by Calculated Risk on 11/19/2010 12:04:00 PM

Friday, November 19, 2010

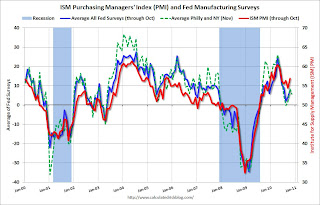

Fed Manufacturing Surveys and ISM Manufacturing Index

Earlier this week, the NY Fed and the Philly Fed manufacturing surveys were released. The readings couldn't have been more different, with the NY Fed survey showing "conditions deteriorated", and the Philly Fed showing activity improved sharply:

The Empire State Manufacturing Survey indicates that conditions deteriorated in November for New York State manufacturers. For the first time since mid-2009, the general business conditions index fell below zero, declining 27 points to -11.1. The new orders index plummeted 37 points to -24.4, and the shipments index also fell below zero.And the Philly Fed:

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of 1.0 in October to 22.5 in November. This is the highest reading in the index since last December. Indexes for new orders and shipments also improved this month, and each index increased 15 points.Usually these two surveys are fairly consistent, and this is reminder not to make too much of any one data point! Is manufacturing slowing or is activity picking up again? These two surveys provide opposite answers.

The other regional Fed surveys and the ISM manufacturing index will be released over the next two weeks, and hopefully they will provide some clarity.

The following graph compares the regional Fed surveys with the ISM manufacturing index, including the NY Fed and Philly Fed surveys for November. Averaging the NY Fed and Philly Fed survey suggests manufacturing is still expanding, but at a sluggish pace:

Click on graph for larger image in new window.

Click on graph for larger image in new window.The New York and Philly Fed surveys are averaged together (dashed green, through November), and averaged five Fed surveys (blue, through October) including New York, Philly, Richmond, Dallas and Kansas City.

The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

The ISM manufacturing index will released on Dec 1st. The Richmond Fed survey will be released on Tuesday Nov 23rd, the Kansas City Fed survey on Wednesday Nov 24th, and the Dallas Fed survey on Monday Nov 29th.

A slowdown in manufacturing has been one of the reasons I thought GDP growth would slow in the 2nd half of 2010 and into 2011 (this is part of the general sluggish and choppy recovery). My view was based on the end of the inventory adjustment, a slowdown in export growth, and sluggish growth for consumer spending. So the Philly Fed reading was surprising to me.