn't just a liquidity crisis - this is a solvency crisis (the assets are almost certainly worth less than the liabilities) - and this does nothing to address the solvency issues.

excerpted with permission

Apartment Rents Fall 4.9% in SoCal

by Calculated Risk on 11/29/2009 09:23:00 AM

From Alejandro Lazo at the LA Times: Falling rents aid homeowners in mortgage trouble

Southern California rents peaked at $1,501 in the third quarter of 2008 ... Since then, rents have fallen 4.9%, to an average of $1,427 in the third quarter of this year, according to a survey of larger apartment complexes by property research firm RealFacts. The drop came as the occupancy rate of the buildings ticked down 0.8% to 93.7%. The data don't include homes converted into rental units or smaller apartment buildings.Although falling rents and significant concessions are good news for renters, this will also lead to more apartment defaults, higher default rates for apartment CMBS, and more losses for small and regional banks.

...

Job losses and competition from foreclosed homes have made concessions by large landlords common. Thomas Shelton, president of Western National Property Management in Irvine, said he was offering about a month of free rent for every 12-month lease signed.

And falling rents are already pushing down owners' equivalent rent (OER). Since OER is the largest component of CPI, this will apply downward pressure on CPI for some time. And lower rents will also put pressure on house prices, since renting is a competing product.

But renting is a relief to some:

Thomas DeLong walked away from the mortgage on his final home in September and began renting a house for about $1,400 a month, with utilities, in the high-desert area of Perris.

DeLong ... said renting was a relief after years of worry and a financial juggling act that came crashing down all around him.

Saturday, November 28, 2009

Abu Dhabi and Dubai: Dueling Headlines

by Calculated Risk on 11/28/2009 10:55:00 PM

From The Times: Abu Dhabi rides in to rescue Dubai from debt crisis

And from the Telegraph: Abu Dhabi will not race to Dubai's rescue

Actually both stories are pretty much the same. From The Times article:

An Abu Dhabi official said yesterday it would “pick and choose” how to assist its neighbour, a hint that the restructuring of Dubai’s debts may not be straightforward. “We will look at Dubai’s commitments and approach them on a case-by-case basis,” the official said. “It does not mean that Abu Dhabi will underwrite all their debts.”Clearly Abu Dhabi will ride, but not race, to the rescue.

Growth of Problem Banks (unofficial)

by Calculated Risk on 11/28/2009 06:52:00 PM

By request here is a graph of the number of banks on the unofficial problem bank list.

We started posting the Unofficial Problem Bank list in early August (credit: surferdude808). The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest. Some of this data is released with a lag (the FDIC announced the October enforcement actions yesterday). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of banks on the unofficial list. The number has grown by almost 40% since early August.

The two red dots are the number of banks on the official problem bank list as announced in the FDIC quarterly banking profile for Q2 and Q3. The dots are lagged one month because of the delay in announcing formal actions.

The unofficial count is close, but is slightly lower than the official count - probably mostly due to timing issues.

Consensus on Permanent Mods: "Program has proved inadequate"

by Calculated Risk on 11/28/2009 03:42:00 PM

It sounds like the permanent mod numbers will be grim ...

From Peter Goodman at the NY Times: U.S. to Pressure Mortgage Firms for Loan Relief

The Obama administration on Monday plans to announce a campaign to pressure mortgage companies to reduce payments for many more troubled homeowners, as evidence mounts that a $75 billion taxpayer-financed effort aimed at stemming foreclosures is foundering.There is much more in the article. We will see the numbers in a couple of weeks.

“The banks are not doing a good enough job,” Michael S. Barr, Treasury’s assistant secretary for financial institutions, said in an interview Friday.

...

“I’ve been very frustrated by the pace of the program,” said Senator Jeff Merkley, an Oregon Democrat who sits on the Senate Banking Committee. “Very few people have emerged from the trial period.”

...

Capitol Hill aides in regular contact with senior Treasury officials say a consensus has emerged inside the department that the program has proved inadequate, necessitating a new approach. ...

"[A]t senior levels, where people are looking at this and thinking ‘Good God,’ there’s a sense that we need to think about doing something more.” said a Senate Democratic aide, who spoke on the condition he not be named for fear of angering the administration.

emphasis added

Thanksgiving Weekend Mortgage Litigation Roundup

by Calculated Risk on 11/28/2009 11:55:00 AM

CR Note: This is a guest post from albrt.

Thanksgiving Weekend Mortgage Litigation Roundup

CR forwarded me a couple of links recently, so I told him I’d write up a summary for your holiday weekend entertainment. I’m also including a little ubernerd bonus at the end.

Mortgage Cancelled Due to Unconscionable, Vexatious and Opprobrious Conduct

One case has been mentioned in the comments a few times, but for hat tip purposes I believe it was first sent in by Art Vandalay. The link is to a summary at Law.Com, which has a link to the decision. Note that this is a local trial court decision – the county trial courts in New York are called the Supreme Court, while the highest court is called the Court of Appeals.

