by Calculated Risk on 9/13/2011 10:15:00 AM

Tuesday, September 13, 2011

CoreLogic: 10.9 Million U.S. Properties with Negative Equity in Q2

CoreLogic released the Q2 2011 negative equity report today.

CoreLogic ... released Q2 negative equity data showing that 10.9 million, or 22.5 percent, of all residential properties with a mortgage were in negative equity at the end of the second quarter of 2011, down very slightly from 22.7 percent in the first quarter. An additional 2.4 million borrowers had less than five percent equity, referred to as near-negative equity, in the second quarter. Together, negative equity and near-negative equity mortgages accounted for 27.5 percent of all residential properties with a mortgage nationwide. The new report also shows that nearly three-quarters of homeowners in negative equity situations are also paying higher, above-market interest on their mortgages.Here are a couple of graphs from the report:

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the distribution of negative equity. The more negative equity, the more at risk the homeowner is to losing their home.

Close to 10% of homeowners with mortgages have more than 25% negative equity. This is trending down slowly - the decline is apparently mostly due to homes lost in foreclosure.

The second graph from CoreLogic shows the cumulative distribution of mortgage rates for borrowers with positive and negative equity.

The second graph from CoreLogic shows the cumulative distribution of mortgage rates for borrowers with positive and negative equity. From CoreLogic: "Negative equity significantly limits the ability of borrowers to capture the benefit of the low-rate environment. There are nearly 28 million outstanding mortgages that have above market rates and are in theory refinanceable1. Twenty million borrowers with positive equity, or 53 percent of all above-water borrowers, have above market rates. Eight million borrowers with negative equity, or nearly 75 percent of all underwater borrowers, have above market rates."

1 "The definition of an above market rate was 5.1%, which is roughly the current mortgage rate of 4.1% plus a 100 basis point refinance trigger."

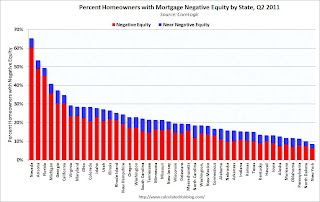

The third graph shows the break down of negative equity by state. Note: Data not available for Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming.

The third graph shows the break down of negative equity by state. Note: Data not available for Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming.From CoreLogic: "Nevada had the highest negative equity percentage with 60 percent of all of its mortgaged properties underwater, followed by Arizona (49 percent), Florida (45 percent), Michigan (36 percent) and California (30 percent).

The negative equity share in the hardest hit states has improved. Over the past year, the average negative equity share for the top five states has declined from 41 percent to 38 percent. Nevada had the largest decline over the last year, with the negative equity share dropping from 68 percent to 60 percent. The reason for the Nevada decline is the high number of foreclosures that led to lower numbers of remaining negative equity borrowers."