by Calculated Risk on 6/18/2011 11:11:00 AM

Saturday, June 18, 2011

Summary for Week Ending June 17th

You know it was a tough week when the “good news” was a smaller than expected decline in retail sales, and also a minor increase in housing starts. Of course the headlines were mostly about the financial crisis in Europe, especially in Greece. The next "bailout" for Greece is expected very soon.

The negative U.S. economic news included both the New York and Philadelphia Fed manufacturing surveys indicating contraction in June. Also Industrial Production in May edged up only slightly and capacity utilization was flat.

At the same time, core inflation picked up a little in May – so we saw slowing growth and a little more inflation – not good news for the economy (although oil and gasoline prices have fallen sharply, so measured inflation will probably moderate in June). Meanwhile consumer sentiment declined in the preliminary June reading.

This continues the recent trend of weak economic news - something that will probably continue next week with the release of existing and new home sales for May. Below is a summary of economic data last week mostly in graphs:

• Retail Sales declined 0.2% in May

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

On a monthly basis, retail sales decreased 0.2% from April to May (seasonally adjusted, after revisions), and sales were up 7.7% from May 2010.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 16.4% from the bottom, and now 2.3% above the pre-recession peak.

• Housing Starts increased in May

This graph shows total and single unit starts since 1968. Total housing starts were at 560 thousand (SAAR) in May, up 3.5% from the revised April rate of 541 thousand.

This graph shows total and single unit starts since 1968. Total housing starts were at 560 thousand (SAAR) in May, up 3.5% from the revised April rate of 541 thousand.

Single-family starts increased 3.7% to 419 thousand in May.

This was above expectations of 547 thousand starts in May. Multi-family starts are beginning to pickup - although from a very low level - but single family starts are still moving sideways.

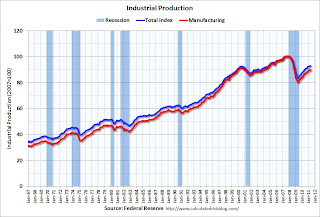

• Industrial Production edged up in May, Capacity Utilization unchanged

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.

Industrial production edged up slightly in May to 93.0. Capacity utilization for total industry was flat at 76.7 percent.

Both industrial production and capacity utilization have stalled recently. The was below the consensus of a 0.2% increase in Industrial Production in May, and an increase to 77.0% for Capacity Utilization.

• Core Measures of Inflation increased in May

"According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in May. The 16% trimmed-mean Consumer Price Index increased 0.2% (2.8% annualized rate) during the month."

"According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in May. The 16% trimmed-mean Consumer Price Index increased 0.2% (2.8% annualized rate) during the month."

Over the last 12 months, core CPI has increased 1.5%, median CPI has increased 1.5%, and trimmed-mean CPI increased 1.9%.

This graph shows these three measure of inflation on a year-over-year basis.

These measures all show that year-over-year inflation is still low, but increasing. Although the year-over-year increases are below the Fed's inflation target, the annualized rates were above the target in May.

• Philly Fed and NY Fed Manufacturing Surveys showed contraction in June

From the Philly Fed: June 2011 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from 3.9 in May to -7.7, its first negative reading since last September.From the NY Fed: Empire State Survey indicates contraction

The general business conditions index slipped below zero for the first time since November of 2010, falling twenty points to -7.8.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through June. The ISM and total Fed surveys are through May.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through June. The ISM and total Fed surveys are through May.This early reading suggests the ISM index could be below 50 in June - if so, this would be the lowest reading since mid-2009.

• NFIB: Small Business Optimism Index decreased in May

From National Federation of Independent Business (NFIB): Consumer Spending Remains Weak: Small Business Optimism Dips Lower in May

From National Federation of Independent Business (NFIB): Consumer Spending Remains Weak: Small Business Optimism Dips Lower in May This graph shows the small business optimism index since 1986. The index decreased to 90.9 in May from 91.2 in April.

This has been trending up, although optimism has declined for three consecutive months now.

• Consumer Sentiment declines in June

The preliminary June Reuters / University of Michigan consumer sentiment index declined to 71.8 from 74.3 in May.

The preliminary June Reuters / University of Michigan consumer sentiment index declined to 71.8 from 74.3 in May.In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However, even with gasoline prices falling, consumer sentiment is mostly moving sideways at a low level.

This was below the consensus forecast of 74.0.

• Other Economic Stories ...

• Residential Remodeling Index increased in April

• Hotels: Occupancy Rate increased 3.0 percent compared to same week in 2010

• Lawler: CAR vs. “Reality,” and the NAR Benchmarking

• State Unemployment Rates "little changed" in May

• Lawler: Early Read on Existing Home Sales in May

• NAHB Builder Confidence index declined in June

Best wishes to all!