The bottom line in this case is that the trial judge spent several months trying to encourage IndyMac to modify a mortgage that was in foreclosure. The borrowers made a number of different offers, including offering to have other family members cosign on the modified loan. IndyMac refused, and also submitted some questionable information to the court. The judge finally had enough and decided that the note and the mortgage should be “vacated, cancelled, released and discharged of record.”

This is a very unusual result in a foreclosure case. Not only did the judge refuse to enforce the mortgage by foreclosure, he actually wiped out the debt completely. The decision is entertaining, but it doesn’t highlight any legal principles that are likely to affect other mortgages other than the most fundamental of all legal maxims: “try not to piss off the judge.” It’s very hard to guess whether a decision like this will be upheld on appeal.

More Trouble with Paperwork in Massachusetts

The other case is from Massachusetts, which as you may recall has strict standards for recording mortgage documents. This link is also a Law.Com summary with a link to the recent decision in the case of MERS v. Agin. Hat tip Dogbert.

The first thing to notice about this case is that Mr. Agin is a bankruptcy trustee, not a borrower. The borrower declared Chapter 7 bankruptcy, which essentially means there is no workout plan, and everything will be liquidated except certain property that is exempt by law. A house (or a certain amount of equity in a house) can be exempt, but this is unlikely if there is a significant mortgage.

A Chapter 7 trustee has two major responsibilities: to make sure the debtor is not withholding assets, and to serve as a referee among the different creditors. Mr. Agin, perhaps with prompting from some of the other creditors, filed a motion asking the bankruptcy court to determine whether the mortgage was valid. The bankruptcy court decided the mortgage was not valid because the borrower’s name was not filled in on the notary acknowledgement. The federal district court upheld the decision.

As a result, the mortgage was eliminated but the debt was not. The mortgage lender became an unsecured creditor, just like a credit card lender. The house will be sold, but the proceeds will be split between all the creditors on a pro-rata basis instead of going to the mortgage lender first. I don’t see any obvious reason to expect this decision to be overturned on appeal.

For Ubernerds: A Note on Bona Fide Purchasers

Footnote 2 of the Agin case contains a mysterious reference to a legal doctrine that may be of interest to the ubernerds amongst us:

Section 544 allows the trustee to avoid a transfer of an interest in real property of the debtor to the extent a bona fide purchaser of the property may avoid the transfer “without regard to the knowledge of the trustee or of any creditor.”The footnote doesn’t make much sense unless you understand the significance of being a bona fide purchaser without knowledge. This site has a pretty good definition:

bona fide purchaser n. commonly called BFP in legal and banking circles; one who has purchased an asset (including a promissory note, bond or other negotiable instrument) for stated value, innocent of any fact which would cast doubt on the right of the seller to have sold it in good faith. This is vital if the true owner shows up to claim title, since the BFP will be able to keep the asset, and the real owner will have to look to the fraudulent seller for recompense.A “purchaser” includes anyone who has given value, which means it generally includes a secured lender as well as a buyer. A “holder in due course” is similar to a BFP, except that the term is generally limited to a purchaser of a negotiable financial instrument. Purchasers of debt instruments are not just worried about whether the person who sold the instrument was the “real owner” – they are also worried about whether the borrower will try to avoid repaying the loan by accusing the original lender of fraud or something similar. BFP status protects against both of these things.

Like most everything in the law, the BFP concept is hedged with all sorts of qualifications, mostly having to do with reasonableness – a bona fide purchaser should not be able to ignore things that a reasonable person should have known. The most obvious example is that a BFP cannot ordinarily ignore a document that was properly recorded in the local land records.

In Agin, the issue was whether the missing name on the acknowledgement was enough to make the mortgage void. An ordinary person who purchased the debtor’s house might not have been able to avoid the mortgage if the purchaser should reasonably have known from the records that the mortgage existed. But the bankruptcy statute allowed the trustee to be treated as a BFP of the debtor’s house regardless of what he knew or should have known, so all he had to do is show that the mortgage document had a material defect.

So an ordinary BFP doesn’t get quite as much protection as the bankruptcy trustee in Agin, but lenders and investors do consider BFP status important. There are many things to be said for and against giving special treatment to BFPs, but the point I’d like to make today is that the bona fide purchaser concept creates decidedly mixed incentives for due diligence. A buyer or lender wants to discover everything that a reasonable person should discover, but does not particularly want to discover any problems that could be avoided by a BFP without knowledge.

