by Calculated Risk on 7/02/2011 11:11:00 AM

Saturday, July 02, 2011

Summary for Week Ending July 1st

We were looking for “hints of improvement” last week, and although the data was mixed, we found more than “hints”!

There were several regional manufacturing reports that came in stronger than expected (Dallas, Richmond, Kansas City and Chicago PMI), and by Friday everyone expected a somewhat decent ISM manufacturing report – and the report still surprised to the upside.

On housing, both the Case-Shiller (April) and the CoreLogic (May) house price indexes showed seasonal increases. Although prices will probably fall seasonally later this year, this suggests the pace of declines might have slowed. Also the Pending Home Sales index rebounded in May, and mortgage delinquencies declined a little.

There was some more weak news too: auto sales fell further in June (although it appears sales will pick up in July and August), personal consumption was especially weak in May, and consumer sentiment decreased in June.

Over in Europe, the Greek parliament approved another round of austerity, and the euro zone Finance ministers are expected to approve the disbursement of the next tranche of aid (€12 billion) this weekend. This doesn’t solve the problem, but it buys a little more time.

I expect economic activity to increase in the second half of 2011 (although I expect activity to be sluggish relative to the slack in the system), and it appears that the pickup is starting now.

Below is a summary of economic data last week mostly in graphs:

• Case Shiller: Home Prices increase in April

From S&P:April Seasonal Boost in Home Prices

Data through April 2011 ... show a monthly increase in prices for the 10- and 20-City Composites for the first time in eight months. The 10- and 20-City Composites were up 0.8% and 0.7%, respectively, in April versus March. Both indices are lower than a year ago; the 10-City Composite fell 3.1% and the 20-City Composite is down 4.0% from April 2010 levels.

Click on graph for larger image in graph gallery.

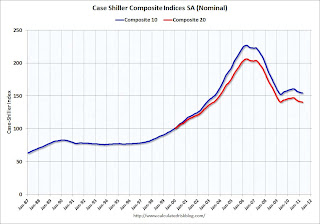

Click on graph for larger image in graph gallery. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.8% from the peak, and up slightly in April (SA). The Composite 10 is still 1.6% above the May 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 31.8% from the peak, and down slightly in April (SA). The Composite 20 is slightly below the May 2009 post-bubble bottom seasonally adjusted.

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.Prices increased (SA) in 9 of the 20 Case-Shiller cities in April seasonally adjusted. Prices in Las Vegas are off 58.6% from the peak, and prices in Dallas only off 8.8% from the peak.

Real Prices: The next graph shows the Case-Shiller Composite 20 index, the Case-Shiller National Index (through Q1) and the CoreLogic index (May) in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 1999 levels, the Composite 20 index is back to September 2000, and the CoreLogic index back to January 2000.

In real terms, the National index is back to Q4 1999 levels, the Composite 20 index is back to September 2000, and the CoreLogic index back to January 2000. In real terms, all appreciation in the last decade is gone.

Price-to-rent: In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through March).

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through March).This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Composite 20 index is back to October 2000 levels, and the CoreLogic index is back to February 2000.

• ISM Manufacturing index increases in June

From the Institute for Supply Management: June 2011 Manufacturing ISM Report On Business®

PMI was at 55.3% in June, up from 53.5% in May. The employment index was at 59.9%, up from 58.2% and new orders increased to 51.6%, up from 51.0%. All better than in May.

PMI was at 55.3% in June, up from 53.5% in May. The employment index was at 59.9%, up from 58.2% and new orders increased to 51.6%, up from 51.0%. All better than in May. Here is a long term graph of the ISM manufacturing index.

This was above expectations of 51.7%. Earlier in the month it looked like the ISM was going to be weak, but recent regional reports indicated improvement towards the end of June.

• U.S. Light Vehicle Sales 11.45 million Annual Rate in June

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.45 million SAAR in June. That is up 2.8% from June 2010, and down 2.6% from the sales rate last month (May 2011).

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.45 million SAAR in June. That is up 2.8% from June 2010, and down 2.6% from the sales rate last month (May 2011).This graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

This was well below the consensus estimate of 12 million SAAR. However I expect a bounce back in sales over the next couple of months.

• CoreLogic: Home Price Index increased 0.8% in May

CoreLogic is now reporting almost a month ahead of Case-Shiller!

