by Calculated Risk on 7/05/2010 01:21:00 PM

Monday, July 05, 2010

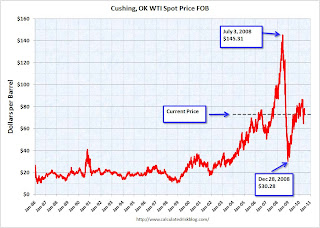

Update on Oil Prices

With the weakness in the US and European economies, and an apparent slowdown in China, it might be time to look at oil prices ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

These are spot prices for Cushing WTI from the EIA (source).

Back in the Spring of 2008, we started seeing many signs of potential demand destruction - including fewer U.S miles driven, Asian countries reducing gasoline subsidies, and China stock piling oil for the Olympics. That was a pretty clear sign that oil prices would fall after China stopped stock piling oil.

So far miles driven have been increasing slowly (although the most recent data is for April, and there may be more weakness in June). And once again the Shanghai stock market is suggesting a slowdown in China. Not a clear sign like in 2008, but something to watch.