The BFP concept played a significant role in the Wall Street securitization process. As Judge Long noted in footnote 29 of the Ibanez ruling:

The Ibanez Private Placement Memorandum is quite explicit regarding the separateness of “Originators” and “Servicers” and the reasons for that separateness. See Private Placement Memorandum at 84 (explaining the “information barrier policies” intended to protect the trust’s status as a holder in due course of the notes and insulate it from claims of fraud, misrepresentation, etc. in the making of the loans).In other words, as many of you suspected all along, “hoocoodanode?” was officially part of the plan for creating mortgage backed securities. Systematic and willful ignorance was incentivized. If Wall Street created a system where each bogus mortgage passed through the hands of a couple of intermediaries who had no ability to do any due diligence on the quality of the loan, then the end buyer of the loan would, legally speaking, be in a better position to collect than the original lender by virtue of BFP status. Did the mortgage broker tell the borrower the loan was fixed rate when it really wasn’t? Oh well, no way the mortgage pool trustee could have known about that after the loan passed through the hands of an originating lender, an unrelated depositor and a legally separate issuer.

Whether for better or for worse, this system is pretty clearly not playing out as intended. BFP status does nothing to protect lenders from broke borrowers and half price houses, both of which were foreseen by knowledgeable people who were not willfully ignorant of details about loan origination. And even the limited protection of BFP status may not be available in cases that are actively litigated, since it won’t be hard to prove that everyone in the industry knew brokers were filling in the blanks on stated income loans with whatever numbers were needed to make the applications go through.

So I guess this is just one more reason why all the Fed’s ponies and all the Treasury’s men are not going to be able to put Humpty Dumpty back together again.

CR Note: This is a guest post from albrt.

Your Morning Dubai

by Calculated Risk on 11/28/2009 08:02:00 AM

A collection of articles ...

From The Times: Dubai debt fears threaten credit crunch 2 — and RBS is exposed

From Bloomberg: India Studying Effect of Dubai’s Debt Delay Plan on Its Economy

India, the world’s top recipient of migrant remittances, is examining the effect Dubai’s attempt to delay debt repayments may have on Asia’s third-largest economy, central bank Governor Duvvuri Subbarao said.From the NY Times: Dubai Debt Woes Raise Fear of Wider Problem

About 4.5 million Indians live and work in the Gulf region and remit more than $10 billion annually, according to government data. The turmoil may affect remittances, said Thomas Issac, finance minister of the southern state of Kerala, which accounted for about a quarter India’s migrant labor in 2005.

[O]ne concern is that some British banks with large credit exposure to the United Arab Emirates are already troubled. Royal Bank of Scotland, majority-controlled by the British government, was one of the largest lenders to Dubai World, having secured $2.3 billion worth of loans to it since early 2007, according to a report by J.P. Morgan. Standard Chartered and Barclays were also large lenders to the region, with more than $10 billion between them, analysts said. HSBC has $17 billion exposure to the United Arab Emirates.From the WSJ: Dubai Jitters Infect Debt of Sovereign Spendthrifts

But while a Dubai default may not provoke a banking crisis, it could well spur a broader crisis of investor confidence in overly leveraged economies.

[S]tress lines were felt in the sovereign-bond market, where the cost of insuring against defaults in places like Hungary, Turkey, Bulgaria, Brazil, Mexico and Russia rose, fueled by concerns that emerging-market nations may have trouble honoring their debts even as the economy heals. The worry is that sovereign debt may now represent another aftershock of the global financial crisis.

Friday, November 27, 2009

Flipper in Trouble?

by Calculated Risk on 11/27/2009 09:13:00 PM

A flipper bought this one in September for $330,000, and has reduced the asking price to $379,000. Still no takers.

Jim the Realtor is watching for "flips turning to flops" and this might be one. For more - and a couple of interviews with Adam (a flipper who had made money) - see Jim's site.

Northern Trust on Dubai

by Calculated Risk on 11/27/2009 06:29:00 PM

James Pressler at Northern Trust provides an overview of the Dubai situation: Dubai’s Latest Mega-project – A Massive Default? (pdf) A few excerpts:

The complexities of the UAE’s governmental structure make the situation difficult to grasp at first glance, but the problem can be captured by a few basic points. First, Dubai is the second-largest emirate in the UAE next to Abu Dhabi, but Abu Dhabi is also the power of the national government and has been challenged by Dubai’s meteoric rise. Next, the UAE has a sovereign wealth fund estimated at one half-trillion dollars in case of emergency, so money is clearly available at the national level to bail out Dubai if that route is chosen. Lastly, the national government wants to emerge from this situation with international markets assured that a state-run entity has the backing of the government and will be subsequently subject to reform and accountability. Taken together, these points plus an appreciation of the politicial undercurrents suggest a scenario that avoids outright default.This suggests that Abu Dhabi will bailout Dubai, but that isn't certain:

