by Calculated Risk on 4/21/2011 10:00:00 AM

Thursday, April 21, 2011

Philly Fed Survey shows slower expansion in April

From the Philly Fed: April 2011 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from 43.4 in March to 18.5 this month. [any reading above zero is expanion]. The demand for manufactured goods, as measured by the current new orders index, showed a similar slowing: The index fell 22 points, following seven consecutive months of increase. The shipments index declined 6 points and remained at a relatively high level. Firms continued to report that unfilled orders and delivery times were still rising.This indicates continued expansion in April, but at a slower pace. This was well below the consensus of 36.8. The concern remains the pickup in both prices paid and received:

Firms’ responses continue to indicate overall improvement in labor markets. The current employment index fell 6 points but has remained positive for eight consecutive months. The percentage of firms reporting an increase in employment (20 percent) is higher than the percentage reporting a decline (8 percent). Over twice as many firms reported a longer workweek (32 percent) than reported a shorter one (14 percent) and the workweek index increased 5 points.

Firms continue to report price increases for inputs as well as their own manufactured goods. The prices paid index declined 7 points this month but remains about 45 points higher than readings just seven months ago. Fifty-nine percent of the firms reported higher prices for inputs this month, compared to 64 percent last month. On balance, firms also reported an increase in prices for their own manufactured goods

Click on graph for larger image in graph gallery.

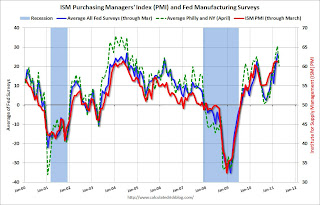

Click on graph for larger image in graph gallery.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through April. The ISM and total Fed surveys are through March.

This early reading suggests the ISM index will be in the low 60s again in April. This showed slower expansion, but still decent growth in April.