by Calculated Risk on 7/23/2011 05:40:00 PM

Saturday, July 23, 2011

Schedule for Week of July 24th

Earlier:

• Summary for Week Ending July 22nd

The key economic report for the coming week is the Q2 advance GDP report to be released on Friday. There are also two important housing reports to be released early in the week: New Home sales and Case-Shiller house prices, both on Tuesday.

8:30 AM ET: Chicago Fed National Activity Index (June). This is a composite index of other data.

10:30 AM: Dallas Fed Manufacturing Survey for July. The Texas production index fell to 5.6 in June (still expansion).

9:00 AM: S&P/Case-Shiller Home Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May. The consensus is for flat prices in May, however I expect prices to increase NSA.

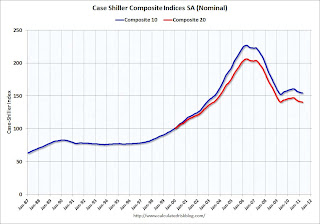

9:00 AM: S&P/Case-Shiller Home Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May. The consensus is for flat prices in May, however I expect prices to increase NSA. This graph shows the seasonally adjusted Composite 10 and Composite 20 indices through April (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.8% from the peak, and was up slightly in April (SA). The Composite 20 index is off 31.8% from the peak, and was down slightly in April (SA).

10:00 AM: New Home Sales for June from the Census Bureau.

10:00 AM: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the current sales rate.

The consensus is for a slight increase in sales to 321 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 319 thousand in May.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for July. The consensus is for the index to be at 4, up from 3 in June (above zero is expansion).

10:00 AM: Conference Board's consumer confidence index for July. The consensus is for a decrease to 56.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last couple months suggesting weak home sales through summer (not counting all cash purchases).

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 0.3% increase in durable goods orders after increasing 2.1% in May.

2:00 PM: Fed's Beige Book. This is an informal review by the Federal Reserve Banks of current economic conditions.

8:30 AM: The initial weekly unemployment claims report will be released. The number of claims has been elevated for the last couple of months. The consensus is for a decrease to 415,000 from 418,000 last week.

10:00 AM: Pending Home Sales Index for June. The consensus is for a 2.0% decrease in contracts signed. Economist Tom Lawler is forecasting a slight increase in pending home sales.

11:00 AM: Kansas City Fed regional Manufacturing Survey for July. The index was at 14 in June.

8:30 AM: Q2 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 1.8% annualized in Q2.

9:45 AM: Chicago Purchasing Managers Index for July. The consensus is for a slight decrease to 60.2, down from 61.1 in June.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for July). The consensus is for an increase to 64.0 from the preliminary reading of 63.8.

10:00 AM: Q2 Housing Vacancies and Homeownership report from the Census Bureau.