The first sign of things to come could be as early as the first week in December, when Gulf markets re-open from the Eid al-Adha holiday (Dubai World announcing its debt postponement plans just before Eid celebrations was in all likelihood not a coincidence). This will mark the first chance for officials to state positions and make confidence-building claims, with the further interest of calming international markets. Between that time and the December 14 due date for Dubai World’s next debt payment, we expect to see a concrete plan laid out for bailing out the conglomerate and some pressure taken off the credit markets. However, if no settlement can be reached, it would not surprise us if another major entity started talking about restructuring or a debt freeze before year-end – and not necessarily a company in the UAE.And from the Financial Times: Abu Dhabi expected to prop up smaller brother

[W]ith Dubai raising the possibility that one of its flagship entities may default, attention is now focusing on just how far Abu Dhabi is willing to go to bail out its smaller brother. Underlying the uncertainty, it is thought that Abu Dhabi officials were caught unaware by Dubai World’s dramatic statement ... Ultimately, though, there is consensus that Abu Dhabi will not see it fail.Should be an interesting couple of weeks.

excerpted with permission

Unofficial Problem Bank List Increases Significantly

by Calculated Risk on 11/27/2009 03:07:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Changes and comments from surferdude808:

The FDIC finally released its enforcement actions for October today, which led to a large increase in the number of institutions on the Unofficial Problem Bank List.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

This week the list changed by a net 30 institutions to 543 from 513 while aggregate assets increased by $10 billion to $312 billion.

For the 33 institutions added, their average asset size is $321 million. The largest include Hillcrest Bank, Overland Park, Kansas ($1.9 billion); Charter Bank, Santa Fe, New Mexico ($1.3 billion), and Severn Savings Bank, Annapolis, Maryland ($990 million). Geographic highlights include the addition of five Illinois-based institutions and four each in Georgia and Texas.

The FDIC issued a Prompt Corrective Action Order against Rockbridge Commercial Bank, Atlanta, Georgia ($294 million), and LibertyPointe Bank, New York, New York ($212 million); LibertyPointe has been operating under a Cease & Desist Order since July 2009.

The deletions this week include Commerce Bank of Southwest Florida, which failed last Friday, and First Independent Bank, where the FDIC terminated the enforcement action during October 2009.

Note: The FDIC announced there were 552 bank on the official Problem Bank list at the end of Q3. The difference is a mostly a matter of timing - some enforcement actions haven't been announced yet, and others may be pending.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

More on Dubai

by Calculated Risk on 11/27/2009 01:00:00 PM

Click on graph for larger image in new window.

First, since the markets closed early ...

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Krugman suggests there are three views on the Dubai situation: 1) the beginning of a wave of sovereign defaults, 2) an extension of the CRE bust, and 3) Dubai as sui generis. Krugman believes it is some combination of two and three.

I agree. Dubai seems like an extreme example of the CRE bust. "Vegas on steroids" as Nanoo-Nanoo wrote in the comments to an earlier post.

It is the state-controlled Dubai World that might delay payments - and both Moody's and Standard & Poor’s have said they may consider delaying payments a default - and it is unclear if oil rich Abu Dhabi will help out Dubai. So the situation is confusing ... but it does seem that Dubai is the most overbuilt city in the world.

Here is a repeat of a video on the Dubai real estate crash I posted in February:

Some photos of Dubai from the Boston Globe last year.

Also from February, an article on "skips" - expatriates fleeing home rather than risk jail for defaulting on loans: Driven down by debt, Dubai expats give new meaning to long-stay car park

And from the NY Times in February: Laid-Off Foreigners Flee as Dubai Spirals Down

WaPo: A Liar Loan Example

by Calculated Risk on 11/27/2009 10:53:00 AM

From Donna St. George at the WaPo: The $698,000 mistake

[A]ll of this began in the heady days of the mortgage boom ... [Ms. White] only knew that there seemed to be possibilities, even to those with little means such as herself, which is how a woman who had never paid more than $700 a month in rent and who had relied in recent years on Section 8 housing vouchers suddenly owned a house.You can already tell how this story will end.

A four-bedroom house.

With 3 1/2 bathrooms. And walk-in closets, black granite countertops and a fireplace.

On settlement day, reality bore down.To get White to sign, the sellers - who were real estate agents - agreed to make the first two mortgage payments for Ms. White. According to the article, White received $40,000 in cash out at closing - and the seller made over $200,000 on the house. Naturally it went into foreclosure and Ms. White is back living in an apartment.

...

Papers were read and presented, most of which White did not try to decipher. ... White's papers cited income of $163,320 a year, even though she says her 2005 income-tax earnings were less than $15,000 and she relied at times on food stamps.

...

White signed papers while waiting for the one she cared most about: her monthly payment. ... "Please let this be something I can afford," she said to herself. She was pretty sure she could afford $2,000. She told herself that if her day-care business did well, perhaps she could afford $2,500. If it was $2,800, she would struggle. Here, now, came reality: $5,635 a month.

UBS Analysts: Dubai Debt may be more than $80 Billion

by Calculated Risk on 11/27/2009 08:33:00 AM

A little more Dubai news ...

