by Calculated Risk on 12/29/2010 11:36:00 AM

Wednesday, December 29, 2010

A few Graphs for 2010

Click on graphs for a larger image in graph gallery.

Click on graphs for a larger image in graph gallery.

The first graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses.

As of November there were 7.4 million fewer payroll jobs in the U.S. compared to the peak of employment in 2007. If the U.S. economy adds 200,000 jobs per month, it will take 3 years to get back to the previous peak (2 years at 300,000 per month). And that doesn't include jobs needed to offset population growth (about 125,000 jobs per month).

The second graph shows the employment population ratio, the participation rate, and the unemployment rate.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate.

Two of the key stories in 2010 were the unemployment rate (red line) stayed near 10% (at 9.8% in November), and the Labor Force Participation Rate declined to 64.5% in November (blue line). This is the percentage of the working age population in the labor force - and the decline suggests that a large number of people have just given up looking for work.

And now to housing ...

This graph shows existing home sales (left axis) and new home sales (right axis) through November.

This graph shows existing home sales (left axis) and new home sales (right axis) through November.

A key story in 2010 was the collapse in home sales following the expiration of the homebuyer tax credit (Note: the tax credit is widely viewed as a failure).

Existing home sales are back to the levels of 1997 / 1998 and new home sales fell to record lows in the 2nd half of 2010.

As existing home sales declined, existing home inventory and months-of-supply increased.

As existing home sales declined, existing home inventory and months-of-supply increased.

This graph shows the year-over-year change in inventory and the months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Inventory increased 5.4% YoY in November and the months-of-supply (9.5 months in November) is well above normal.

And the high level of inventory has pushed down house prices. This graph shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

And the high level of inventory has pushed down house prices. This graph shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

With the increase in inventory (and months-of-supply), it was no surprise that house prices started declining again in the 2nd half of 2010.

The good news is housing starts stayed near record low levels. This is helping to reduce the excess inventory of housing units.

The good news is housing starts stayed near record low levels. This is helping to reduce the excess inventory of housing units.

This graph shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for two years - with a slight up and down over the last six months due to the home buyer tax credit.

Another piece of "good news" is it appears that mortgage delinquencies might have peaked.

This graph based on quarterly data from the MBA shows the percent of loans delinquent by days past due.

This graph based on quarterly data from the MBA shows the percent of loans delinquent by days past due.

Although delinquencies might have peaked, the level is still very high and there are many more foreclosures in the pipeline.

Note: With declining house prices, the number of homeowners with negative equity will increase - and the delinquency rate might start increasing again.

Some "bad news" for housing is that REO (Real Estate Owned) inventories at Fannie, Freddie and the FHA are at record levels.

This graph shows the REO inventory for Fannie, Freddie and FHA through Q3 2010.

This graph shows the REO inventory for Fannie, Freddie and FHA through Q3 2010.

The REO inventory for the "Fs" has increased sharply over the last year, from 153,007 at the end of Q3 2009 to a record 293,171 at the end of Q3 2010.

Remember this is just a portion of the total REO inventory. Private label securities and banks and thrifts also hold a substantial number of REOs, and the overall REO inventory is below the peak in 2008.

On manufacturing, there was a pickup in capacity utilization and industrial production, but there is still a large amount of excess capacity.

On manufacturing, there was a pickup in capacity utilization and industrial production, but there is still a large amount of excess capacity.

This graph shows Capacity Utilization. This series is up 10.3% from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.2% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

Another key story in 2010 is that the consumer has started spending again.

Another key story in 2010 is that the consumer has started spending again.

This graph shows real Personal Consumption Expenditures (PCE) through November (2005 dollars).

The two-month method of estimating real PCE growth for Q4 (a fairly accurate method), suggests real PCE growth of 4.3% in Q4! So this looks like a pretty strong quarter for growth in personal consumption. The last time real PCE grew at more than 4% was in 2006.

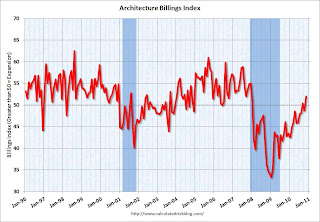

And the final graph is a little bit of good news for commercial real estate.

And the final graph is a little bit of good news for commercial real estate.

In 2010, investment in non-residential structures was a drag on GDP growth. However, this graph of the Architecture Billings Index shows expansion in billings for the first time in almost 3 years. (above 50 is expansion).

This index usually leads investment in non-residential structures by about 6 to 9 months.

Best to all