by Calculated Risk on 6/22/2010 08:36:00 AM

Tuesday, June 22, 2010

Moody's: Commercial Real Estate Prices increase 1.7% in April

Moody's reported today that the Moody’s/REAL All Property Type Aggregate Index increased 1.7% in April, after declining for the previous two months. This is a repeat sales measure of commercial real estate prices.

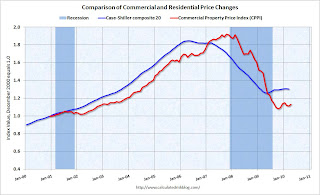

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted. Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices. Click on graph for larger image in new window.

Click on graph for larger image in new window.

CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

It is possible that commercial real prices have bottomed - in general - but it is hard to tell because the number of transactions are very low and there are a number of distressed sales. Prices have been choppy and mostly moving sideways.

Commercial real estate values are now down 16% over the last year, and down 41% from the peak in late 2007.