by Calculated Risk on 6/01/2011 10:29:00 PM

Wednesday, June 01, 2011

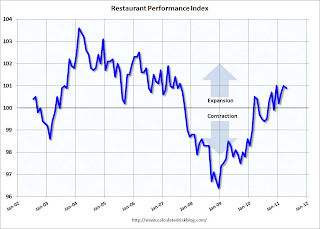

Restaurant Performance Index indicates expansion in April

Earlier today the economic data was weak:

• ADP: Private Employment increased by 38,000 in May

• ISM Manufacturing index declines to 53.5 in May

• U.S. Light Vehicle Sales 11.8 million SAAR in May

The restaurant index is one of several industry specific indexes I track each month. The following report is for April.

From the National Restaurant Association: Restaurant Industry Outlook Remains Positive as Restaurant Performance Index Stood Above 100 for Fifth Consecutive Month

The National Restaurant Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.9 in April, essentially unchanged from a level of 101.0 in March. In addition, April represented the fifth consecutive month in which the RPI stood above 100, which signifies expansion in the index of key industry indicators.

...

Restaurant operators continued to report net positive same-store sales results in April. ... Restaurant operators also reported a net increase in customer traffic in April, although levels were somewhat softer than the March results.

...

Capital spending activity among restaurant operators trended upward in recent months. Forty-eight percent of operators said they made a capital expenditure for equipment, expansion or remodeling during the last three months, the highest level in nearly three years.

...

For the seventh consecutive month, restaurant operators reported a positive outlook for staffing levels in the coming months.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The index decreased to 100.9 in April (above 100 indicates expansion).

Unfortunately the data for this index only goes back to 2002.

This report was for April, and the economy clearly slowed in May (so the report next month will be interesting). This is a minor report (really not even "D-List" data), but I'd expect discretionary spending to slow sharply if consumers become really worried.