by Calculated Risk on 7/20/2011 02:14:00 PM

Wednesday, July 20, 2011

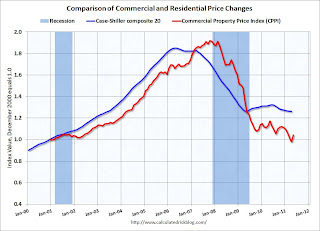

Moody's: Commercial Real Estate Prices increased in May

From Bloomberg: U.S. Commercial Property Prices Increased 6.3% in May, Moody’s Says

The Moody’s/REAL Commercial Property Price Index rose 6.3 percent from April ... It’s down 11 percent from a year earlier and 46 percent below the peak of October 2007Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

“A number of transactions that were recorded in May had their most recent prior sales in 2009 as the market was beginning to bottom and subsequently traded for substantial returns,” Tad Philipp, director of commercial real estate research at Moody’s, said in a separate statement.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are down 11% from a year ago and down about 46% from the peak in 2007. Prices fell sharply over the previous six months, and this increase only erases part of that decline.

Note: There are few commercial real estate transactions compared to residential, so this index is very volatile.