by Calculated Risk on 8/24/2011 07:28:00 AM

Wednesday, August 24, 2011

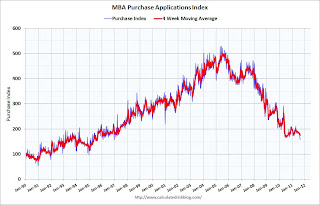

MBA: Mortgage Purchase Activity at Lowest Level Since 1996

The MBA reports: Mortgage Applications Decrease with Purchase Index at Lowest Level Since 1996

The Refinance Index decreased 1.7 percent from the previous week. The seasonally adjusted Purchase Index decreased 5.7 percent from one week earlier and is at the lowest level in the survey since December 1996.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Another week of volatile markets and rampant uncertainty regarding the economy kept prospective homebuyers on the sidelines, with purchase applications falling to a 15-year low," said Mike Fratantoni, MBA's Vice President of Research and Economics. "This decline impacted borrowers across the board, with purchase applications for jumbo loans falling by more than 15 percent, and purchase applications for the government housing programs (FHA, VA, and USDA) falling by 8.2 percent. Although mortgage rates remain quite low, they increased over the week, bringing refinance application volumes down slightly."

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.39 percent from 4.32 percent, with points increasing to 0.88 from 0.86 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average of the purchase index has been moving down recently and is at about 1997 levels. Of course this doesn't include the large number of cash buyers ... but purchase application activity was especially weak over the last two weeks.