by Calculated Risk on 9/02/2011 10:21:00 AM

Friday, September 02, 2011

Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

This was a very weak report, so let's start with a few positives:

• August is over. Just like in June, when employment was impacted by the tsunami in Japan, employment in August was impacted by the debt ceiling debate in August. As I noted yesterday, the BLS survey reference week includes the 12th of the month, and that was just after the economy froze up due to the D.C. debate, and also after the European crisis flared up again.

• The Verizon labor dispute subtracted 45,000 payroll jobs. This dispute is over and these jobs will be added back in the September report. From the BLS: "45,000 workers in the telecommunications industry were on strike and thus off company payrolls during the survey reference period."

• The household survey showed an increase of (edit) 331,000 jobs in August. This increase in the household survey kept the unemployment rate from rising, even as more people participated in the workforce. The unemployment rate was unchanged at 9.1%, and the participation rate increased to 64.0%. The employment population ratio also increased slightly to 58.2%.

But overall this was a very weak report. There were no jobs added in August (0 total and 17,000 private sector).

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, increased to 16.2%; this is at the high for the year.

The BLS revised down the June and July payrolls. "The change in total nonfarm payroll employment for June was revised from +46,000 to +20,000, and the change for July was revised from +117,000 to +85,000."

The average workweek declined slightly to 34.2 hours, and average hourly earnings decreased. "In August, average hourly earnings for all employees on private nonfarm payrolls decreased by 3 cents, or 0.1 percent, to $23.09. This decline followed an 11-cent gain in July. Over the past 12 months, average hourly earnings have increased by 1.9 percent."

Through the first eight months of 2011, the economy has added 872,000 total non-farm jobs or just 109 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.9 million fewer payroll jobs than at the beginning of the 2007 recession. The economy has added 1,162,000 private sector jobs this year, or about 145 thousand per month.

There are a total of 13.967 million Americans unemployed and 6.0 million have been unemployed for more than 6 months. Very grim.

Although there were special factors - the debt ceiling shock to the economy and the Verizon strike - overall this was another very weak report. The economy has only added 158 thousand jobs over the last four months.

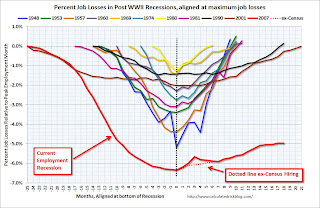

Percent Job Losses During Recessions

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the previous post, the graph showed the job losses aligned at the start of the employment recession.

In terms of lost payroll jobs, the 2007 recession was by far the worst since WWII.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) rose from 8.4 million to 8.8 million in August. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased to 8.826 million in August from 8.396 million in July.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 16.2% in August from 16.1% in July.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 6.034 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 6.185 million in July. This is very high, and long term unemployment is one of the defining features of this employment recession.

• Earlier Employment post: August Employment Report: 0 Jobs (unchanged), 9.1% Unemployment Rate