by Calculated Risk on 5/08/2011 08:14:00 AM

Sunday, May 08, 2011

Schedule for Week of May 8th

The key reports this week are April Retail Sales on Thursday, the Consumer Price Index (CPI) on Friday and the monthly Trade Balance report on Wednesday.

10:00 AM ET: New York Fed Q1 Quarterly Household Debt and Credit Report

7:30 AM: NFIB Small Business Optimism Index for April.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the small business optimism index since 1986. The index decreased to 91.9 in March from 94.5 in February.

This has been mostly trending up, although the level is still very low.

8:30 AM: Import and Export Prices for April. The consensus is a for a 1.8% increase in import prices.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for March.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales through mid-year (not counting all cash purchases).

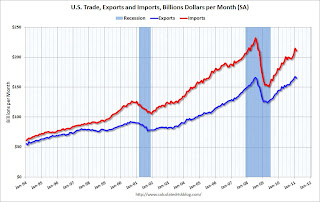

8:30 AM: Trade Balance report for March from the Census Bureau.

This graph shows the monthly U.S. exports and imports in dollars through February 2011.

This graph shows the monthly U.S. exports and imports in dollars through February 2011.Exports are up sharply and are now above the pre-recession peak. The consensus is for the U.S. trade deficit to be around $47.0 billion, up from $45.8 billion in February.

9:00 AM ET: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for April (a measure of transportation).

10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS. This report has been showing a general increase in job openings, but very little turnover in the labor market.

8:30 AM: The initial weekly unemployment claims report will be released. The number of claims increased sharply last week partially due to some one time factors. The consensus is for a decrease to 428,000 from 474,000 last week, however the storms in the south might impact the report this week.

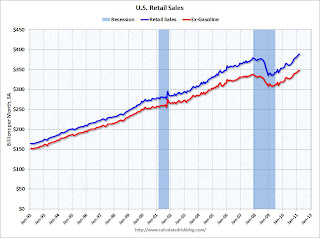

8:30 AM: Retail Sales for April.

This graph shows retail sales since 1992. This is monthly retail sales including food service, seasonally adjusted (total and ex-gasoline).

This graph shows retail sales since 1992. This is monthly retail sales including food service, seasonally adjusted (total and ex-gasoline).Retail sales are up 16.0% from the bottom, and now 2.5% above the pre-recession peak.

The consensus is for retail sales to increase 0.6% in April (0.6% increase ex-auto).

8:30 AM: Producer Price Index for April. The consensus is for a 0.6% increase in producer prices (0.2% core).

10:00 AM: Manufacturing and Trade: Inventories and Sales for March. The consensus is for a 0.9% increase in inventories.

10:00 AM: Testimony of Fed Chairman Ben Bernanke before the U.S. Senate Committee on Banking, Housing, and Urban Affairs, "Dodd-Frank Implementation: Monitoring Systemic Risk and Promoting Financial Stability"

8:30 AM: Consumer Price Index for April. The consensus is for a 0.4% increase in prices. The consensus for core CPI is an increase of 0.2%.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for May. The consensus is for a slight increase to 70.0 from 69.8 in April.

Best wishes to All!