by Calculated Risk on 8/27/2011 08:10:00 AM

Saturday, August 27, 2011

Summary for Week Ending August 26th

The focus last week was on Fed Chairman Ben Bernanke’s speech at Jackson Hole. Although Bernanke did not discuss additional monetary easing, he did note that the September meeting will be expanded to two days to allow for a "fuller discussion" of policy options. For more on his speech, see: A few articles on Bernanke's Speech

The data last week was weak again. Second quarter GDP growth was revised down to a 1.0% annual rate, from the already weak 1.3% advance estimate. July New Home sales were under 300 thousand on a seasonally adjusted annual rate (SAAR) basis. And mortgage delinquencies increased slightly in Q2.

Two more regional manufacturing surveys for August were released; the Richmond Fed survey indicated activity declined in August; however the Kansas City survey showed modest growth.

In Europe, the negotiations over the Greek bailout plan heated up, and the Greek bond yields are soaring. Otherwise the European bond markets were relatively quiet for the week.

Here is a summary in graphs:

• Q2 real GDP growth revised down to 1.0% annualized rate

From the BEA: Gross Domestic Product, Second Quarter 2011 (second estimate "Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 1.0 percent in the second quarter of 2011". Growth was revised down from 1.3%, and was slightly below the consensus of 1.1%.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The current quarter is in blue.

The dashed line is the current growth rate. Growth in Q2 at 1.0% annualized was below trend growth (around 3%) - and very weak for a recovery, especially with all the slack in the system.

The alternate measure of GDP - Gross Domestic Income - grew at a 1.6% annualized rate in Q2 and is now back above the pre-recession peak.

• New Home Sales in July at 298,000 Annual Rate

The Census Bureau reported New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 298 thousand. This was down from a revised 300 thousand in June (revised from 312 thousand).

The Census Bureau reported New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 298 thousand. This was down from a revised 300 thousand in June (revised from 312 thousand).

This graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale was at 61,000 units in July. The combined total of completed and under construction is at the lowest level since this series started.

This graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

This graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In July 2011 (red column), 27 thousand new homes were sold (NSA). The record low for July was 26 thousand in 2010 (following the expiration of the homebuyer tax credit). The high for July was 117 thousand in 2005.

This was below the consensus forecast of 313 thousand, and was just above the record low for the month of July. New home sales have averaged only 300 thousand SAAR over the 15 months since the expiration of the tax credit ... moving sideways at a very low level.

• MBA: Mortgage Delinquencies increased slightly in Q2

The MBA reported that 12.87 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q2 2011 (seasonally adjusted). This is up slightly from 12.84 percent in Q1 2011. From the MBA: Delinquencies Rise, Foreclosures Fall in Latest MBA Mortgage Delinquency Survey

This graph shows the percent of loans delinquent by days past due.

This graph shows the percent of loans delinquent by days past due.Loans 30 days delinquent increased to 3.46% from 3.35% in Q1. This is probably related to the increase in the unemployment rate. Delinquent loans in the 60 day bucket increased slightly to 1.37% from 1.35%.

There was a slight decrease in the 90+ day delinquent bucket. This decreased to 3.61% from 3.65% in Q1 2011. The percent of loans in the foreclosure process decreased to 4.43%.

So short term delinquencies ticked up, and the 90+ day and in-foreclosure rates declined.

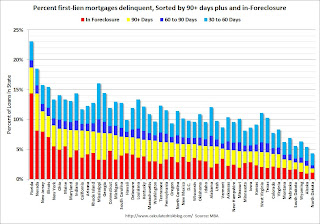

This graph shows the percent of loans in the foreclosure process by state and by foreclosure process. Red is for states with a judicial foreclosure process. Because the judicial process is longer, those states typically have a higher percentage of loans in the process. Nevada is an exception.

This graph shows the percent of loans in the foreclosure process by state and by foreclosure process. Red is for states with a judicial foreclosure process. Because the judicial process is longer, those states typically have a higher percentage of loans in the process. Nevada is an exception.Florida, Nevada, New Jersey and Illinois are the top four states with percent of loans in the foreclosure process.