From Bloomberg: Dubai Debt May Be Higher Than $80 Billion, UBS Analysts Say

Dubai... may owe more than the $80 billion to $90 billion in liabilities assumed by investors, UBS AG analysts said in a note.And more: RBS Led Dubai World Lenders, HSBC May Have Most at Stake in UAE

“Perhaps Dubai’s debt includes sizeable off-balance sheet liabilities that imply a total debt burden well above the $80 billion to $90 billion markets have estimated so far,” real estate analyst Saud Masud wrote in a note yesterday. “This could imply that the debt issued by Dubai in recent weeks is insufficient to meet upcoming redemptions.”

RBS, the largest U.K. government-controlled bank, arranged $2.3 billion, or 17 percent, of Dubai World loans since January 2007, JPMorgan said in a report today .... HSBC, Europe’s biggest bank, has the “largest absolute exposure” in the U.A.E. with $17 billion of loans in 2008, JPMorgan said ...

Thursday, November 26, 2009

Europe, Asia Sell-Off on Dubai Reports

by Calculated Risk on 11/26/2009 09:39:00 PM

Some Turkey Night reports and futures ...

From The Times: Dubai in deep water as ripples from debt crisis spread

Fears of a dangerous new phase in the economic crisis swept around the globe yesterday ... Shares plunged, weak currencies were battered and more than £14 billion was wiped from the value of British banks on fears that they would be left nursing new losses.The French CAC-40 was down 3.4% and the German DAX index was down 3.3%.

...

Although the scale of Dubai’s debts is comparatively modest at $80 billion (£48 billion), the uncertainty spooked the markets ... The FTSE 100 plunged by 171 points to 5,194 — its biggest one-day fall in eight months ...

In Asia, the Hang Seng is off about 3%, and Nikkei is off 1.8%.

In the U.S, the S&P futures are off about 25 points (Dow futures off 200). Some sources:

Bloomberg Futures.

CNBC Futures

Best to all.

$430 Billion in CRE Losses?

by Calculated Risk on 11/26/2009 05:55:00 PM

From Jon Lansner at the O.C. Register: How banks may lose $430 billion more

Banks are projected to lose $430 billion on commercial real estate loans in the next two to three years [said] Stan Mullin, an associate with California Real Estate Receiverships in Newport BeachThis is similar to the recent presentation by Dr. Randall Zisler, CEO of Zisler Capital Partners:

...

Highlight’s of Mullin’s talk:•$1.4 trillion in commercial loans are coming due in the next five years.

•That’s equal to the same amount that came due in the last 15 years.

•Lenders could take massive losses on their real estate portfolios from 2010-2013.

A crisis of unprecedented proportions is approaching. Of the $3 trillion of outstanding mortgage debt, $1.4 trillion is scheduled to mature in four years. We estimate another $500 billion to $750 billion of unscheduled maturities (i.e., defaults).And from the WSJ in October:

Commercial real-estate loans are the second-largest loan type after home mortgages. More than half of the $3.4 trillion in outstanding commercial real-estate debt is held by banks.And of course this is why the FDIC released the recent Policy Statement on Prudent Commercial Real Estate Loan Workouts

The Fed presentation states that the most "toxic" loans on bank books are so-called interest-only loans, which require borrowers to repay interest but no principal. Those loans "get no benefit from amortization," the report states.

"Today, most of the borrowers are paying because interest rates are so low, but the question is whether the loans will get paid off when they come due," said Michael Straneva, global head of Ernst & Young's transaction real-estate practice.

This policy statement stresses that performing loans, including those that have been renewed or restructured on reasonable modified terms, made to creditworthy borrowers will not be subject to adverse classification solely because the value of the underlying collateral declined.And the "value of the underlying collateral" had definitely declined - by 43% on average according to Moody's.

In the end, the size and timing of the losses really depends on the success of the workouts, and I expect the terms on many of these loans will be extended for a number of years - taking advantage of the very low interest rates and hoping property values eventually rebound.

Music: It's Beginning to Look a Lot More Riskless

by Calculated Risk on 11/26/2009 02:45:00 PM

Happy Thanksgiving! Make sure to check out the previous post on Dubai.

Dubai Default

by Calculated Risk on 11/26/2009 11:01:00 AM

No one saw this coming ...

From Bloomberg: Dubai Debt Delay Rattles Confidence in Gulf Borrowers

Dubai is shaking investor confidence across the Persian Gulf after its proposal to delay debt payments risked triggering the biggest sovereign default since Argentina in 2001.And a few articles from the WSJ: Dubai Starts to Untangle Dubai World Fallout

...

Moody’s Investors Service and Standard & Poor’s cut the ratings on state companies yesterday, saying they may consider state-controlled Dubai World’s plan to delay debt payments a default. The sheikhdom, ruled by Sheikh Mohammed Bin Rashid Al Maktoum, borrowed $80 billion in a four-year construction boom ...

