by Calculated Risk on 12/25/2010 02:45:00 PM

Saturday, December 25, 2010

Schedule for Week of December 26th

This will be a light week for economic news. The Case-Shiller house price index will be released on Tuesday, and several regional manufacturing surveys will be released during the week.

10:30 AM: Dallas Fed Manufacturing Survey for December. The Texas survey showed expansion last month (at 13.1), and is expected to show expansion again in December.

The regional Fed surveys provide a hint about the ISM manufacturing index, as the following graph shows. Both the Philly Fed, and Empire State indexes showed improvement in December.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through December), and averaged five Fed surveys (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

The ISM manufacturing index will released on Monday, Jan 3, 2011.

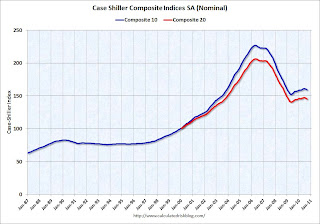

9:00 AM: S&P/Case-Shiller Home Price Index for October. Although this is the October report, it is really a 3 month average of August, September and October. The consensus is for prices to decline about 0.4% in October; the fourth straight month of house price declines.

This graph shows the seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000) through September.

This graph shows the seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000) through September.Prices are falling again, although still above the lows set in early 2009.

Prices in October might show a year-over-year decline for the composite indexes for the first time since 2009.

10:00 AM: Conference Board's consumer confidence index for December. The consensus is for an increase to 57.4 from 54.1 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for December. The consensus is for a reading of 11 (expansion), a slight increase from 9 last month.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index declined sharply following the expiration of the tax credit, and the index has only recovered slightly since then.

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims has been trending down over the last couple of months. The consensus is for the same as last week at 420,000.

9:45 AM: Chicago Purchasing Managers Index for December. The consensus is for the same as in November at 62.5.

10:00 AM: Pending Home Sales Index for November. The consensus is for a 1% increase in contracts signed. It usually takes 45 to 60 days to close, so this will provide an early indication of closings in January.

11:00 AM: Kansas City Fed regional Manufacturing Survey for December. The index was at 14 in November.

Markets will be open on New Year's Eve.

12:00 AM: Happy New Year!