by Calculated Risk on 11/23/2010 10:00:00 AM

Tuesday, November 23, 2010

October Existing Home Sales: 4.43 million SAAR, 10.5 months of supply

The NAR reports: Existing-Home Sales Decline in October Following Two Monthly Gains

Existing-home sales1, which are completed transactions that include single-family, townhomes, condominiums and co-ops, declined 2.2 percent to a seasonally adjusted annual rate of 4.43 million in October from 4.53 million in September, and are 25.9 percent below the 5.98 million-unit level in October 2009 when sales were surging prior to the initial deadline for the first-time buyer tax credit.

...

Total housing inventory at the end of October fell 3.4 percent to 3.86 million existing homes available for sale, which represents a 10.5-month supply4 at the current sales pace, down from a 10.6-month supply in September.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October 2010 (4.43 million SAAR) were 2.2% lower than last month, and were 25.9% lower than October 2009.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 3.86 million in October from 4.00 million in September. The all time record high was 4.58 million homes for sale in July 2008.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall. I'll have more on inventory later ...

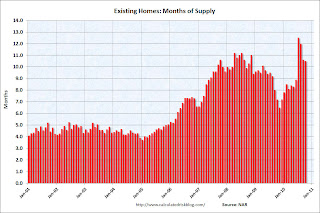

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply decreased to 10.5 months in October from 10.6 months in September. This is extremely high and suggests prices, as measured by the repeat sales indexes like Case-Shiller and CoreLogic, will continue to decline.

These weak numbers are exactly what I expected. The ongoing high level of supply - and double digit months-of-supply are the key stories. I'll have more ...