And European Banks Seen Exposed To Dubai World

Most banks on Thursday said their exposure to Dubai and Dubai World is small or declined to comment, but Credit Suisse analysts estimate European banks have about $40 billion in exposure to debt issued by various Dubai city-state entities, including Dubai World.And from December 2008: Citi Voices Upbeat View on Dubai (ht jb)

With questions about Dubai's looming debt obligations swirling, Citigroup Inc. said it had raised $8 billion for the Persian Gulf city-state over the course of the past year and still had a positive outlook on its economy.When there are bad loans to be made, apparently Citi never sleeps.

Citigroup Chairman Win Bischoff was quoted in the bank's statement Monday as saying Citigroup continues to see Dubai as among its "most significant markets."

UPDATES: Brad DeLong suggests it might be Time to Reread the History of Austria's Creditanstalt in 1931...

Interesting time. In Europe, the Creditanstalt's bankruptcy and what followed was what turned the recession into the European Great Depression...And DeLong excerpts from a Financial Times article by Roula Khalaf: The emirate has a lot of explaining to do

And from Izabella Kaminska at the FT Alphaville: Barclays Capital ‘change their view’ on Dubai

My, my, what a difference a few weeks make.There is much more at the link.

Earlier this month — when all still seemed relatively well in the UAE emirate of Dubai — Barclays Capital was among those touting Dubai-related debt as a decent investment for clients. The bank even confidently predicted the repayment of the now infamous Nakheel sukuk.

In fact on November 4 — the day Moody’s slashed its ratings on five Dubai government related entities — BarCap analysts wrote:We expect several developments to act as positive catalysts for Dubai’s sovereign spreads. First, the likely repayment of the Nakheel sukuk in December. Second, Dubai’s ability to raise the second USD10bn tranche with the support of Abu Dhabi. Third, a successful conclusion of the merger between Emaar and Dubai Holding, as well as a solution allowing mortgage providers Amlak and Tamweel to resume lending.

On that basis, we recommend a long position in Dubai sovereign credit and see today’s negative price actions as an opportunity to buy.

Mortgages: Few Permanent Mods

by Calculated Risk on 11/26/2009 08:53:00 AM

One of the keys to the housing market is the success of the modification programs. The Treasury Department is expected to release a key measurement next month: the number of permanent modifications for the Making Home Affordable program.

Scott Reckard at the LA Times has an overview: Few mortgages have been permanently modified

Loan-modification limbo is of high concern these days ... even after reporting this month that trial modifications had topped 650,000, the government still hasn't said how many of those loans have been permanently restructured. ...We will know more in December, but it might not have been a great idea to loan the money first, and then qualify the borrowers.

"You can't claim victory at 500,000 trial modifications and then have half of them drop out," said Paul Leonard, California director for the Center for Responsible Lending, a Durham, N.C.-based advocacy group.

...

Exactly what is holding up the conversions depends on whom you talk to.

"Getting these loans to the finish line is tough" for loan servicers, Chase Home Lending Senior Vice President Douglas Potolsky said ... The main obstacle, he and other bankers said, is borrowers who don't properly complete their paperwork.

...

Getting income documentation is a major problem now that the era of "low doc" and "no doc" loans is long gone, [Sam Khater, an economist with mortgage data firm First American CoreLogic] said in an interview.

Wednesday, November 25, 2009

Fannie Mae to Tighten Some Standards

by Calculated Risk on 11/25/2009 11:42:00 PM

From the WaPo: Fannie Mae to tighten lending standards (ht Ann, Pat, Tim)

Starting Dec. 12, the automated system that Fannie Mae uses to approve loans will reject borrowers who have at least a 20 percent down payment but whose credit scores fall below 620 out of 850. Previously, the cut-off was 580.This change will only impact a small percentage of Fannie Mae loans. I'm surprised they still allow debt payments to be as high as 45% of gross income - that seems a little loose and leaves the borrowers house poor.

Also, for borrowers with a 20 percent down payment, no more than 45 percent of their gross monthly income can go toward paying debts. Fannie declined to disclose the previous threshold, except to say that it was higher. ...

Brian Faith, a Fannie Mae spokesman, said ... Loans to people with credit scores below 620 fell seriously behind at a rate approximately nine times higher than other loans purchased in the same period ...

Housing: A Weak Start to November

by Calculated Risk on 11/25/2009 10:14:00 PM

A short excerpt from the WSJ Developments: Think Twice About Cheering New Home Sales

Already, builders report weak November traffic. One private builder in Raleigh, N.C. - long considered a strong market because of tech and higher-education employers - reports no shoppers in the first week, according to John Burns Real Estate Consulting.I've heard similar reports from real estate agents that the first two weeks of November were exceptionally weak, but that the phones started ringing again once the word spread that the tax credit had been extended.