From CoreLogic: CoreLogic® Home Price Index Shows Second Consecutive Month-Over-Month Increase

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.The index was up 0.8% in May, and is down 7.4% over the last year, and off 32.7% from the peak.

This is the tenth straight month of year-over-year declines, and the index is still 2.4% below the March 2009 low (the previous post-bubble low).

Some of this increase is seasonal (the CoreLogic index is NSA) and the index is still off 7.4% from last May (the largest year-over-year decline since Sept 2009).

• Personal Income increased 0.3% in May, PCE increased less than 0.1%

This graph shows real Personal Consumption Expenditures (PCE) through April (2005 dollars).

This graph shows real Personal Consumption Expenditures (PCE) through April (2005 dollars).PCE increased less than 0.1% in May, but real PCE decreased 0.1% as the price index for PCE increased 0.2 percent in May. The graph shows that real PCE declined in the first two month of Q2.

This puts real PCE growth in Q2 on pace for only about 1% (an average of Q2 over Q1) - the slowest pace since Q4 2009.

• Construction Spending declined in May

The Census Bureau reported:

[Private] Residential construction was at a seasonally adjusted annual rate of $228.9 billion in May, 2.1 percent (±1.3%) below the revised April estimate of $233.8 billion. Nonresidential construction was at a seasonally adjusted annual rate of $248.3 billion in May, 1.2 percent (±1.4%)* above the revised April estimate of $245.4 billion.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.Residential spending is 66% below the peak in early 2006, and non-residential spending is 40% below the peak in January 2008.

The small increase in non-residential in May was mostly due to power.

Construction spending is still mostly moving sideways (and a little down). I expect some pickup in residential construction spending as more multi-family units are started.

• Consumer Sentiment declines in June

The final June Reuters / University of Michigan consumer sentiment index decreased to 71.5 from the preliminary reading of 71.8. This is down from 74.3 in May.

The final June Reuters / University of Michigan consumer sentiment index decreased to 71.5 from the preliminary reading of 71.8. This is down from 74.3 in May. In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However, even with gasoline prices falling, consumer sentiment is mostly moving sideways at a low level.

This was below the consensus forecast of 72.0.

• LPS: Mortgage Delinquency Rates decreased slightly in May

According to LPS, 7.96% of mortgages were delinquent in May, down slightly from 7.97% in April, and down from 9.74% in May 2010.

LPS reports that 4.11% of mortgages were in the foreclosure process, down from 4.14% in April. This gives a total of 12.07% delinquent or in foreclosure. It breaks down as:

• 2.27 million loans less than 90 days delinquent.

• 1.92 million loans 90+ days delinquent.

• 2.16 million loans in foreclosure process.

For a total of 6.35 million loans delinquent or in foreclosure in May.

This graph shows the total delinquent and in-foreclosure rates since 1995.

This graph shows the total delinquent and in-foreclosure rates since 1995.The total delinquent rate has fallen to 7.96% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is still a long way to go.

However the in-foreclosure rate at 4.11% is barely below the peak rate of 4.21% in March 2011. There are still a large number of loans in this category (about 2.16 million).

• Fannie Mae and Freddie Mac Serious Delinquency Rates decline in May

Fannie Mae reported that the serious delinquency rate decreased to 4.14% in May, down from 4.19% in April. This is down from 5.15% in May of 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Fannie Mae reported that the serious delinquency rate decreased to 4.14% in May, down from 4.19% in April. This is down from 5.15% in May of 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.Freddie Mac reported that the Single-Family serious delinquency rate decreased to 3.53% in May from 3.57% in April. This is down from 4.06% in May 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

The serious delinquency rate is falling as Fannie and Freddie work through the backlog of loans and either modify the loan, foreclose, short sale, or the loan cures.

• Other Economic Stories ...

• ATA Trucking index decreased 2.3% in May

• Texas Manufacturing survey shows slower expansion in June

• Richmond Fed: Manufacturing Activity Stabilized in June

• Kansas City Manufacturing Survey: Manufacturing activity rebounded solidly in June

• Chicago PMI indicated a rebound in June

• Restaurant Performance Index decreases in May

• From the NAR: Pending Home Sales Turn Around in May

Best wishes to all!