by Calculated Risk on 6/29/2010 04:00:00 PM

Tuesday, June 29, 2010

2nd Half: Slowdown or Double-Dip?

No one has a crystal ball, but it appears the U.S. economy will slow in the 2nd half of 2010.

For the unemployed and marginally employed, and for many other Americans suffering with too much debt or stagnant real incomes, there is little difference between slower growth and a double-dip recession. What matters to them is jobs and income growth.

In both cases (slowdown or double-dip), the unemployment rate will probably increase and wages will be under pressure. It is just a matter of degrees.

The arguments for a slowdown and double-dip recession are basically the same: less stimulus spending, state and local government cutbacks, more household saving impacting consumption, another downturn in housing, and a slowdown and financial issues in Europe and a slowdown in China. It is only a question of magnitude of the impact.

My general view has been that the recovery would be sluggish and choppy and I think this slowdown is part of the expected "choppiness". I still think the U.S. will avoid a technical "double-dip" recession.

Usually the deeper the recession, the more robust the recovery. That didn't happen this time (no "V-shaped" recovery), and it is probably worth reviewing why this period is different than an ordinary recession-recovery cycle.

An examination of the aftermath of severe financial crises shows deep and lasting effects on asset prices, output and employment. ... Even recessions sparked by financial crises do eventually end, albeit almost invariably accompanied by massive increases in government debt.

Click on graph for larger image in new window.

Click on graph for larger image in new window. The graph from Rudebusch's shows a modified Taylor rule. According to Rudebusch's estimate, the Fed Funds rate should be around minus 5% right now if we ignore unconventional policy (obviously there is a lower bound) and probably close to minus 3% if we include unconventional policy. Obviously the Fed can't lower rates using conventional policy, although it is possible for more unconventional policy.

On this third point, I put together a table of housing supply metrics last weekend to help track the housing market. It is hard to have a robust economic recovery without a recovery in residential investment - and there will be no strong recovery in residential investment until the excess housing supply is reduced substantially.

During previous recoveries, housing played a critical role in job creation and consumer spending. But not this time. Residential investment is mostly moving sideways.

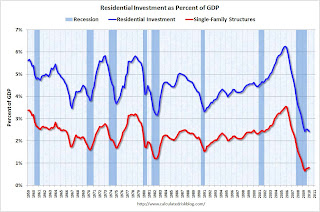

This graph shows residential investment (RI) and investment in single family structures as a percent of GDP. RI is mostly investment in single family structures, home improvement, multi-family structures and commissions on sale of existing structures.

This graph shows residential investment (RI) and investment in single family structures as a percent of GDP. RI is mostly investment in single family structures, home improvement, multi-family structures and commissions on sale of existing structures.It isn't the size of the sector (currently only about 2.5% of GDP), but the contribution during the recovery that matters - and housing is usually the largest contributor to economic growth and employment early in a recovery.

Two somewhat positive points: 1) builders will deliver a record low number of housing units in 2010, and that will help reduce the excess supply (see: Housing Stock and Flow), and 2) usually a recession (or double-dip) is preceded by a sharp decline in Residential Investment (housing is the best leading indicator for the business cycle), and it hard for RI to fall much further!

So I'm sticking with a slowdown in growth.

Click on graph for interactive version in new window.

The graph has tabs to look at the different bear markets - "now" shows the current market - and there is also a tab for the "four bears".