I wouldn't be surprised by a dip in New home sales in November - although existing home sales will probably still be fairly strong from people buying in September (existing home sales are reported at the close of escrow).

Jim the Realtor Interviews a Real Estate Flipper

by Calculated Risk on 11/25/2009 07:08:00 PM

Jim shows a property and interviews the investor. The investor recently bought the property for $590,000 on the court house steps, and sold it fairly quickly for $685,000.

Bankruptcy Filings Increase 34 Percent

by Calculated Risk on 11/25/2009 05:10:00 PM

From the U.S. Courts: Bankruptcy Filings Up 34 Percent over Last Fiscal Year

Bankruptcy cases filed in federal courts for fiscal year 2009 totaled 1,402,816, up 34.5 percent over the 1,042,993 filings reported for the 12-month period ending September 30, 2008, according to statistics released today by the Administrative Office of the U.S. Courts.

The federal Judiciary’s fiscal year is the 12-month period ending September 30. The bankruptcies reported today are for October 1, 2008 through September 30, 2009.

...

For the 12-month period ending September 30, 2009, business filings totaled 58,721, up 52 percent from the 38,651 business filings in the 12-month period ending September 30, 2008. Non-business filings totaled 1,344,095, up 34 percent from the 1,004,342 non-business bankruptcy filings in September 2008.

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the bankrutpcy filings over the last year per 1,000 population by states and territories.

Nevada makes sense with close to 70% of homeowners underwater. And Michigan is the state with the highest unemployment rate, and a large percentage of homeowners underwater. But I'm not sure why Tennessee is #2.

Ratio of Existing to New Home Sales

by Calculated Risk on 11/25/2009 03:26:00 PM

Here is more on the "distressing gap" between existing and new home sales.

The following graph shows the ratio of existing home sales divided by new home sales through October. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This ratio has increased again to a new all time high.

The ratio of existing to new home sales increased at first because of the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The recent increase in the ratio was due primarily to the timing of the first time homebuyer tax credit (before the extension). New home sales are counted when the contract is signed, and usually before construction begins. So to close before the original Dec 1st deadline, the contract had to be signed early this Summer (that might explain the dip in the ratio earlier this year).

Existing home sales are counted when escrow closes, and escrow usually takes less than 60 days. So the recent surge in sales were boosted by buyers rushing to beat the tax credit. And this has pushed the ratio to a new record. The second graph shows the same information with existing home sales (left axis), and new home sales (right axis). This is updated through the October data released this morning.

The second graph shows the same information with existing home sales (left axis), and new home sales (right axis). This is updated through the October data released this morning.

Although distressed sales will stay elevated for some time, I expect this gap to eventually close.

The ratio could decline because of an increase in new home sales, or a decrease in existing home sales - I expect a combination of both.

MBA: Mortgage Applications Decrease, Rates Fall Slightly

by Calculated Risk on 11/25/2009 12:38:00 PM

I skipped the MBA market index earlier ...

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 4.5 percent on a seasonally adjusted basis from one week earlier. ...Note: This is the lowest contract interest rate since mid-May.

The Refinance Index decreased 9.5 percent from the previous week and the seasonally adjusted Purchase Index increased 9.6 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.82 percent from 4.83 percent, with points increasing to 1.19 from 1.18 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

In the past, the MBA index was predictive of future sales, but it has been questionable for some time. The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007 even though activity was actually declining.

Recently there has been a substantial number of cash buyers, so the MBA index missed the strength of the recent existing home sales increase. Still the recent plunge in the 4 week moving average of the purchase index is probably worth watching.

New Home Sales in October

by Calculated Risk on 11/25/2009 10:00:00 AM

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 430 thousand. This is an increase from the revised rate of 405 thousand in September (revised from 402 thousand). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. In October 2009, 35 thousand new homes were sold (NSA); the record low was 29 thousand in October 1981; the record high for October was 105 thousand in 2005. This is the 6th lowest sales for October since the Census Bureau started tracking sales in 1963.

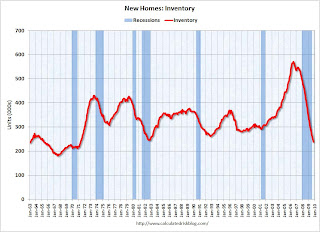

Sales in October 2009 were above October 2008 (32 thousand). This is the first year over same month increase since October 2005. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but are now 31% above the low in January.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but are now 31% above the low in January.

Sales of new one-family houses in October 2009 were at a seasonally adjusted annual rate of 430,000 ... This is 6.2 percent (±17.6%) above the revised September rate of 405,000 and is 5.1 percent (±14.9%) above the October 2008 estimate of 409,000.And another long term graph - this one for New Home Months of Supply.

There were 6.7 months of supply in October - significantly below the all time record of 12.4 months of supply set in January.

