by Calculated Risk on 9/17/2011 08:17:00 AM

Saturday, September 17, 2011

Summary for Week ending Sept 16th

This was another weak week for U.S. economic data. Retail sales were flat in August, the Philly and NY Fed manufacturing surveys showed further contraction, and initial weekly unemployment claims increased again. Also core measures of inflation moved higher in August.

There was also some quarterly data released: CoreLogic released their negative equity report showing little improvement in Q2, and the Fed released the Flow of Funds report showing that household mortgage debt is decreasing, but still much higher than in previous decades as a percent of GDP.

And once again the European financial crisis was on the front pages. It seemed

s the story changed day-to-day - and on Wednesday German Chancellor Angela Merkel and French President Nicolas Sarkozy made some positive comments about Greece and the ECB, Fed and several other central banks announced a dollar liquidity program for European banks. Still, nothing has been resolved.

Here is a summary in graphs:

• Retail Sales flat in August

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

On a monthly basis, retail sales were flat from July to August (seasonally adjusted, after revisions), and sales were up 7.2% from August 2010. Retail sales excluding autos increased 0.1% in August. Sales for and June and July were revised down.

Retail sales are up 17.1% from the bottom, and now 2.9% above the pre-recession peak. The consensus was for retail sales to increase 0.2% in August, and for a 0.3% increase ex-auto.

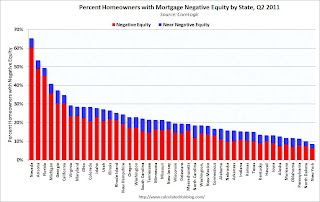

• CoreLogic: 10.9 Million U.S. Properties with Negative Equity in Q2

CoreLogic released the Q2 2011 negative equity report this week. "CoreLogic ... released Q2 negative equity data showing that 10.9 million, or 22.5 percent, of all residential properties with a mortgage were in negative equity at the end of the second quarter of 2011, down very slightly from 22.7 percent in the first quarter."

CoreLogic released the Q2 2011 negative equity report this week. "CoreLogic ... released Q2 negative equity data showing that 10.9 million, or 22.5 percent, of all residential properties with a mortgage were in negative equity at the end of the second quarter of 2011, down very slightly from 22.7 percent in the first quarter."

This graph shows the break down of negative equity by state. Note: Data not available for Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming.

From CoreLogic: "Nevada had the highest negative equity percentage with 60 percent of all of its mortgaged properties underwater, followed by Arizona (49 percent), Florida (45 percent), Michigan (36 percent) and California (30 percent)."

• Industrial Production increased 0.2% in August, Capacity Utilization increases slightly

From the Fed: Industrial production and Capacity Utilization. "Industrial production increased 0.2 percent in August ... Capacity utilization for total industry edged up to 77.4 percent, a rate 1.9 percentage points above its level from a year earlier but 3.0 percentage points below its long-run (1972--2010) average."

From the Fed: Industrial production and Capacity Utilization. "Industrial production increased 0.2 percent in August ... Capacity utilization for total industry edged up to 77.4 percent, a rate 1.9 percentage points above its level from a year earlier but 3.0 percentage points below its long-run (1972--2010) average."

This graph shows Capacity Utilization. This series is up 10.1 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.4% is still 3.0 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

Capacity utilization at 77.4% is still 3.0 percentage points below its average from 1972 to 2010 and below the pre-recession levels of 81.3% in December 2007.

This graph shows industrial production since 1967.

Industrial production increased in August to 94.0 (although earlier months were revised down).

After the fairly rapid increase last year, increases in industrial production and capacity utilization have slowed recently.

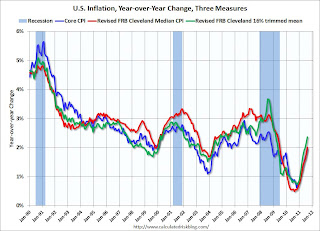

• Key Measures of Inflation increased in August

The Cleveland Fed released the median CPI and the trimmed-mean CPI this week: "According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.6% annualized rate) in August. The 16% trimmed-mean Consumer Price Index increased 0.3% (4.0% annualized rate) during the month. ... the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.4% (4.6% annualized rate) in August. The CPI less food and energy increased 0.2% (3.0% annualized rate) on a seasonally adjusted basis."

