by Calculated Risk on 10/30/2010 04:45:00 PM

Saturday, October 30, 2010

Residential Investment declines to new low as Percent of GDP

A couple more graphs ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.

I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

It is interesting to note that RI as a percent of GDP has declined to a post war low of 2.22%. Some people have asked how could a sector that only accounts for 2.2% of GDP be so important? The answer is that usually RI accounts for a large percentage of the employment and GDP growth in the first year or so of a recovery. Not this time.

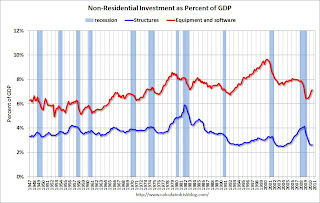

The second graph shows non-residential investment in structures and equipment and software.

The second graph shows non-residential investment in structures and equipment and software.

Equipment and software investment has been booming, and non-residential investment in structures is near a record low.