by Calculated Risk on 2/20/2011 09:27:00 AM

Sunday, February 20, 2011

Summary for Week ending February 19th

Here is the economic schedule for the coming week.

Retail sales were weaker than expected in January, and the reports for November and December were revised down. This suggests consumption in Q4 will be revised down slightly, and that the first quarter started a little slower than expected.

Industrial production and capacity utilization decreased slightly in January; however the manufacturing surveys from the New York and Philly Fed both showed improvement in February, suggesting any slowdown in January was probably due to the weather.

Housing is still flat on the floor. Housing starts increased in January because of an increase in multi-family starts (as expected). Single-family starts decreased 1.0% to 413 thousand in January - the lowest level since early 2009.

Both the producer price index (PPI 0.8%, core PPI 0.5%) and consumer price index (CPI 0.4%, core CPI 0.2%) increased in January. Core measures are still low, but have also been increasing.

Below is a summary of the previous week, mostly in graphs.

• Retail Sales increased 0.3% in January

On a monthly basis, retail sales increased 0.3% from December to January(seasonally adjusted, after revisions), and sales were up 7.8% from January 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 13.7% from the bottom, and now 0.4% above the pre-recession peak.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 7.1% on a YoY basis (7.8% for all retail sales). This was below expectations for a 0.5% increase. Retail sales ex-autos were up 0.3%; also below expectations of a 0.5% increase. Although lower than expected, retail sales are now above the pre-recession peak in November 2007.

• Housing Starts increased in January

Total housing starts were at 596 thousand (SAAR) in January, up 14.6% from the revised December rate of 520 thousand, and up 25% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Total housing starts were at 596 thousand (SAAR) in January, up 14.6% from the revised December rate of 520 thousand, and up 25% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

The increase in starts in January was entirely because of multi-family starts. Single-family starts decreased 1.0% to 413 thousand in January - the lowest level since early 2009.

This was above expectations of 540 thousand starts, but still very low. The low level of starts is good news for housing, and I expect starts to stay low until more of the excess inventory of existing homes is absorbed. Multi-family starts will rebound in 2011, but completions will probably be at or near record lows since it takes over a year to complete most multi-family projects.

• Industrial Production, Capacity Utilization decrease slightly in January

This graph shows Capacity Utilization. This series is up 7.9 percentage points from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 7.9 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.1% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.

Industrial production decreased in January due to a decline in utilities. Production is still 5.6% below the pre-recession levels at the end of 2007.

The decline was a combination of an upward revision to December and less demand for heating in January.

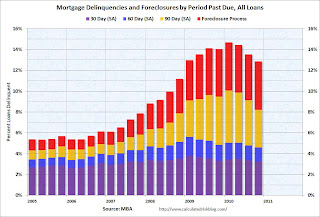

• MBA: Loans in Foreclosure Tie All-Time Record, fewer Short-term Delinquencies

The MBA reports that 12.85 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q4 2010 (seasonally adjusted). This is down from 13.52 percent in Q3 2010.

The following graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent decreased to 3.25% from 3.36% in Q3. This is below the average levels of the last 2 years, but still high.

Loans 30 days delinquent decreased to 3.25% from 3.36% in Q3. This is below the average levels of the last 2 years, but still high.

Delinquent loans in the 60 day bucket decreased to 1.34% from 1.44% in Q3; this is the lowest since Q2 2008.

The biggest decline was in the 90+ day delinquent bucket. This declined from 4.34% in Q3 3.63% in Q4. This is mostly due to modifications or putting the loans in the foreclosure process.

The percent of loans in the foreclosure process increased to 4.63% (tying the record set in Q1 2010). This is due to the foreclosure pause.

From the MBA: Short-term Delinquencies Fall to Pre-Recession Levels, Loans in Foreclosure Tie All-Time Record

• Core Measures show increase in Inflation

This graph shows these three measure of inflation on a year-over-year basis. Over the last 12 months, core CPI has increased 0.95%, median CPI has increased 0.83%, and trimmed-mean CPI increased 0.97% - all less than 1%.

This graph shows these three measure of inflation on a year-over-year basis. Over the last 12 months, core CPI has increased 0.95%, median CPI has increased 0.83%, and trimmed-mean CPI increased 0.97% - all less than 1%.

However, all three increased in January at a higher annualized rate: core CPI increased at an annualized rate of 2.1%, median CPI 2.0% annualized, and trimmed-mean CPI increased 2.7% annualized. This is just one month, but the annualized rate for these key measures is at or above the Fed's inflation target. With the slack in the system, I have been expecting these core measures to stay below 2% this year.

• NAHB Builder Confidence unchanged in February

The National Association of Home Builders (NAHB) reports the housing market index (HMI) was unchanged at 16 in February. This was slightly below expectations of an increase to 17. Confidence remains very low ... any number under 50 indicates that more builders view sales conditions as poor than good.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the February release for the HMI and the December data for starts (January housing starts will be released tomorrow).

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the February release for the HMI and the December data for starts (January housing starts will be released tomorrow).

Both confidence and housing starts have been moving sideways at a very depressed level for over two years.

• Other Economic Stories ...

• CoreLogic: NAR’s 2010 existing home sales are overstated by 15% to 20%

• From the NY Fed: The Empire State Manufacturing Survey indicates that conditions for New York manufacturers continued to improve in February

• From David Leonhardt at the NY Times Economix: Seattle’s Foreseeable Housing Bust

• From David Streitfeld article: Housing Crash Is Hitting Cities Thought to Be Stable

• From Nick Timiraos, Victoria McGrane and Ruth Simon at the WSJ: Big Banks Face Fines on Role of Servicers

• From the NY Fed: Quarterly Report on Household Debt and Credit

• An economic letter from Justin Weidner and John Williams at the SF Fed: What Is the New Normal Unemployment Rate?

• From the Philly Fed: Philly Fed Survey highest since January 2004

• Unofficial Problem Bank list increases to 951 Institutions

Best wishes to all!