by Calculated Risk on 11/02/2010 12:35:00 PM

Tuesday, November 02, 2010

LPS: Over 4.3 million loans 90+ days or in foreclosure

LPS Applied Analytics released their September Mortgage Performance data today. According to LPS:

• The average number of days delinquent for loans in foreclosure is now 484 days

• In five judicial states (NY, FL, NJ, HI and ME), the average exceeds 500 days

• Over 4.3 million loans are 90 days or more delinquent or in foreclosure

• New problem loans (60+ days delinquent) are back on the rise

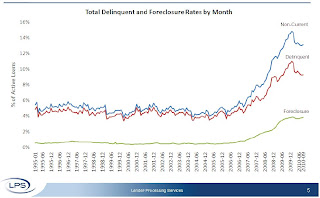

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages.

According to LPS, 9.27 percent of mortgages are delinquent, and another 3.84 are in the foreclosure process for a total of 13.11 percent. It breaks down as:

• 2.64 million loans less than 90 days delinquent.

• 2.32 million loans 90+ days delinquent.

• 2.05 million loans in foreclosure process.

For a total of 7.02 million loans delinquent or in foreclosure.

This is similar to the quarterly data from the Mortgage Bankers Association.