The Cleveland Fed released the median CPI and the trimmed-mean CPI this week: "According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.6% annualized rate) in August. The 16% trimmed-mean Consumer Price Index increased 0.3% (4.0% annualized rate) during the month. ... the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.4% (4.6% annualized rate) in August. The CPI less food and energy increased 0.2% (3.0% annualized rate) on a seasonally adjusted basis."

On a year-over-year basis, these measures of inflation are increasing, and are near the Fed's target.

• Fed Manufacturing Surveys indicate Contraction

From the NY Fed: Empire State Manufacturing Survey: "The general business conditions index inched down one point, to -8.8." This was lower than expectations of a reading of -3.6.

From the NY Fed: Empire State Manufacturing Survey: "The general business conditions index inched down one point, to -8.8." This was lower than expectations of a reading of -3.6.

From the Philly Fed: September 2011 Business Outlook Survey. "The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a very low reading of -30.7 in August to -17.5 in September." This indicates contraction in September and was slightly below the consensus forecast of -15.0.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through September. The ISM and total Fed surveys are through August.

The average of the Empire State and Philly Fed surveys rebounded in September, but is still well below zero - possibly indicating a further decline in the ISM index.

• Weekly Initial Unemployment Claims increased to 428,000

The DOL reported: "In the week ending September 10, the advance figure for seasonally adjusted initial claims was 428,000, an increase of 11,000 from the previous week's revised figure of 417,000."

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 419,500.

The 4-week average has been increasing recently and this is the highest level since early July.

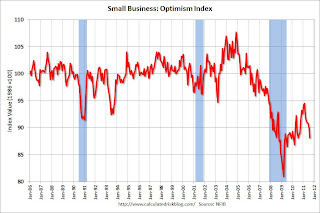

• NFIB: Small Business Optimism Index declines in August

From the National Federation of Independent Business (NFIB): Small Business Confidence Takes Huge Hit: Optimism Index Now in Decline for Six Months Running.

From the National Federation of Independent Business (NFIB): Small Business Confidence Takes Huge Hit: Optimism Index Now in Decline for Six Months Running.

"Confidence in the economy among small-business owners tumbled in August, as NFIB’s monthly Small-Business Optimism Index dropped a whopping 1.8 points, settling at a disturbingly low 88.1. The Index has now been in decline for a full six months."

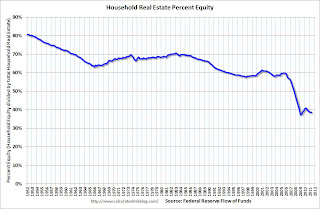

• Q2 Flow of Funds: Household Real Estate assets off $6.6 trillion from peak

The Federal Reserve released the Q2 2011 Flow of Funds report this week: Flow of Funds. The Fed estimated that the value of household real estate fell $65 billion to $16.18 trillion in Q2 2011, from $16.25 trillion in Q1 2011. The value of household real estate has fallen $6.6 trillion from the peak - and is still falling in 2011.

Household net worth peaked at $65.9 trillion in Q2 2007, and then net worth fell to $49.5 trillion in Q1 2009 (a loss of $16 trillion). Household net worth was at $58.5 trillion in Q2 2011 (up $8.9 trillion from the trough, but before the recent stock sell-off).

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q2 2011, household percent equity (of household real estate) was at 38.6% - about the same as in Q1.

Note: about 30.3% of owner occupied households have no mortgage debt as of April 2010. So the approximately 52+ million households with mortgages have far less than 38.6% equity - and 10.9 million households have negative equity.

TThis graph shows household real estate assets and mortgage debt as a percent of GDP.

TThis graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $47 billion in Q2. Mortgage debt has now declined by $678 billion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

Household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

• Other Economic Stories ...

• From the WSJ: Central Banks Boost Dollar Liquidity

• Ceridian-UCLA: Diesel Fuel index declined in August

• From Diana Olick at CNBC: Huge Surge in Bank of America Foreclosures

• Households Doubling Up and Housing

• State Unemployment Rates "little changed" in August

• Early Look: 2012 Social Security Cost-Of-Living Adjustment on track for 3.5% increase