by Calculated Risk on 11/08/2010 11:14:00 AM

Monday, November 08, 2010

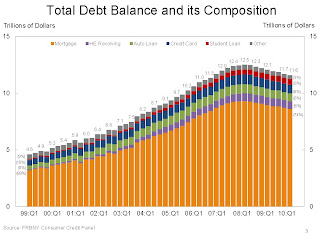

NY Fed: Continued Decline in Consumer Debt

This is a new quarterly report from the NY Fed ... an interesting finding is that consumers are actively reducing their debt - the decline in debt isn't just because of defaults.

From the NY Fed: Q3 Report on Household Debt and Credit Shows Continued Decline in Consumer Debt

The Federal Reserve Bank of New York today released its Quarterly Report on Household Debt and Credit for the third quarter of 2010, which shows that consumer debt continues its downward trend of the previous seven quarters, though the pace of decline has slowed recently. Since its peak in the third quarter of 2008, nearly $1 trillion has been shaved from outstanding consumer debts.Here is the Q3 report: Quarterly Report on Household Debt and Credit

Additionally, this quarter’s supplemental report addresses for the first time the question of how this decline has been achieved and notes a sharp reversal in household cash flow from debt, indicating a decrease in available funds for consumption. According to newly available data through year end 2009, the payoff of debt by consumers reduced their cash flow by about $150 billion, whereas between 2000 and 2007, borrowing had contributed more than $300 billion annually to consumers’ cash flow.

Excluding the effects of defaults and charge-offs, available data show that non-mortgage debt fell for the first time since at least 2000. Also, net mortgage debt paydowns, which began in 2008, reached nearly $140 billion by year end 2009. These unique findings suggest that consumers have been actively reducing their debts, and not just by defaulting.

“Consumer debt is declining but only part of the reduction is attributable to defaults and charge-offs,” said Donghoon Lee, senior economist in the Research and Statistics Group at the New York Fed. “Americans are borrowing less and paying off more debt than in the recent past. This change, which we continue to study carefully, can be a result of both tightening credit standards and voluntary changes in saving behavior.”

And a supplemental report: Have Consumers Become More Frugal?

So are consumers becoming more frugal? Yes. Holding aside defaults, they are indeed reducing their debts at a pace not seen over the last ten years. A remaining issue is whether this frugality is a result of borrowers being forced to pay down debt as credit standards tightened, or a more voluntary change in saving behavior.And some data and graphs.

Click on graph for larger image in new window.

Click on graph for larger image in new window.From the NY Fed:

Aggregate consumer debt continued to decline in the second quarter, continuing its trend of the previous six quarters. As of June 30, 2010, total consumer indebtedness was $11.7 trillion, a reduction of $812 billion (6.5%) from its peak level at the close of 2008Q3, and $178 billion (1.5%) below its March 31, 2010 level. Household mortgage indebtedness has declined 6.4%, and home equity lines of credit (HELOCs) have fallen 4.4% since their respective peaks in 2008Q3 and 2009Q1. Excluding mortgage and HELOC balances, consumer indebtedness fell 1.5% in the quarter and, after having fallen for six consecutive quarters, stands at $2.31 trillion, 8.4% below its 2008Q4 peak.There are a number of credit graphs at the NY Fed site.