by Calculated Risk on 2/01/2010 12:43:00 PM

Monday, February 01, 2010

Q4: Office, Mall and Lodging Investment

Here are graphs of office, mall and lodging investment through Q4 2009 based on the underlying detail data released by the BEA ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

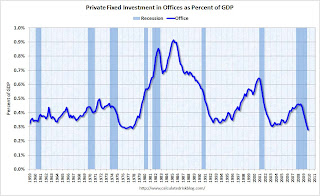

This graph shows investment in offices as a percent of GDP. Office investment as a percent of GDP peaked at 0.46% in Q3 2008 and has declined sharply to a new all time low (as percent of GDP).

Reis reported that the office vacancy rate rose to a 15 year high in Q4 to 17.0%, from 16.5% in Q3 and from 15.9% in Q2. The peak vacancy rate following the 2001 recession was 16.9%. With the office vacancy rate rising, office investment will probably decline through 2010.

Office investment is usually the most overbuilt in a boom, but this time the office market struggled for a few years after the stock market bubble burst and there was comparatively more investment in malls and hotels. The second graph is for investment in malls.

The second graph is for investment in malls.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and has fallen by 50% (note that investment includes remodels, so this will not fall to zero). Mall investment will probably continue to decline through 2010.

Reis reported that the mall vacancy rate in Q4 was the highest on record at 8.8% for regional malls, and 10.6% for strip malls. From Reis economist Ryan Severino:

"Our outlook for retail properties as a whole is bleak ... we do not foresee a recovery in the retail sector until late 2012 at the earliest."

The third graph is for lodging (hotels).

The third graph is for lodging (hotels).The recent boom in lodging investment was stunning. Lodging investment peaked at 0.32% of GDP in Q2 2008 and has declined rapidly to 0.16% in Q4 2009.

I expect lodging investment to continue to decline through at least 2010, to perhaps one-third of the peak or even lower (investment as percent of GDP).

As projects are completed there will be little new investment in these categories probably at least through 2010. This will be a steady drag on GDP (nothing like the decline in residential investment though), and a steady drag on construction employment.

Notice that investment in all three categories typically falls for a year or two after the end of a recession, and then usually recovers very slowly. Something similar will probably happen again, and there will not be a recovery in these categories until the vacancy rates fall significantly.