by Calculated Risk on 3/22/2010 12:55:00 PM

Monday, March 22, 2010

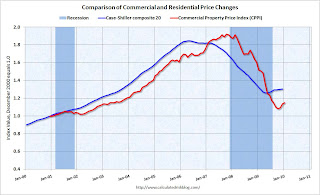

Moody's: CRE Prices increase 1% in January 2010

From Bloomberg: U.S. Property Index Rises for Third Straight Month

The Moody’s/REAL Commercial Property Price Index climbed 1 percent from December, Moody’s said today in a report. Values are 40 percent lower than the peak in October 2007. The index fell 24 percent from a year earlier.Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

...

The number of transactions fell 8 percent to 376 in January from a year earlier and was lower than December, when buyers and sellers tried to complete deals before the year’s end, according to the report.

“A few months of price gains does not necessarily indicate a sustainable trend, particularly in these difficult times,” Moody’s said.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted. Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices.

Click on graph for larger image in new window.

Click on graph for larger image in new window.CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

CRE prices peaked in late 2007 and are now 40% below the peak in October 2007. Prices are at about the same level as early 2003.