There were 6.7 months of supply in October - significantly below the all time record of 12.4 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of October was 239,000. This represents a supply of 6.7 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

Months-of-supply and inventory have both peaked for this cycle, and sales have probably bottomed too. New home sales are far more important for the economy than existing home sales, and new home sales will remain under pressure until the overhang of existing housing inventory declines much further.

I'll have more later ...

October PCE and Saving Rate

by Calculated Risk on 11/25/2009 08:48:00 AM

From the BEA: Personal Income and Outlays, October 2009

Personal income increased $30.1 billion, or 0.2 percent, and disposable personal income (DPI) increased $45.7 billion, or 0.4 percent, in October, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $68.3 billion, or 0.7 percent.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.4 percent in October, in contrast to a decrease of 0.7 percent in September.

...

Personal saving -- DPI less personal outlays -- was $490.3 billion in October, compared with $510.4 billion in September. Personal saving as a percentage of disposable personal income was 4.4 percent in October, compared with 4.6 percent in September.

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the October Personal Income report. The saving rate was 4.4% in October.

I expect the saving rate to continue to rise - possibly to 8% or more - slowing the growth in PCE.

The following graph shows real Personal Consumption Expenditures (PCE) through October (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

Note that PCE in Q3 was distorted by the cash-for-clunkers program (especially August). Just using the October numbers, PCE would increase at about a 2.6% annualized rate in Q4. In general PCE growth will probably be below normal well into 2010 as households continue to repair their balance sheets.

Weekly Initial Unemployment Claims Decline Sharply

by Calculated Risk on 11/25/2009 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Nov. 21, the advance figure for seasonally adjusted initial claims was 466,000, a decrease of 35,000 from the previous week's revised figure of 501,000 [revised from 505,000]. The 4-week moving average was 496,500, a decrease of 16,500 from the previous week's revised average of 513,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending Nov. 14 was 5,423,000, a decrease of 190,000 from the preceding week's revised level of 5,613,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 16,500 to 496,500. This is the lowest level since last November.

This is good news - although the level is still high suggesting continuing job losses in November.

Tuesday, November 24, 2009

ATA Truck Tonnage Index Declines in October

by Calculated Risk on 11/24/2009 09:37:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Dipped 0.2 Percent in October Click on graph for slightly larger image in new window.

Click on graph for slightly larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.2 percent in October, following a 0.3 percent contraction in September. The latest decline lowered the SA index to 103.6 (2000=100) from the revised 103.8 in September. ...The economy fell off a cliff in September

Compared with October 2008, SA tonnage fell 5.2 percent, which was the best year-over-year showing since November 2008. In September, the index was down 7.3 percent from a year earlier.

ATA Chief Economist Bob Costello said that the latest reading reflects an economic recovery that is still trying to gain balance, although it is on more solid ground than a year ago. “Repeating what I said last month, the trucking industry should not be alarmed by the small decreases in September and October,” Costello noted. “The economy is behaving as expected, with starts and stops. This is being reflected in truck tonnage, as well as most economic indicators.” He reiterated that the industry should remain prepared for ups and downs in the months ahead, but the general trend should be modest improvement. “Since consumer spending and manufacturing are not surging, trucking shouldn’t expect robust growth either. However, both retail sales and manufacturing output are exhibiting mild upward trend lines, which is the path I expect truck freight to take.”

...

Trucking serves as a barometer of the U.S. economy, representing nearly 69 percent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods.

Philly Fed State Coincident Indicators

by Calculated Risk on 11/24/2009 06:59:00 PM

So much data, so little time ... just catching up. This was released earlier today: Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. Thirty seven states are showing declining three month activity. The index increased in 12 states, and was unchanged in 1.

Here is the Philadelphia Fed state coincident index release for October.

In the past month, the indexes increased in 15 states (Kansas, Massachusetts, Michigan, Minnesota, Montana, North Carolina, New Hampshire, New Jersey, Ohio, Oregon, Rhode Island, Tennessee, Virginia, Vermont, and West Virginia), decreased in 27, and remained unchanged in eight (Arkansas, Colorado, Florida, Iowa, Indiana, Maine, Missouri, and Nevada) for a one month diffusion index of -24. Over the past three months, the indexes increased in 12 states (Indiana, Massachusetts, Minnesota, Montana, North Carolina, New Hampshire, Ohio, South Dakota, Tennessee, Virginia, Vermont, and West Virginia), decreased in 37, and remained unchanged in one (Idaho) for a three-month diffusion index of -50.

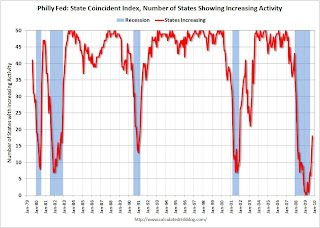

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

Although the number of states in recession has been declining, a majority of states still showed declining activity in October.