by Calculated Risk on 8/30/2011 08:14:00 PM

Tuesday, August 30, 2011

LPS: Average Loan in Foreclosure Is Delinquent for Record 599 Days

LPS Applied Analytics released their July Mortgage Monitor Report today. From LPS: LPS' Mortgage Monitor Report Shows Average Loan in Foreclosure Is Delinquent for Record 599 Days; First-Time Foreclosure Starts Near Three-Year Lows

The July Mortgage Monitor report released by Lender Processing Services, Inc. shows that foreclosure timelines continue their steady upward trend, as a payment has not been made on the average loan in foreclosure in a record 599 days. Of the nearly 1.9 million loans that are 90 or more days delinquent but not yet in foreclosure, 42 percent have not made a payment in more than a year with an average delinquency of 397 days, also a new record. At the same time, first-time foreclosure starts in June were near three-year lows, and first-time delinquencies accounted for only 25 percent of new delinquent inventory.According to LPS, 8.34% of mortgages were delinquent in July, up from 8.15% in June, and down from 9.31% in July 2010.

As of the end of June, 4.1 million loans were either 90 or more days delinquent or in foreclosure, as delinquencies remain two times and foreclosures eight times pre-crisis levels. Foreclosure sales remain constricted, with foreclosure starts outnumbering sales by a factor of almost three to one.

LPS reports that 4.11% of mortgages were in the foreclosure process, down slightly from 4.12% in June, and up from 3.74% in July 2010. This gives a total of 12.45% delinquent or in foreclosure. It breaks down as:

• 2.48 million loans less than 90 days delinquent.

• 1.90 million loans 90+ days delinquent.

• 2.16 million loans in foreclosure process.

For a total of 6.54 million loans delinquent or in foreclosure in July.

Click on graph for larger image in graph gallery.

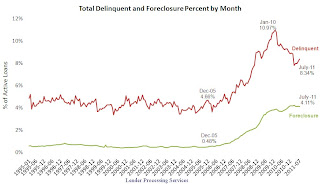

Click on graph for larger image in graph gallery.This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has increased recently (part of the increase is seasonal), but the rate has fallen to 8.34% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long long ways to go.

However the in-foreclosure rate at 4.11% is barely below the peak rate of 4.21% in March 2011. There are still a large number of loans in this category (about 2.16 million) - and the average loan in foreclosure has been delinquent for a record 599 days!

This graph provided by LPS Applied Analytics shows the number of loans entering the foreclosure process each month and the number of foreclosure sales.

This graph provided by LPS Applied Analytics shows the number of loans entering the foreclosure process each month and the number of foreclosure sales.Looking at this graph, one might expect the number of loans in the foreclosure process to be increasing sharply since there are so many more starts than sales.

And there are very few cures too - what is happening is a large number of loans each month have been moving from "in foreclosure" back to "90+ days delinquent" status - so the number of loans "in foreclosure" hasn't increased recently.

The third graph shows mortgage origination by the original term.

The third graph shows mortgage origination by the original term. This graph is interesting because of the surge in shorter duration loans.

This is probably being driven by two factors: 1) older borrowers are hoping to pay off their loans as part of their retirement planning and are taking out 15 year mortgages, and 2) many jumbo borrowers are probably taking out 5 year loans with a balloon payment since 30 year jumbo rates are much higher.

Earlier:

• Case Shiller: Home Prices increased in June

• Real House Prices and Price-to-Rent