by Calculated Risk on 7/16/2010 02:01:00 PM

Friday, July 16, 2010

Mortgage Repurchase: The growing writedown

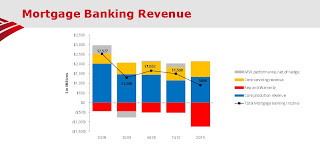

Another graph from the BofA Second Quarter 2010 Earnings Presentation (ht Brian)

This graph shows the components of BofA mortgage banking revenue. The increasing red contribution is from "Rep and warranty" - these are the loans being pushed back on BofA.

Notice the pipeline of repurchase requests continues to grow, the high rescission rate of 40-50%, and the loss severity of 50-55% (the loss to First Horizon on mortgages they have to repurchase).

Note: the FHFA issued subpoenas last week "seeking documents related to private-label mortgage-backed securities" in which Fannie Mae and Freddie Mac invested. That could lead to more repurchase requests for the Wall Street banks.