This graph shows all delinquent loans by state (sorted by percent seriously delinquent).

This graph shows all delinquent loans by state (sorted by percent seriously delinquent).Florida and Nevada have the highest percentage of serious delinquent loans, followed by New Jersey, Illinois, New York, Ohio and Maine.

Note: the MBA's National Delinquency Survey (NDS) covered "MBA’s National Delinquency Survey covers about 43.9 million first-lien mortgages on one- to four-unit residential properties" and the "The NDS is estimated to cover around 88 percent of the outstanding first-lien mortgages in the market." This gives almost 50 million total first lien mortgages or about 6.4 million delinquent or in foreclosure.

This graph shows the range of percent seriously delinquent and in-foreclosure for each state (dashed blue line) since Q1 2007. The red diamond indicates the current serious delinquency rate (this includes 90+ days delinquent or in the foreclosure process).

This graph shows the range of percent seriously delinquent and in-foreclosure for each state (dashed blue line) since Q1 2007. The red diamond indicates the current serious delinquency rate (this includes 90+ days delinquent or in the foreclosure process). Some states have made progress: Arizona, Michigan, Nevada and California. Other states, like New Jersey and New York, have made little or no progress in reducing serious delinquencies.

Arizona, Michigan, Nevada and California are all non-judicial foreclosure states. States with little progress like New Jersey, New York, Illinois and Florida are all judicial states.

Note: This data is for 42 states only and D.C.

• Regional Manufacturing Surveys

There were two more regional manufacturing surveys released this week: Richmond Fed and Kansas City Fed. From the Richmond Fed: Manufacturing Activity Pulled Back Markedly in August; Shipments and New Orders Declined. And from the Kansas City Fed: Manufacturing Sector Continues to Expand Modestly

Here is a table of the regional surveys in July and August; the Dallas Fed Texas Manufacturing will be released on Monday, August 29th.

| Manufacturing Survey | July | August |

|---|---|---|

| Empire State | -3.76 | -7.7 |

| Philly Fed | 3.2 | -30.7 |

| Richmond Fed | -1 | -10 |

| Kansas City Fed | 3 | 3 |

| Dallas Fed | 10.8 | --- |

Most of the regional surveys were very weak in August. The ISM index for August will be released Thursday, Sept 1st.

• Final August Consumer Sentiment at 55.7, Down Sharply from July

The final August Reuters / University of Michigan consumer sentiment index increased slightly to 55.7 from the preliminary reading of 54.9. This was down sharply from 63.7 in July.

The final August Reuters / University of Michigan consumer sentiment index increased slightly to 55.7 from the preliminary reading of 54.9. This was down sharply from 63.7 in July. In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. I think consumer sentiment declined sharply in August because of the heavy coverage of the debt ceiling debate.

This was slightly below the consensus forecast of 56.0.

• Weekly Initial Unemployment Claims increased to 417,000

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 407,500.

Weekly claims have increased for two consecutive weeks and the 4-week average is still elevated.

• Moody's: Commercial Real Estate Prices increased in June

From Bloomberg: Commercial Property Prices Rose 0.9% in June, Moody’s Says. Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

From Bloomberg: Commercial Property Prices Rose 0.9% in June, Moody’s Says. Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted. CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are down 6.6% from a year ago and down about 45% from the peak in 2007. Some of this is probably seasonal, although Moody's mentioned a price pickup "beyond trophy properties and major U.S. coastal cities". Note: There are few commercial real estate transactions compared to residential, so this index is very volatile.

• Other Economic Stories ...

• Chicago Fed: Economic growth below trend in July

• ATA Trucking index decreased 1.3% in July

• Europe Update: Greek Bond Yields Surge

• Update on Q2 REO Inventory

• FHFA Introduces Expanded House Price Index

Have a great weekend. Stay safe on the East Coast!