by Calculated Risk on 9/21/2011 08:12:00 AM

Wednesday, September 21, 2011

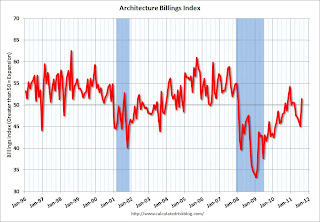

AIA: Architecture Billings Index Turns Positive

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Turns Positive after Four Straight Monthly Declines

On the heels of a period of weakness in design activity, the Architecture Billings Index (ABI) took a sudden upturn in August. ... The American Institute of Architects (AIA) reported the August ABI score was 51.4, following a very weak score of 45.1 in July. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 56.9, up sharply from a reading of 53.7 the previous month.

“Based on the poor economic conditions over the last several months, this turnaround in demand for design services is a surprise,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “Many firms are still struggling, and continue to report that clients are having difficulty getting financing for viable projects, but it’s possible we’ve reached the bottom of the down cycle.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the Architecture Billings Index since 1996. The index increased to 51.4 in August from 45.1 in July. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So the recent contraction suggests further declines in CRE investment in early 2012, but possibly flattening out in 9 to 12 months (just one month's data).