by Calculated Risk on 3/05/2010 03:36:00 PM

Friday, March 05, 2010

Update on Post Bubble Real Estate Swindle in San Diego

This is an update on a great series by Kelly Bennett of Voice of San Diego.

First a little background: According to Kelly, in 2008 - after the bubble burst - James McConville bought distressed condos from developers in bulk, and then sold them to straw buyers at inflated prices (individuals with solid credit records who agreed to sign for the loans for a fee). McConville pocketed the difference between the straw buyer price and the bulk price - approximately $12.5 million.

McConville promised to rent the properties, and pay the mortgages from the rental income. Good luck!

This was happening in 2008.

And the update from Kelly Bennett at Voice of San Diego: A Year Later, Losses Pile Up in Complexes Ravaged by Swindle

All of the 81 condos from the Sommerset Villas, Sommerset Woods and Westlake Ranch complexes involved in the scam have been repossessed. Twenty-four have yet to find new buyers. But the other 57 have resold for prices drastically lower than the mortgages were worth, let alone the initial purchase prices.There is much more in the article, but this ties into another article today from Bloomberg: Fannie, Freddie Ask Banks to Eat Soured Mortgages

The U.S. taxpayer is paying for the mounting losses. Across the complexes, the cost to taxpayers is at least $7.8 million.

When the units were just in the beginning stages of foreclosure, it was too soon to tell whether the government-sponsored mortgage companies, Freddie Mac and Fannie Mae, had definitely purchased the shaky loans.

Fannie Mae and Freddie Mac may force lenders including Bank of America Corp., JPMorgan Chase & Co., Wells Fargo & Co. and Citigroup Inc. to buy back $21 billion of home loans this year as part of a crackdown on faulty mortgages.

That’s the estimate of Oppenheimer & Co. analyst Chris Kotowski, who says U.S. banks could suffer losses of $7 billion this year when those loans are returned and get marked down to their true value.

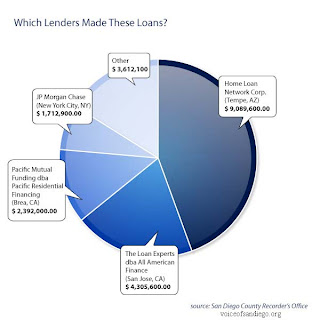

Click on graph for larger image.

Click on graph for larger image.Kelly provided me with this graphic on the San Diego swindle. This shows the lenders that were swindled. Since most of these loans were sold to Fannie and Freddie, there is a good chance the loans will be pushed back on the lenders - if they still exist. We know JPMorgan is still around!

More from Bloomberg:

The banks have to buy back the loans at par, and then take an impairment, because borrowers usually have stopped paying and the price of the underlying home has plunged. JPMorgan said in a presentation last month that it loses about 50 cents on the dollar for every loan it has to buy back.The losses will be much higher than 50 cents on the dollar on these loans.