by Calculated Risk on 3/19/2011 11:41:00 AM

Saturday, March 19, 2011

Summary for Week ending March 18th

World events are obscuring somewhat better U.S. economic data, excluding, of course, new home construction. And even for residential investment, there has been a clear pickup in home improvement and multi-family construction. The first two graphs below show this divergence: the Philly Fed and Empire State manufacturing surveys indicated faster growth, yet housing starts were near a record low. This is no surprise – housing starts will stay low until more of the excess inventory of existing homes is absorbed.

There was also some good labor news last week – initial weekly unemployment claims continued to decline, and the regional manufacturing surveys showed increased hiring. But overall hiring is still very low. And unfortunately the overall employment situation remains grim with the unemployment rate at 8.9%, and with 13.7 million Americans currently unemployed. There are 7.5 million fewer payroll jobs now than before the recession started in 2007 and another 8.3 million people are working part time for economic reasons. About 4 million more workers have left the labor force. And of those unemployed, 6 million have been unemployed for six months or more.

So the U.S. economy might be improving, but the economy is leaving millions behind.

Of course all this data was obscured by world events. Most of the focus was on the Japanese nuclear issues, but North Africa (Libya), and the Middle-East (Yemen and Bahrain) were also front page news.

The European financial crisis eased a little last week, and the next meeting of all 27 EU leaders will be in Brussels on March 24th and 25th (this coming Thursday and Friday).

On a personal note, my thoughts are with all the people suffering through these difficult times.

Below is a summary of economic data last week mostly in graphs:

• Philly Fed and Empire State Manufacturing Surveys show strong growth

From the Philly Fed: Highest reading since January 1984 and from the NY Fed Empire State Manufacturing Survey indicates faster growth in March

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph compares the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through March. The ISM and total Fed surveys are through February.

This early reading suggests the ISM index will be in the 60s again this month. These were two strong reports, although price increases remain a concern.

• Housing Starts decreased sharply in February

Total housing starts were at 479 thousand (SAAR) in February, down 22.5% from the revised January rate of 618 thousand, and barely up from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Total housing starts were at 479 thousand (SAAR) in February, down 22.5% from the revised January rate of 618 thousand, and barely up from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts decreased 11.8% to 375 thousand in February - the lowest level since early 2009. This was well below expectations of 560 thousand starts, and near the record low.

This low level of starts is good news for housing, and I expect starts to stay low until more of the excess inventory of existing homes is absorbed. Note: This is the lowest level for Building permits since the Census Bureau started tracking permits.

• NAHB Builder Confidence increased slightly in March, Still depressed

The National Association of Home Builders (NAHB) reports the housing market index (HMI) increased slightly to 17 in March. This was at expectations of an increase to 17. Any number under 50 indicates that more builders view sales conditions as poor than good.

The National Association of Home Builders (NAHB) reports the housing market index (HMI) increased slightly to 17 in March. This was at expectations of an increase to 17. Any number under 50 indicates that more builders view sales conditions as poor than good.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the March release for the HMI and the January data for starts.

Press release from the NAHB: Builder Confidence Edges Up One Point in March . Builders are still depressed, and the HMI has been below 25 for forty-five consecutive months - almost 4 years.

• Residential Remodeling Index shows strong increase year-over-year

The BuildFax Residential Remodeling Index was at 99.0 in January. This is based on the number of properties pulling residential construction permits in a given month.

The BuildFax Residential Remodeling Index was at 99.0 in January. This is based on the number of properties pulling residential construction permits in a given month.

This graph shows the year-over-year change from the same month of the previous year. The remodeling index is up 22% from January 2010.

Although new home construction is still moving sideways, it appears that two other components of residential investment are increasing in 2011: multi-family construction and home improvement (based on this index).

• Industrial Production, Capacity Utilization decline in February

Capacity utilization at 76.3% is still below normal - and well below the pre-recession levels of 81.2% in November 2007.

Capacity utilization at 76.3% is still below normal - and well below the pre-recession levels of 81.2% in November 2007.

This graph shows Capacity Utilization. This series is up 8.1 percentage points from the record low set in June 2009 (the series starts in 1967).

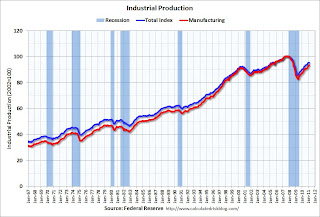

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.

Industrial production decreased in February to 95.5, however January was revised up from 95.1 to 95.6. The decline was due to warmer weather in February (less production at utilities) and the upward revision to the January data. Production is still 5.2% below the pre-recession levels at the end of 2007.

The consensus was for a 0.6% increase in Industrial Production in February, and an increase to 76.5% (from 76.1%) for Capacity Utilization. Even including the January revisions, this was still below consensus.

• Core Measures show increase in Inflation

Over the last 12 months, core CPI has increased 1.1%, median CPI has increased 1.0%, and trimmed-mean CPI increased 2.1%. This graph shows these three measure of inflation on a year-over-year basis.

Over the last 12 months, core CPI has increased 1.1%, median CPI has increased 1.0%, and trimmed-mean CPI increased 2.1%. This graph shows these three measure of inflation on a year-over-year basis.

These measures all show that year-over-year inflation is still low, but increasing lately.

Also, all three increased in February at a higher annualized rate: core CPI increased at an annualized rate of 2.4%, median CPI 2.4% annualized, and trimmed-mean CPI increased 3.8% annualized. This is the second consecutive month with the annualized rate for these three key measures at or above the Fed's inflation target. With the slack in the system, I have been expecting these core measures to stay below 2% this year.

• Weekly Initial Unemployment Claims decline to 385,000

This graph shows the 4-week moving average of weekly claims for the last 40 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 7,000 to 386,250.

This graph shows the 4-week moving average of weekly claims for the last 40 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 7,000 to 386,250.

This is the 3rd consecutive week with the 4-week average below the 400,000 level, and although there is nothing magical about 400,000, this is a positive step for the labor market. Unfortunately the recent JOLTS data indicated that hiring hasn't picked up significantly yet, even as layoffs and discharges have slowed.

• Other Economic Stories ...

• From John Stark at The Bellingham Herald: FDIC sues WaMu execs, seeks to freeze their assets

• From the Federal Reserve: Federal Reserve completes Analysis of 19 Largest Banks, Allows some Dividends

• From Landon Thomas at the NY Times: E.U.'s Latest Rescue Package Seen Falling Short-Again

• FOMC Statement: No Change, "Economic recovery is on a firmer footing"

• February LA Port Traffic: Exports weak year-over-year

• Unofficial Problem Bank list increases to 982 Institutions

Best wishes to all!